On its first year anniversary, The Scotiabank Women Initiative™ releases new survey findings, expands program to Global Banking and Markets (GBM)

TORONTO, ON–Women entrepreneurs who apply for business loans may fare better than they expect, according to survey results released today by Scotiabank on the first anniversary of The Scotiabank Women Initiative. The survey of nearly 1,000 small business owners across Canada aims to identify the financial needs of women entrepreneurs.

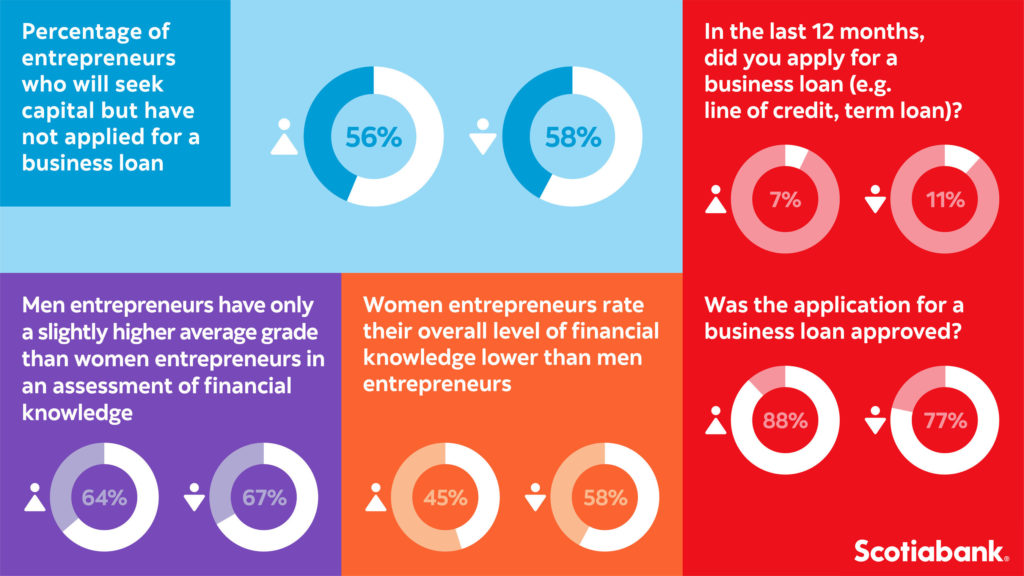

The survey found that women entrepreneurs lag men entrepreneurs in applying for business loans – but are more likely to have the loan application approved. Seven per cent of the 499 women respondents had applied for a business loan in the 12 months leading up to the survey, compared to 11 per cent of men respondents. Yet, women were more likely to have their loan application approved compared to men (88 per cent vs. 77 per cent, respectively).

“The landscape of Canadian entrepreneurship is changing and we’re encouraged to see the number of women be approved for business loans – but we want to empower even more women to gain access to capital by helping them build financial knowledge,” said Gillian Riley, President and CEO, Tangerine Bank and executive sponsor of The Scotiabank Women Initiative. “Women need to step forward in pursuit of their business ownership goals. The Scotiabank Women Initiative can help women-led businesses access the tools they need – from financing to having the right financial knowledge and support to be successful.”

In a successful first year of The Scotiabank Women Initiative, the Bank has committed $3 billion in capital to support women-led businesses in Canada over the program’s first three years. Earlier this year, Scotiabank committed capital to Disruption Ventures – Canada’s first private female-founded venture capital fund for women entrepreneurs. The program also delivered approximately 40 half-day and mini regional Un-Mentorship Boot Camps™ nationally.

In a successful first year of The Scotiabank Women Initiative, the Bank has committed $3 billion in capital to support women-led businesses in Canada over the program’s first three years. Earlier this year, Scotiabank committed capital to Disruption Ventures – Canada’s first private female-founded venture capital fund for women entrepreneurs. The program also delivered approximately 40 half-day and mini regional Un-Mentorship Boot Camps™ nationally.

And today, Scotiabank announced the expansion of The Scotiabank Women Initiative to its capital markets business – Global Banking and Markets.

From financial knowledge to financial confidence

The survey found that women entrepreneurs are more likely to employ capital from personal savings, personal lines of credit, and family and friends, rather than business sources. In contrast, they are less likely to reinvest cash flow and to apply for a business line of credit or term loan compared to men entrepreneurs.

Results also found that women entrepreneurs rate their overall level of financial knowledge lower than men entrepreneurs: only 45 per cent of women participants perceived themselves to be ‘knowledgeable’ or ‘very knowledgeable’ compared to 58 per cent of men.

“Financial knowledge leads to financial confidence, and that confidence is what many women entrepreneurs need to seek out business sources of capital,” said Alida Pellegrino, Vice President, Credit Adjudication, Scotiabank. “Through The Scotiabank Women Initiative, we’re committed to educating women entrepreneurs about loan assessment criteria and other key elements of small business financial knowledge.”

Program expands to capital markets business

Building on the success of the first year of The Scotiabank Women Initiative, Scotiabank today announced an expansion of the program for its capital markets clients. The Scotiabank Women Initiative for Global Banking and Markets is a tailored, comprehensive program in support of women clients and those who stand behind an inclusion agenda.

“We knew from the outset that this program could be game changing for GBM clients and our business, while also recognizing that the challenges faced by our clients were different from commercial and small business customers,” said Loretta Marcoccia, EVP & Chief Operating Officer, Global Banking and Markets at Scotiabank. “We spoke with our clients to hear first-hand where they saw the greatest opportunities. They shared the challenges that they faced, and with their suggestions, we built a tailor-made program to help clients take their careers and businesses to the next level.”

Building on Scotiabank’s rich expertise, the new program for GBM provides access to education, advisory, and innovative solutions.

About the survey

The online survey was conducted between October 18 and 29, 2019 by Scotiabank in consultation with Dr. Barbara Orser and Dr. Allan Riding of the Telfer School of Management, University of Ottawa. Its 499 women and 500 men respondents all own at least 50 per cent of their company and are either the primary or joint financial decision maker. A more detailed report of the findings will be released in 2020.

About Scotiabank

Scotiabank is a leading bank in Canada and a leading financial services provider in the Americas. We are here for every future. We help our customers, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets.