Inside The Value of Institutional DeFi

Special Report Decentralized finance (DeFi), which uses blockchain-based smart contracts to execute a variety of financial services activities, has seized the attention of technology developers, investors, and financial institutions. DeFi protocols have already enabled nascent markets in the crypto-asset industry on public blockchains, such as borrowing and lending as well as decentralized exchanges. Imagine the potential if the technology were to be applied to streamline transactions in foreign exchange, equities, bonds, and other real-world assets.

This will require the creation of digital representations, or tokens, of real-world assets to bring them onto the blockchain. The cost savings and new business opportunities of creating a “tokenized” version of real-world assets for transacting through DeFi protocols could be significant for issuers and investors, as well as for financial institutions that can adapt their technology and business models.

That’s an alluring prospect, but many DeFi protocols today are not designed for use in mainstream finance. Firms that wish to apply DeFi in their client offerings must incorporate the same, if not higher, levels of safeguards and security standards that have been developed over decades in the finance industry.

This is where we look to the idea of Institutional DeFi – a system that combines the power and efficiency of DeFi protocols with a level of safeguards to meet regulatory compliance and customer-safety requirements. Many existing DeFi protocols lack identity solutions to enable institutions to meet anti-money laundering (AML), know your customer (KYC), and combatting the finance of terrorism (CFT) requirements.

Cybersecurity is another major risk, as recent high profile hacks demonstrate. There is also limited, if any, recourse for investors should something go wrong. Firms need to develop safeguards to address these challenges before DeFi protocols can be adopted at scale in mainstream finance.

To create viable Institutional DeFi solutions that fit their purpose and ambitions, we believe financial institutions need to make several key design choices to implement appropriate safeguards and drive innovation. These design choices will influence everything from the level of privacy and efficiency in transactions to the pace of user adoption and the extent of interoperability with other tokenized assets.

The choices lie in three critical areas: 1) Blockchain – which underlying network to build on and what information is visible to whom; 2) Participation – the mechanisms that determine who can develop and access solutions, and 3) Token Design– how tokens are issued, transacted, settled, and standardized.

In an effort to advance industry thinking on these issues, the Monetary Authority of Singapore launched Project Guardian in May 2022. The project aims to test the feasibility of applications in asset tokenization and DeFi while managing risks to financial stability and integrity. Project Guardian will help MAS build a framework for a digital asset ecosystem, develop and enhance relevant policies, and provide direction on required technology standards. The project’s first pilot was being led by our co-authors DBS, Onyx by J.P. Morgan, and SBI Digital Asset Holdings. The Project Guardian pilot carried out transactions involving foreign exchange with tokenized deposits and separate transactions with government bonds, in each case, on a public blockchain network, using digital identity solutions and logic adapted from existing DeFi protocols.

The pilot demonstrated the feasibility and transformative potential of using DeFi protocols in financial markets with appropriate guardrails. It also validated the crucial role of two key factors in this process: 1) the use of regulated institutions to act as “trust anchors,” issuing and verifying the credentials of participating entities to establish the identities of transacting parties and connect with existing legal frameworks, and 2) the need for an agreed set of technical standards around business logic and token standards for interoperability.

Both are essential elements for Institutional DeFi and can be helpful across systems and jurisdictions to drive adoption, and improve transaction efficiency for a globally integrated finance industry. Broader efforts are needed, however, to unlock the full potential of Institutional DeFi and make it scalable. The Project Guardian pilot identified seven key areas where further work is needed, such as legal clarity, adoption incentives, and technical standards alignment. We believe these areas need joint actions from multiple parties across regulators, financial intermediaries, clients, and other third parties, including DeFi communities. The joint actions should address legal and regulatory uncertainties, establish shared standards, and seek to forge a common vision of how the industry should operate.

Given the transformative potential of Institutional DeFi, financial institutions need to develop a playbook for getting the most value out of it. Institutional DeFi will likely vary by jurisdiction and market structure, and the report suggests three ways financial institutions should start responding:

- Develop a house view on Institutional DeFi implications across business portfolios. We share potential future paradigms and their implications for key sectors.

- Decide on a participation strategy to adapt existing business and embrace new opportunities enabled by Institutional DeFi. We suggest several questions that can help firms on their journey.

- Get the organization ready to fulfill its ambitions by developing the required capabilities. We identify three areas, including organizational structure, delivery model, and talent strategy.

Value of Institutional DeFi

Financial services are built on trust and empowered by information. This trust rests on financial intermediaries who maintain the integrity of records covering ownership, liabilities, conditions, and covenants, among other areas, across a variety of siloed ledgers that are separate from the means they use to communicate. As each intermediary has a different piece of the puzzle, the system requires much post-transaction coordination to reconcile the various ledgers and settle transactions. For example, many securities transactions, particularly cross-border ones, can take anywhere from one to four days to settle.

Distributed ledger technology (DLT), such as blockchain, has the potential to resolve some of those inefficiencies by presenting transactional and ownership information on a single shared ledger. The growing acceptance of tokenization, which creates digital representations of assets such as a stocks and bonds on a blockchain, can extend the benefits of DLT to enable exchange and settlement of a wide range of asset classes.

Institutions can generate further efficiency by adopting DeFi protocols, which use software code to automatically execute a range of financial transactions pursuant to present rules and conditions.

We define Institutional DeFi as the application of DeFi protocols to tokenized real-world assets, combined with appropriate safeguards to ensure financial integrity, regulatory compliance, and customer protection. (It is important to note that in the joint paper they do not refer to Institutional DeFi as institutional players participating in crypto DeFi.) The prize for innovators who hone this model for use in the world’s trillion-dollar finance industry could be substantial. Institutional DeFi is:

Real-world asset tokenization

Representation of real-world assets on a mutualized ledger, shifting from siloed records to a shared one viewable by all participants

DeFi protocols

Rapidly evolving area at the vanguard of financial services and digital assets; providing services on a blockchain settlement layer; such as lending, trading, investments, insurance, and asset management

Appropriate Safeguards

Controls and security standards for investor protection and financial stability, for example, Know Your Customer, trade surveillance; using a public blockchain could require more safeguards.

Tokenization is already bringing new potential to money and assets

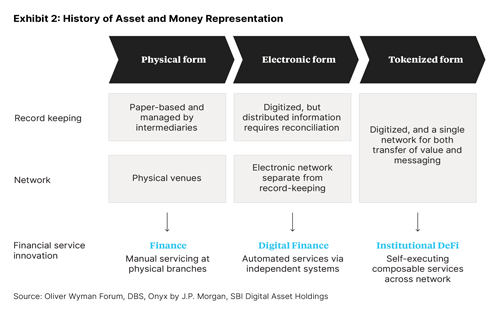

Technology continually evolves and modernizes financial services by creating new ways of executing and recording transactions. Each step in this evolution brings new business opportunities. For example, dematerialization replaced paper certificates with digital ones in the form of electronic book-entries, fostering the rise of electronic payments and trading. That, in turn, made securitization possible, which added value to previously illiquid assets such as mortgages.

Despite recent waves of digitization, trillions of dollars’ worth of real-world assets are recorded in a multiplicity of ledgers that remain separate from messaging networks. This means that financial intermediaries have to record transactions on siloed ledgers and then message each other to reconcile their books and finalize settlement. The need for coordination across ledgers and networks between entities creates inefficiencies that increase costs and risks, lengthens settlement times, and in general adds overhead to financial services.

The past few years have witnessed an increased focus on blockchain technology as a potential panacea for resolving these inefficiencies. The promised value of blockchain comes from combining ledgers and networks in a way that allows multiple parties to see the same information, hence greatly reducing the need for reconciliation after a trade or transaction. In addition to creating a shared view of information (transaction balances, ownerships, etc.), blockchains also enable business rules and logic to be executed and viewed with high transparency and in a deterministic manner.

For example, lending business logic can be codified transparently in smart contracts, thereby enforcing adherence to rules and automating settlement.

In the process of adopting blockchain technology, financial firms are exploring the concept of representing real-world assets as tokens on a blockchain. Such tokenization can reduce settlement risk and decrease settlement times, which typically takes one to two days even for low-risk assets such as G10 government bonds, by enabling so-called “atomic” settlement – the instant exchange of two assets on the condition that assets are simultaneously transferred. No party to a transaction is then left waiting for delivery.

In the process of adopting blockchain technology, financial firms are exploring the concept of representing real-world assets as tokens on a blockchain. Such tokenization can reduce settlement risk and decrease settlement times, which typically takes one to two days even for low-risk assets such as G10 government bonds, by enabling so-called “atomic” settlement – the instant exchange of two assets on the condition that assets are simultaneously transferred. No party to a transaction is then left waiting for delivery.

The application of smart contracts in asset tokenization also has delivered a number of benefits, including enhanced and new offerings. For example, J.P. Morgan leverages tokenization to offer intra-day repo solutions for clients on its Onyx Digital Assets platform, and DBS Digital Exchange offers corporates a platform to raise capital through the digitization of their securities and assets, with options to offer smaller denominations.

These tokenization benefits are also welcomed by asset managers, as 70 percent of institutional investors expressed willingness to pay extra for increased liquidity and faster asset turnover, according to a recent survey conducted by Celent.

Tokenization efforts in the industry are well under way covering both payment instruments and assets, which creates the potential for end-to-end asset exchange on blockchain.

Payment Instruments

Tokenized payment instruments are gaining scale through public- and private-sector efforts Tokenized assets are growing as multiple pilots have validated their feasibility and value.

Eighty-eight percent of global institutional investors are comfortable with digital representations of cash using blockchain-based technology, according to a 2022 Celent survey.

Tokenized payment instruments are being explored by both the public and private sector. On the public sector side, a 2021 survey of 81 central banks by the Bank for International Settlements (BIS) found that 90 percent of central banks were investigating the potential of central bank digital currencies (CBDCs), including 26 percent that were actively developing CBDCs or conducting pilot projects.3 The transaction volume of China’s digital yuan, or e-CNY, reached RMB 100 billion ($13.9 billion) at the end of August 2022,4 nearly three years after its launch. The European Central Bank in September selected five companies to develop potential user interfaces for a digital euro; it expects to complete its investigation on whether to launch a CBDC in October 2023.

Central banks are broadening the scope of their CBDC experiments. As of October 2022 the BIS was running seven CBDC projects with various member central banks. More recently, the Banque de France announced a new project to look at using DeFi for wholesale CBDC liquidity management.

On the private sector side, privately issued stablecoins, which are cryptocurrencies typically pegged to fiat money such as the US dollar, have grown to a nearly $150 billion market.

There are increasing efforts from regulators to clarify the status of stablecoins. Recently, MAS published a consultation paper to support the development of stablecoins as a credible medium of exchange in the digital asset ecosystem.

In 2022, the European Union agreed on the first major regulatory framework for the cryptoasset industry, including stablecoins. Japan also passed a bill providing a legal framework for stablecoins that allows licensed banks, money transfer agents, and trust companies to issue them.

Ninety-one percent of institutional investors are interested in investing in tokenized assets, according to a 2022 Celent survey.

We see many firms entering the space across multiple asset classes including equities, bonds, real estate, commodities and others. For example, J.P. Morgan’s intra-day repo application on Onyx Digital Assets has processed more than $430 billion of repo transactions since its launch in November 2020; the daily transaction volume of Broadridge’s Distributed Ledger Repo platform using tokenized government bonds reached $35 billion in the first weeks after launch; DBS has successfully issued the DBS Digital Bond in May 2021 via security token offering (STO); Mata Capital, a French asset manager, tokenized €350 million ($343 million) worth of funds.

Last year, Switzerland implemented a so-called DLT Act granting tokenized securities the same legal status as traditional ones. Furthermore, in May 2021 Germany’s parliament passed a law allowing securities to be issued in electronic form, not paper, enabling the issuance of tokenized assets. The European Investment Bank subsequently issued a digital bond on a public blockchain in 2021 under this German law.

Delivering financial services

DeFi protocols enable new ways to deliver financial services In parallel to industry efforts to develop real-world asset tokenization, the concept of decentralized finance has flowered in the public crypto-asset space. DeFi, as it is popularly known, refers to decentralized applications (DApps), which provide financial services via sophisticated and automated computer code on a blockchain as the settlement layer. These services include payments, lending, trading, investments, insurance, and asset management. DeFi protocols are the code and procedures that govern these applications. These protocols typically operate without centralized intermediaries or institutions, use open-source code, and allow for flexible composability (code or applications can be taken from one protocol/service and plugged into another).

DeFi has rapidly emerged in the past three years and grew more than tenfold to $160 billion in 2021 in terms of total value locked before retreating to stand at a little over $50 billion as of October 2022. DeFi innovations have flourished across various financial ecosystems and attracted billions of dollars of liquidity across decentralized exchanges (such as Curve and Uniswap), lending protocols (such as Aave and Compound), and other DeFi solutions, such as liquidity staking and collateralized debt positions, which lock up collateral in a smart contract in exchange for stablecoins. Some noteworthy innovations in the DeFi space involve crypto lending/borrowing protocols and decentralized exchanges:

Liquidity pools, for instance, create all-to-all markets. These pools link buyers and sellers along with liquidity providers in decentralized exchanges, or DEXes, and lenders and borrowers in lending protocols. Aave and Compound are examples of large crypto lending and borrowing protocols in terms of total value locked, whose operations involve liquidity pools. Both retail and institutional investors can deposit, borrow, or trade crypto from the pool using business logic that is governed by smart contracts. If pools are on the same chain or made interoperable, this aggregates liquidity by attracting more investors.

Automated market markers (AMM) provide a new method of price discovery. An AMM facilitates buy and sell orders in a self-executing manner, always standing ready to provide quotes and setting a price based on a predefined, transparent formula considering supply and demand. Uniswap and Curve are examples of a decentralized crypto exchange that uses an AMM. When a user wants to swap crypto A for crypto B, the AMM automatically calculates how much crypto B the user can get and at what price rather than relying on a market maker to quote a price or to match a buyer and a seller.

DeFi, as described above, is prevalent in the public blockchain space and applies mostly to transactions in the largely unregulated crypto-asset industry. Yet the logic embedded in DeFi protocols, which are programmable, self-executing business processes, can be applied to interact with any tokenized asset.

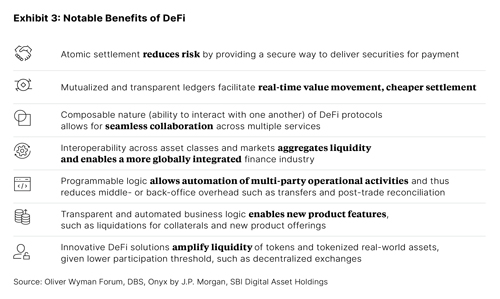

Building full-scale financial services that leverage tokenization and programmability could have far-reaching implications for the finance industry. It could generate substantial cost savings, as code dramatically reduces middle and back-office operations across firms and intermediaries. In the exhibit below we list some notable benefits of DeFi solutions. New business opportunities are also likely to emerge as financial institutions take advantage of the composability of DeFi protocols, packaging multiple DeFi protocols together to offer new solutions. First, however, firms must adapt the DeFi protocols to the regulatory standards of today’s trillion-dollar markets for money, stocks, bonds, and other assets.

Safeguards are the key to Institutional DeFi

Today’s finance industry rests on an array of safeguards that protect investors from fraud and abusive practices, combat financial crime and cyber malfeasance, maintain investor privacy, ensure that industry participants meet certain minimum standards, and provide a mechanism for recourse in case things go wrong.

Institutional DeFi will need to incorporate the same, if not higher, level of standards to meet regulatory requirements, create trust, and drive adoption by issuers, investors, and financial institutions.

Here are some of the key safeguards needed to build DeFi-based solutions for institutions:

• AML/KYC risk controls. Mechanisms that ensure AML/KYC compliance for participants can avert the potential legal liability of dealing with sanctioned parties or unqualified investors, and also prevent inadvertently enabling or participating in money laundering. Designing appropriate risk controls however are not easy. In 2021, financial institutions were fined $2.7 billion for their deficiencies and failures in AML compliance policies, procedures, and processes.18 To avoid the severe consequences that could arise from control failures, the average mid-size to large organization spends $22.7 million annually on financial crime compliance operations to build up effective standards.19 Appropriate controls are needed if regulated financial activity is to take place through DeFi protocols, and regulators have begun to set expectations.

In August 2022, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on Tornado Cash, a cryptocurrency mixer that facilitates anonymous transactions by obfuscating their origin, destination, and counterparties, alleging that it had facilitated the laundering of more than $7 billion worth of cryptocurrency.20 Blockchain technologies may offer novel ways of ensuring appropriate controls at lower cost. For example, there are methods for ensuring compliance with AML/KYC without necessarily revealing one’s personal information, such as using zero-knowledge proofs combined with pseudonymous identity mechanisms.

• Data privacy. Data privacy is crucial for clients in certain segments, in particular to protect their trading history and positions for certain asset markets. Information on public blockchains is permanently visible to all by default, and investor orders can at times be inferred from publicly available data, something that becomes increasingly more likely as time goes on and data is accumulated. For example, whale tracking tools on Twitter and Telegram are widely used by the public to track large crypto-asset transactions done via decentralized exchanges and other DeFi protocols, whereby people have strong assumptions or hypotheses on who these whales (investors holding a vast number of crypto-assets) are. In the finance industry, client information in respective transactions is masked and protected through brokers, without being revealed to the market. Appropriate privacy protections will be necessary.

• Cybersecurity protections. While almost anything digital can be vulnerable to hackers, cybersecurity protections are especially important for digital assets and DeFi protocols due to the nature of blockchain. Although the underlying blockchain technology makes it difficult to alter data, firms seeking to develop Institutional DeFi solutions must address cybersecurity vulnerabilities in cross-chain bridges, private digital keys, and on-chain price oracles, as well as guarding against market manipulation. Such controls are needed to enhance client trust and protect the safe ownership of digital assets. A rise in thefts from DeFi protocols led to a

58 percent increase in crypto hacking losses, to $1.9 billion, in the first seven months of 2022. Bridges connecting different networks are particularly vulnerable, as hackers demonstrated in July 2021 by attacking the cross-chain DeFi platform Poly Network, and causing roughly $600 million in losses in Ethereum and other tokens. Users manage their own private keys to access their crypto assets, which can also compromise security. Losses due to compromised private keys have totalled $274 million in the first eight months of 2022 alone.

• Mature governance and conduct models. Reliable DeFi protocol governance and stakeholder conduct standards are needed to ensure that the quality of Institutional DeFi solutions offered are in alignment with financial services professional standards. Financial institutions are highly regulated with mature quality assurance processes. For example, there are more than nine different federal financial regulators in the United States on top of multiple regulators in each of the 50 states. Multilateral organizations help coordinate financial regulation internationally. Banks invest over $270 billion a year and dedicate an average of 10 percent to 15 percent of their staff to comply with regulatory obligations. Standards for conduct exist for both institutions and individuals. Existing DeFi protocols are based on different governance and conduct assurance mechanisms, most often done through governance tokens that bestow holders with voting rights. This is similar to most common equity structures but without the same level of corporate governance. Also, many DeFi protocols have a very high concentration of voting control: Research by Chainalysis into ten major governance tokens found that fewer than one percent of token holders held 90 percent of the voting rights. Indeed, participants could consider whether to and how to cover DeFi protocols under a corporation construct – such as trusts, special purpose vehicles, or other limited purpose corporations – to allow for structured governance and liability recourse.

• Proper recourse mechanisms. Recourse and dispute management should be properly established upfront. Incidents such as theft or loss due to operational errors can occur in any financial system. The finance industry today is built with robust recourse mechanisms or legal remedies to protect users and investors in most cases. For instance, the London Court of International Arbitration, one of the world’s leading arbitral institutions, managed 86 international dispute cases from the banking and finance industry in 2021. Such mechanisms are lacking in public DeFi solutions, giving rise to uncertainty in arbitration procedures. When a hacker stole $130 million in crypto assets from users of DeFi platform BadgerDAO, they were unable to afford full restitution immediately with a mere $53 million in their treasury and no insurance coverage. Without an available legal recourse mechanism, this left a handful of affected users uncompensated.

• Legal clarity around smart contract-based business activity. The legal status of financial business activity has been continuously clarified by countless acts of legislation and major litigation efforts over past decades. The UK High Court, for example, typically hears 80 to 100 important banking and finance cases annually. That level of clarity does not yet exist for smart contract-based DeFi activity. According to international law firm Norton Rose Fulbright, it remains unclear which smart contracts are legally enforceable, which could depend on the intentions of contracting parties or local jurisdictions. In the United States, the enforceability and interpretation of contracts in the United States is commonly governed by state law. Some states such as Arizona and Nevada have amended their respective laws (such as the Uniform Electronic Transactions Act) to explicitly incorporate blockchains and smart contracts. Some code-only smart contracts would be enforceable under state laws governing contracts. The International Swaps and Derivatives Association (ISDA) also developed legal guidelines for smart derivatives contracts to provide general guidance for different jurisdictions. More legal clarity in commercial law is necessary to reinforce these requirements and foster a trusted environment for smart contract-based business.

Conclusion

Now is the time to actively explore Institutional DeFi The foundation for Institutional DeFi is being established by the growth of real-world asset tokenization and the innovations observed in DeFi. Financial institutions have the opportunity to transform parts of their business by adapting DeFi protocols and combining them with the level of safeguards that regulators and clients expect. Institutional investors’ appetite for digital assets is growing and they are willing to pay extra for increased liquidity and faster transactions. 88 percent said they are still planning to move forward with current plans around digital assets despite market downturn. In May 2022, the Monetary Authority of Singapore launched Project Guardian to test the feasibility of applications in asset tokenization and DeFi while managing risks to financial stability and integrity.

Project Guardian will help MAS build the digital asset ecosystem framework, enhance and develop relevant policies, and provide direction on the technology standards. The full report also explores how financial services providers could adopt Institutional DeFi based on different considerations, leveraging findings from the first pilot under Project Guardian. It also discusses how financial institutions should collaborate to get the most out of the transformation. From the carrier pigeon to the telegraph, the transistor to the mainframe, technology has shaped the finance industry for generations. We believe Institutional DeFi has the potential to be the next great transformative force. It may be too early to predict the end-game scenario, but there are no-regret moves executives can take now to prepare their organization for future options. There is no single right answer, but an answer is needed at both the institution and industry level to move from debates and pilots to scalable, industrialized solutions. Given the challenges discussed in this paper, we expect first movers will have an advantage because they will learn how best to deploy the technology and create a talent environment that fosters innovation.

This article is based on the special report Institutional-DeFi: The Next Generation of Finance? Produced by a collaboration of the OliverWyman Forum, DBS, onyx by J.P. Morgan and SBI Distal Asset Holdings, an SBJ Company.

This article is based on the special report Institutional-DeFi: The Next Generation of Finance? Produced by a collaboration of the OliverWyman Forum, DBS, onyx by J.P. Morgan and SBI Distal Asset Holdings, an SBJ Company.

Authors credits. Oliver Wyman: Jason Ekberg, Partner, Corporate and Institutional Banking, Netherlands; Michael Ho, Partner, Corporate and Institutional Banking Hong Kong; Larissa de Lima, Senior Fellow, Future of Money Initiative, Oliver Wyman Forum, New York; Teddy Hung, Engagement Manager, Financial Services Hong Kong; DBS: Keith Desouza, Group Head, Liquidity Funding Management, Treasury & Markets, Singapore; Peng Khim Ng, Group Head of Institutional Banking Group & Future Ready, Technology, Singapore; Nova Cygni Pelupessy, Head, Financial Market Infrastructure Ecosystems, Group Strategy and Planning, Singapore; Yu Song Low, Financial Market Infrastructure Ecosystems, Group Strategy and Planning, Singapore; Onyx by J.P. Morgan: Naveen Mallela, Global Head of Coin Systems, Singapore; Naveen.Mallela@jpmchase.com; Tyrone Lobban, Head of Blockchain Launch and Onyx Digital Assets, Onyx by J.P. Morgan, London; Nikhil Sharma, Senior Product Manager, Blockchain Launch and Onyx Digital Assets, Nelli Zaltsman, Lead Product Designer, Coin Systems, Onyx by J.P. Morgan, New York; SBI Digital Asset Holdings: Jason Beale Head of Product, SBI Digital Asset Holdings, Japan; Pablo Argibay, Chief Scientist, SBI Security Solutions, Japan. This joint report would not have been possible without ideas and contributions from numerous other members from these organizations.