By David Grindal

By David Grindal

Our traditional world of stable payment acceptance mechanisms is long gone. Payments used to just mean either cash and cards for a merchant or automated clearing house (ACH) and wire transfers and larger-amount cheques for a business, government or institution. The only person-to-person (P2P) payments that were made used cheques, especially for small-value transactions like school trips.

Canada’s payments environment

Canada is fortunate to have one of the world’s highest rates of contactless point of sale (POS) devices. Canadians love to “tap-and-go” regardless of card type. This has also led to widespread acceptance of the “Pays” (e.g. Apple Pay, Google Pay, Samsung Pay) and other near field communication-based payment methods. This is in stark contrast to our neighbours to the south, where contactless cards are still somewhat of a rarity.

At the same time the omnipresence of smartphones (and tourists from the world’s most populous country, yes, China) have driven the acceptance of quick response (QR)-code payments in Canada. Signs for WeChat Pay and Alipay are no longer uncommon. In fact, Air Canada accepts these two payment methods.

Turning to eCommerce, the alternatives for online payments range even wider, with cryptocurrencies, private label eWallets and other mechanisms entering the mix. To get a sense of how vast the alternative payment landscape is, some providers list more than 1,500 different types today.

The greatest changes may be yet to come. Most of the disruptive payment types mentioned above are still built on the paradigm of card payments. While the rectangular plastic form factor may have disappeared, these payment methods still mostly rely on card-like processing rails and familiar settlement mechanisms. The seamless Starbucks app payment experience consumers enjoy each morning still relies on linkage to a card-based bank or credit account (or an occasional inconvenient manual reload).

Upcoming changes

In the next few years, Canada will welcome a completely non-card-based, real-time payments system. Like the Interac e-Transfer today, these rails will go direct from account to account, with funds moving to their intended destination in seconds.

This new payment network (to be called “Real-Time Rails” or RTRs) will also introduce a full application programming interface (API) payment ecosystem, allowing consumers and authorized third parties to initiate payments from an assortment of phone and PC applications. Additional features such as a “Request to Pay” — a variation of e-Transfer’s Request Money — and the support of rich remittance data will revolutionize business invoicing and P2P payments. Businesses will be able to request payments electronically accompanied by invoices, right down to stock keeping unit (SKU)-level detail. The payments themselves will travel with the full information of what’s being paid for (or not), right down to line-level detail.

Preparing for disruption

So, how do Canadian firms prepare for all this new payment tech? Let’s start with merchants. Wanting to accept as many payment types as possible across their customer-facing channels, merchants face some of the greatest adoption challenges.

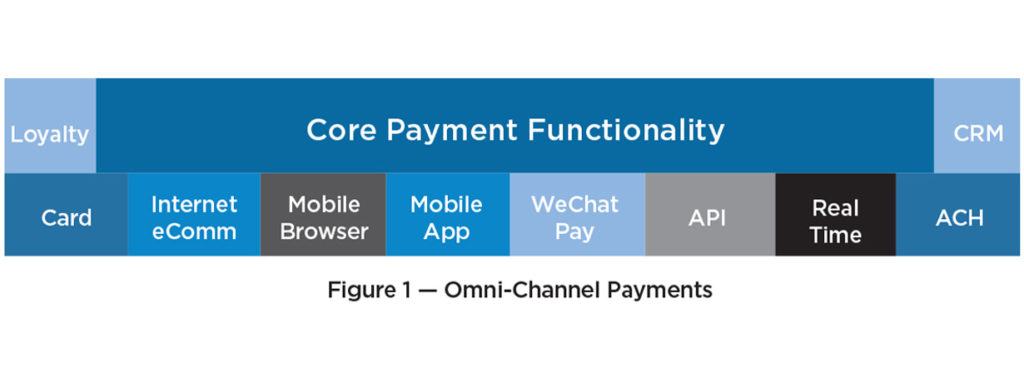

For years, consultants and vendors have encouraged merchants to adopt an omnichannel approach, but what does this actually entail? Merchants need a core payment functionality that services all their distribution channels while retaining the ability to plug in new payment types as needed (see Figure 1). Seamless access to complementary applications like customer relationship management (CRM) and loyalty program databases should also be prioritized. Specific modules can be plugged in as needed to support payment types as desired.

Getting to omnichannel can be difficult, but a modular approach offers the flexibility to accept and remove different payment types as and when the business requires. The truly bleeding-edge technology can be outsourced and integrated only when proven and when volumes justify the change.

Getting to omnichannel can be difficult, but a modular approach offers the flexibility to accept and remove different payment types as and when the business requires. The truly bleeding-edge technology can be outsourced and integrated only when proven and when volumes justify the change.

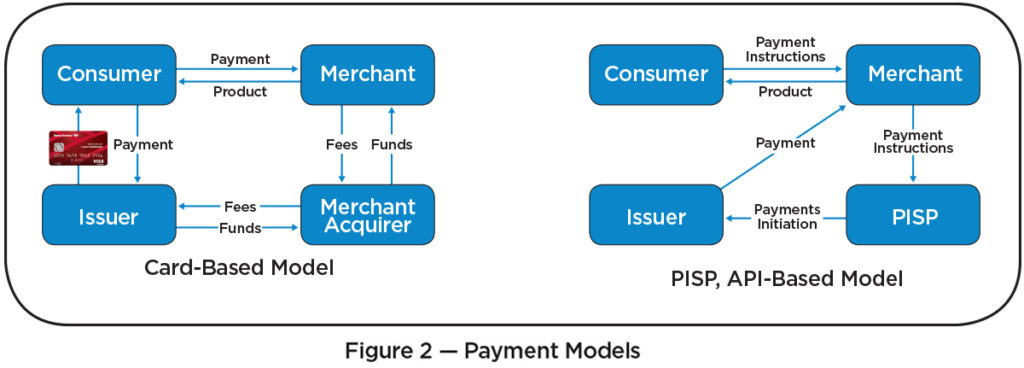

Parallel to any ambitions for omnichannel presence, merchants must also prepare for an API-based payment ecosystem. In today’s world, merchants can only get to the banking system through merchant acquirers that pull a payment through the card rails. In the not-too-distant future of APIs and real-time payments, merchants  will use payment initiation services providers (PISPs) to instruct the customer’s bank to send (i.e. push) a payment across RTRs (See Figure 2).

will use payment initiation services providers (PISPs) to instruct the customer’s bank to send (i.e. push) a payment across RTRs (See Figure 2).

Payments Canada is committed to nurturing a more open and accessible payment ecosystem. Such a change to the payment paradigm would reduce fraud and better secure eCommerce channels and open payments to non-credit card holders. This environment is still a few years away, but merchants need to begin asking their processors, their banks and their own IT and payments teams how they will take advantage of these new capabilities.

Bringing modernization to banking

In the banking sector, new technologies range from those that deliver enhanced customer experiences (personalized card control, cardless ATM withdrawals, personal financial management tools) to more truly transformational ones (real-time payments, Request for Payment capabilities, APIs and open banking). [Note that those last two are not the same. See box below for further discussion.]

To start, financial institutions (FIs) need to be aware of the potential impacts of the technologies mentioned above. These innovations are not new; they have been fully adopted in other regions. Every large bank in Canada has established a payment innovation lab. To varying degrees, most have taken the first experimental steps on the path to an API ecosystem. Smaller institutions should collaborate with their peers, their FinTech partners and member associations to start their journeys.

Given the capital budgeting restrictions that all FIs face, no institution will be able to modernize in a year or two. A longer term and stable capital funding plan is a must.

This is where planning and analysis come in. What parts of your payment systems need renovation and in what order? Which infrastructure or channel enhancements can deliver customer or cost benefits right away? For example, a fancy API-based real-time payment initiation system won’t do much good if it ultimately feeds into an hourly batch payment process.

This is also the time to examine the institution’s core payment architecture. This may be the most difficult (and perhaps single most costly) piece of the payments modernization process, but it also drives the most significant long-term benefits. It will affect every future payment enhancement that FIs want to make.

A key requirement of the new infrastructure will be flexibility. No one knows exactly what changes will be required in the years (or decades) to come. Payment systems must have the capability to adapt, grow and change with each institution’s needs. At this point, many institutions are considering the implementation of a “Payment Hub”: a piece of infrastructure that connects to channels, back-end applications, payment engines and networks, providing the orchestration controls to accept payments and route them where they need to go inside or outside the banks.

Future-proofing the infrastructure

Businesses of all types will face barriers to their success in this area over the next few years. Talent will become an issue as the demand for experienced payment professionals increases. The existence of distinct silos will hinder progress. Individual business units will compete with modernization infrastructure projects for capital funding. The difficulty of renovating legacy siloed systems will increase the complexity, cost and risk of modernization.

To build an effective payments infrastructure, businesses must establish cross-functional teams and merge enterprise-wide objectives with departmental needs. The costs of payment modernization should encourage a business to explore alternative procurement models, a journey that goes beyond the simple buy/build decision. Businesses should evaluate potential partnerships with vendors, emerging FinTechs and other non-traditional payment providers that could fill niches in their modernization plans. Businesses must also recognize that in certain selected areas, outsourcing may be the best approach. With capital budget restrictions, operating expense alternatives, including public cloud computing, should be explored.

Finally (and unfortunately), businesses should not underestimate the effort required. The adoption of new disruptive technologies is (almost by definition) difficult. From the internal naysayers to the inevitable project issues, there will be obstacles. Even with an outsourced approach, there will be issues affecting what firms can achieve and when firms can achieve it.

Therefore, businesses must prepare for a long-term approach. Executive sponsorship must know this will be a multi-year effort. But as always, firms should look for short-term payback deliverables, hopefully ones that deliver real customer impact.

For decades, the Canadian payments ecosystem has stood among the best in the world. As payment technologies evolve, businesses and financial institutions need to ensure we stay there.

David Grindal is director, solution consulting, North America, ACI Worldwide (www.aciworldwide.com).

SIDEBAR:

API ecosystem versus open banking

An open banking environment requires an API ecosystem, but the reverse is not true. An active application programming interface (API) payment ecosystem can exist without the opening of traditional banking information.

In an API payment ecosystem, the various players (including financial institutions (FIs), FinTech developers, payment processors and others) both consume and expose APIs to speed up product development. This expands the number of people working on new customer solutions. It drives efficiencies, provides flexibility and sometimes even drives new, and unintended, use cases. FIs will benefit from a wider acquisition channel for new customer transactions.

A full-fledged open banking environment requires an active and mature API ecosystem, but it also requires FIs to allow authorized and secured partners to access banking and customer payment data, including the ability to initiate, modify and control payments on behalf of a customer.