OTTAWA, ON–The current economic instability caused by the COVID-19 pandemic has raised questions around the world about how best to approach bank capital requirements and the resulting implications for bank dividend policies. This statement provides an overview of the existing regime in Canada.

All of the countries represented on the Basel Committee on Banking Supervision (BCBS) have agreed to a set of minimum standards for bank capital requirements. Member countries can go beyond those minimum standards, and most of them do. These departures from the minimum standards vary across countries, and lead to some important divergences in bank capital regimes.

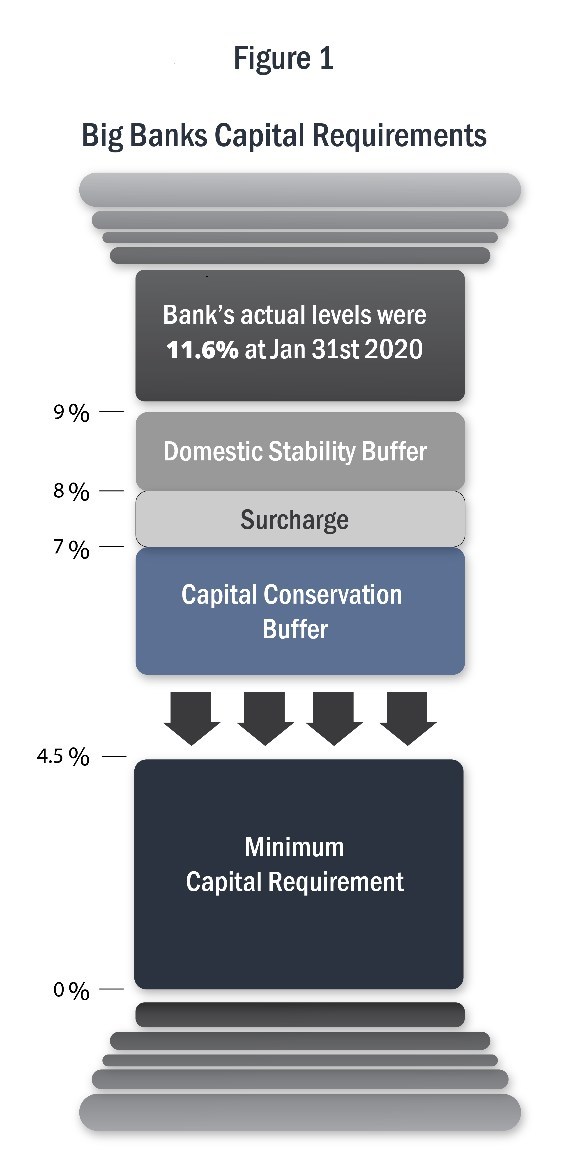

Figure 1 – Big Banks Capital Requirements (CNW Group/Office of the Superintendent of Financial Institutions)

Canada has earned a reputation for strong adherence to international banking standards. At the same time, Canada has also earned a reputation for “going its own way” on bank capital while respecting the international minimum standards. To ensure consistency with international standards, OSFI undergoes regular third-party reviews through the BCBS’s Regulatory Consistency Assessment Programme (RCAP). OSFI has had two assessments in the past decade under the RCAP and each time it received the highest rating. This balanced approach has served Canada well in the past and will continue to serve us well in the future.

As we entered this exceptional period, OSFI had already developed a capital regime that required Canada’s largest banks to have a strong capital base. The capital regime is multi-layered and includes minimum capital levels, a Capital Conservation Buffer, a surcharge for large banks and the Domestic Stability Buffer (see Figure 1). The first two elements are modelled on the international standards set by the BCBS, while the last two elements go beyond and are specifically adapted to Canada’s circumstances.

Since the financial crisis in 2008, OSFI increased the minimum requirements for both the quantity and quality of capital, including building up capital buffers. Larger banks are subject to the Domestic Stability Buffer, and since 2018, OSFI has reviewed the setting of it at least twice per year. Similarly, smaller financial institutions are also subject to buffers, such as the Capital Conservation Buffer. The Domestic Stability Buffer is countercyclical by design as it requires reserves to be built-up in good times so that when risks materialize, banks are able to do more than just absorb losses; they are also able to continue to support the economy through lending, providing services to customers and paying dividends.

Reinforcing Canada’s capital regime started well before this period of uncertainty. Prior to the COVID-19 pandemic, through the Domestic Stability Buffer, OSFI had required big banks to hold a larger countercyclical buffer than in most other countries. In Canada, the countercyclical buffer applies to a bank’s global assets and not just its domestic exposures. When OSFI released this buffer, it was set at 2.25 percent of weighted assets. Even today with the Domestic Stability Buffer set a 1.0 percent of weighted assets, it remains one the largest countercyclical buffers set by prudential regulators globally.

When there are periods of economic uncertainty or a downturn, releasing capital buffers is the first step in OSFI’s contingency plan, as it enables banks to use the funds that had been set aside. To this end, on March 13, OSFI released 1.25 percentage points, which was about 55% of the Domestic Stability Buffer and at the same time, OSFI prohibited dividend increases and cancelled future share buybacks. OSFI will continue to monitor institutions’ capital and liquidity levels and if conditions warrant, is prepared to release the remaining 1.0 percentage points of the buffer.

OSFI has built other contingency measures into Canada’s capital regime. Specifically, as banks move through capital layers, there are disbursement restrictions. For example, if sustaining a bank’s capital level requires it to access funds that are in the Capital Conservation Buffer, the bank will be automatically required to restrict disbursements, including dividends and share buybacks. Restrictions for larger banks would apply earlier when its capital levels fall within the D-SIB surcharge threshold.

OSFI has long signalled its expectations that banks use their capital buffer in the event of a downturn or period of economic uncertainty. For example in 2016 and 2017, I noted “…of course, a bank that is using up its capital needs to recapitalize. If this goes on long enough, or happens quickly enough, dramatic measures may be required. But for a bank that starts with capital well above its regulatory minimum, we all need to see the idea of using some of the bank’s capital buffer as the normal first step in the process …”

All of this has helped to build a strong capital regime in Canada that is unique and appropriate to our context. Having a robust capital plan is important for the financial stability of the country so that banks remain prepared for severe yet plausible scenarios.

About OSFI

The Office of the Superintendent of Financial Institutions (OSFI) is an independent agency of the Government of Canada, established in 1987, to protect depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks.

OSFI supervises more than 400 federally regulated financial institutions and 1,200 pension plans to determine whether they are in sound financial condition and meeting their requirements.