By Christopher Juneau

By Christopher Juneau

The most recent SAP Concur CFO Insights report tackles the emerging theme of CFOs taking increasing responsibility for managing uncertainty in their organizations.

The CFO role continues to grow and evolve as their analytical skills and insights become even more valuable in a climate of economic turmoil. Our global survey found that an emphatic 90 percent of senior finance leaders agree their key task today is to prepare business for the unexpected. Only a mere 2 percent disagree.

Businesses need certainty to plan and grow, but they rarely get it these days. Instead, the IMF’s World Uncertainty Index has trended clearly towards growing economic instability since 2000, pushed by events such as the dotcom crash, the Global Financial Crisis, Brexit, and the COVID-19 pandemic. Since 2022, the Ukraine war has sparked yet another surge in economic upheaval, with supply chain disruptions, rampant inflation, and higher costs of capital.

In this report, we investigate how CFOs’ increased responsibility for managing risk and uncertainty impacts their role. We look at the challenges and opportunities, considering how they should respond and position themselves and their teams.

The ripple effects will be felt across the organization, from forecasting and analytics to innovation, artificial intelligence, and their relationships with other senior leaders, such as chief human resources officers (CHROs). Though managing instability is a tough job, we believe it will ultimately propel well-equipped CFOs to greater heights.

Executive Summary

The research covered the USA, Australia, Canada, UK, Germany, Brazil, and Mexico during 2023. It included a wide range of sectors from financial to healthcare, utilities, consumer and industrial. Amid economic turmoil, businesses are turning to the CFO to manage risks and navigate uncertainty. Four of their top five external challenges relate to economic turmoil. Ninety percent of senior finance leaders say their main task today is to prepare business for the unexpected.

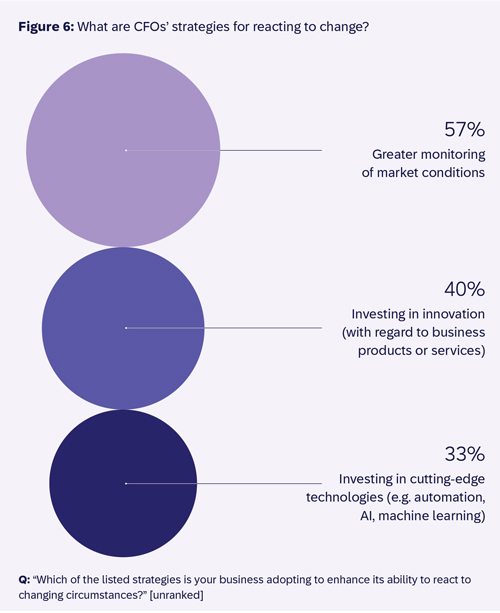

Investment in forecasting is rising. CFOs’ biggest investments are in data analytics and reporting, as they address their top internal challenge—rising complexity in financial forecasting. Fifty-seven percent of CFOs are adapting to change by increasing monitoring of market conditions. Forty percent are investing in innovation and one-third are investing in technologies such as automation and artificial intelligence.

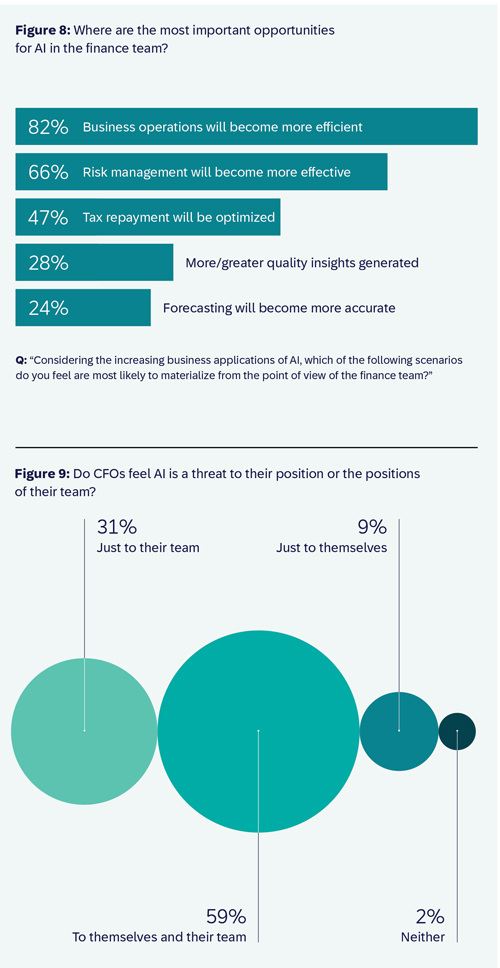

AI will be a threat and critical partner. Though nearly all finance leaders are worried about the threat from artificial intelligence, many also see it as an essential tool for managing the unexpected. Ninety-eight percent of CFOs believe AI threatens them or their team while 61 percent say it will be essential in managing the unexpected.

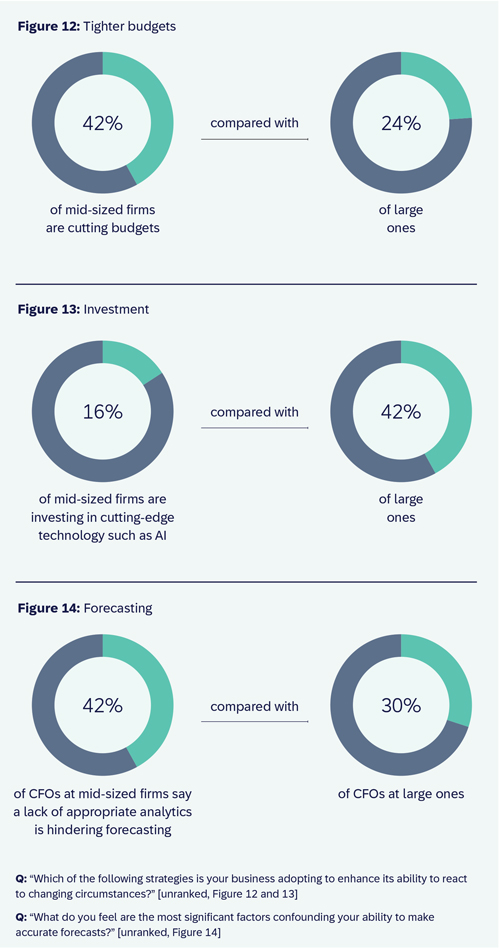

Mid-sized firms need help with innovation and forecasting analytics. CFOs in mid-sized firms are focused on tightening budgets and upgrading their finance function to compete with larger peers. But they also need help with forecasting and investment in innovation. Forty-two percent of CFOs in mid-sized firms say forecasting is hindered by lack of analytics capabilities, compared with 30 percent in large companies. Sixteen percent of mid-size firms are investing in cutting-edge technologies such as AI compared with forty percent of larger firms.

Investors are pushing for sustainability reporting. Climate change is low on the list of external challenges for CFOs, but investors still push companies towards sustainable practices. The associated focus on environmental, social and governance (ESG) reporting can transform CFO roles further. But they need accurate, transparent, and consistent reporting and integrated data.

CFOs also need a closer relationship with HR. Finance leaders acknowledge that they must collaborate more effectively with HR leaders, especially on business performance metrics and common databases. This reflects their changing relationship as more HR heads report to the CEO rather than the CFO. Eighty percent of CFOs believe they must work more effectively with HR heads.

CFOs take centre stage by managing uncertainty and risk

As CFOs respond to growing economic instability, risk management, forecasting and budgeting are the top challenges. As economic turmoil continues to grow, CFOs are increasingly responsible for managing uncertainty in their organizations. This critical new part of the finance role involves focusing more proactively on identifying and mitigating risks in the business.

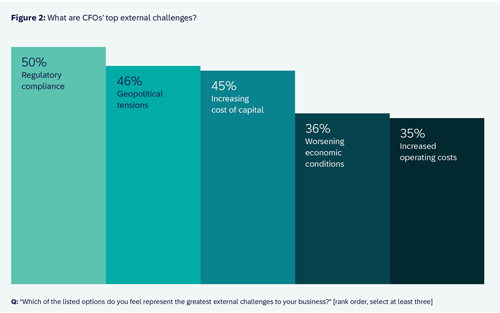

Our global research with CFOs shows four of the top five external business challenges relate to global economic turmoil. Geopolitical tensions, worsening financial conditions, rising costs of capital, and increasing operating expenses all rate in the top five, alongside regulatory compliance.

Business uncertainty has climbed for some time, as factors such as Brexit, the COVID-19 pandemic, and the Ukraine war have disrupted the certainty that businesses need. Uncertainty measures, including those from the IMF, show a clear upward trend over the last 10 to 20 years, and the perception of instability has accelerated since 2016.

Finance leaders are the front line in managing this reduced predictability and preparing businesses for the unexpected. This responsibility will elevate their already critical role in organizations as they take charge of managing risks around heightened inflation and interest rates, digital disruption, and international trade wars, among many others.

Regulation climbs the agenda

The other big external issue for CFOs is regulatory compliance, which 50 percent cite as a top risk. While CFOs have often played an important role in compliance, this responsibility has grown as regulators across sectors have introduced an ever-increasing number of rules and stricter penalties. Fines are increasingly linked to company revenues; in some cases, they have no upper limit. An example is the EU’s strict General Data Protection Regulation (GDPR). Fines for breaches are capped at €20 million or 4 percent of revenue and have reportedly totalled over €4 billion so far.

Internal risk focus

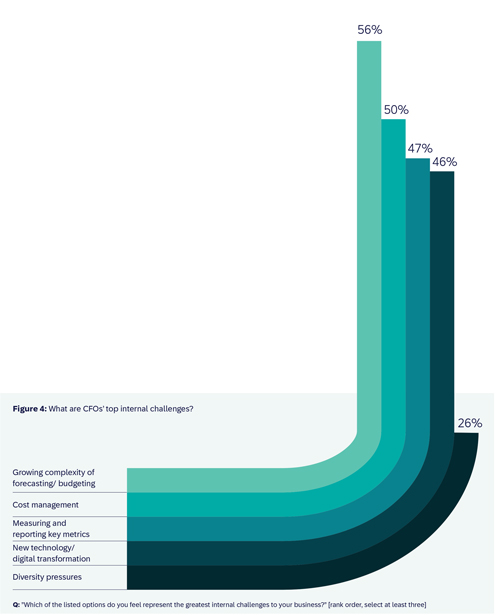

The CFO’s augmented role in managing risk also feeds into their top internal challenge – the growing complexity of forecasting and budgeting. This was closely followed by cost management, measuring and reporting key metrics, and managing new technology and digital transformation.

Economic conditions are so uncertain that previous priorities such as climate change, increasing customer expectations, and talent shortages have been pushed off the list of most-pressing corporate issues.

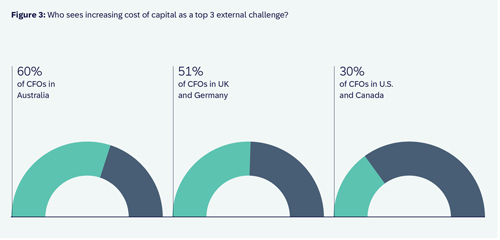

The CFO’s augmented role in managing risk also feeds into their top internal challenge – the growing complexity of forecasting and budgeting. However, there are variations. In the UK and Germany, 51 percent said increasing cost of capital is a top three challenge versus just 30 percent in the U.S. CFOs in northern Europe are more troubled by the cost of capital than those in Mexico and Brazil, where interest rates are above 10 percent.

And in the U.S, many companies are wrestling with other issues, such as diversity or hybrid working, reflecting an elevated spend on collaboration tools. Accurate forecasting is hindered by multiple challenges, including unpredictable economic conditions, difficulty pricing risk, and data and analysis issues. We drill down into these challenges. In the U.S, many companies are wrestling with issues such as diversity or hybrid working, reflecting an elevated spend on collaboration tools.

CFOs invest heavily to tackle forecasting challenges

CFOs’ investment priorities are data analytics and reporting, but many still lack the right tools and data. Data analytics and reporting tools are the biggest areas of investment for CFOs in their new role as uncertainty-reducer-in-chief. In stormy seas, a map and compass are even more important than strong sails and a watertight hull.

Fifty-five percent of all CFOs are investing in data analytics and reporting tools right now. And most of the 10 investment areas mentioned in our global survey relate to increasing reliance on data and technology to drive down risk and ensure business stability. These investments include expenditure management systems (42 percent), collaboration tools (37 percent), digital transformation of finance processes (35 percent), learning management systems (29 percent), predictive analytics and advanced modeling (24 percent), and artificial intelligence (15 percent).

Forecasting challenges and opportunities

Many CFOs still face a challenge to update their forecasting systems and improve data accuracy. Even when a company’s analytics infrastructure has been upgraded, its value will only be realized when its data feeds are robust and accurate. For those who have been working hard on improving data analytics, the results have been exciting.

The key is combining financial information with non-financials, such as market, sales, operational, and people data, which can all be leading indicators of financial impacts. By combining both in a sophisticated model, finance can help the business understand what drives performance and provide insights to improve decisions.

With the right data strategy, technology, and skills, CFOs find they can use analytics to improve almost any aspect of the business, from supply chain efficiency to sales forecasts and risk management.

Practical applications include anything from improving loan approvals to reducing customer churn, measuring effectiveness of user incentives, managing supply and demand, reaching new customers, identifying fraud, monitoring competition, predicting orders, adjusting pricing, and measuring product profitability.

Conversely, as companies rely more on data to drive performance in these ways, using poor-quality data has become one of the biggest threats to their reputation.

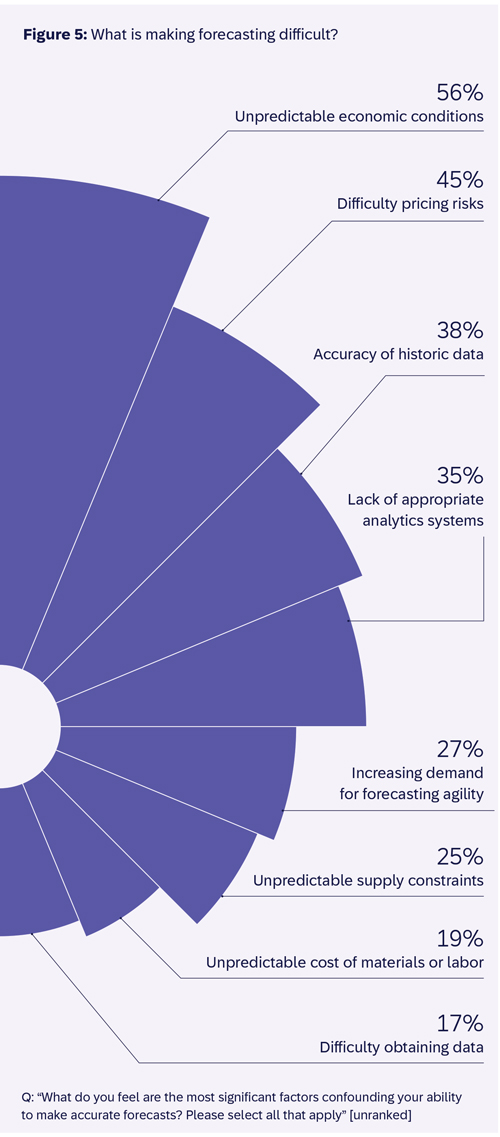

This is reflected in our survey. While the biggest factors affecting CFOs’ ability to forecast accurately are unpredictable economic conditions and difficulty pricing risks, the next most pressing challenges are accuracy of historic data (38 percent) and lack of appropriate analytics systems (35 percent).

Assessing the financial impact of risks is related to improved data and analytics, as the latter should help CFOs assess and price risks better in forecasts. These are critical issues for finance leaders, as many boards and investors now expect them to have superior forecasting abilities to help navigate unprecedented economic conditions. Some 27 percent of CFOs said they face increasing demands for forecasting agility.

Their focus on investment should help. For example, investing in systems that allow multiple model-forecasting scenarios enables faster adjustment to changing conditions. Providing they are based on robust data, these systems can enable better evaluation of opportunities and resources, and more dynamic improvement of processes and workflows. For example, finance leaders can analyze historic trends; look for new emerging marketing techniques; and include a wider range of factors to improve forecasting accuracy. These technologies also work better when linked with efficient automation processes.

How CFOs are Adapting to Change

The SAP Concur global CFO survey also looked at the issue of managing uncertainty by asking CFOs about their firm’s strategies for adapting to change. In this economic environment, it would be easy to assume their go-to strategy is slashing costs. Instead, CFOs say they are adapting by increasing monitoring of market conditions (57 percent). They are also investing in innovation (40 percent) and cutting-edge technologies such as automation and artificial intelligence (33 percent). Budget tightening didn’t make the top three.

One caveat is that budget tightening is a priority in smaller firms – second only to greater monitoring. Investing in innovation is much higher (56 percent) in larger companies compared to smaller ones (35 percent). We discuss the differences between firms of various sizes in more detail in article five of this report, which analyzes the issues facing mid-sized firms.

AI and analytics

Though the proportion of CFOs investing in artificial intelligence (AI) is currently small at 15 percent, this area has enormous potential. AI can help finance leaders in many ways, from improving financial analytics to tracking performance and spotting growth opportunities. CFOs can also combine AI and analytics to adapt to change in multiple ways, such as improving risk management and forecasting speed and accuracy. The next article looks at these approaches in more detail.

How Finance Can harness AI and Analytics

CFOs view artificial intelligence as both a threat and a critical partner in helping manage uncertainty. So, say hello to your new frenemy: artificial intelligence (AI). Though many CFOs are concerned about the threat from AI, they also believe it will be an essential part of their new role in managing the unexpected and a tool for driving broader business goals.

Several of the top impacts of AI mentioned by finance leaders in our survey are outward facing, rather than narrow internal wins such as cutting costs. Given a list of 10 areas AI is likely to influence, task automation came only ninth. Instead, CFOs hope AI will spot data patterns to drive improved efficiency and reduce risk. They expect it will provide more and better-quality insights (28 percent), more accurate forecasting (24 percent), and better risk management (66 percent).

But overall efficiency will be a crucial goal, with 82 percent of CFOs believing AI will make business operations leaner.

How AI can optimize tax

AI’s potential for optimizing tax payments also generates a buzz – some 47 percent of finance leaders believe AI can significantly impact this area. It could help tax functions save time, optimize operations, keep up with changing regulations around the world, and reduce the risk of fraud and errors – another way to cut business uncertainty. CFOs view artificial intelligence as both a threat and a critical partner in helping manage uncertainty.

For example, indirect taxes like VAT in the UK make spend management and compliance extremely complicated to manage with manual processes alone. Concur Tax Assurance solutions by Blue dot uses AI and machine learning to automatically identify VAT-eligible expenses, validate receipts, and optimize reclaim potential. Concur Benefits Assurance solutions by Blue dot also uses these technologies to help tax functions automatically track, report, and calculate taxable employee benefits.

Countering the threat to the CFO role

Despite the optimism about AI’s potential, CFOs feel nervous. Sixty-eight percent believe AI threatens their own position, and only 2 percent think it poses no risks to themselves or their team. One way to counter this threat is to demonstrate understanding of the opportunities and risks in AI and use it as a partner. As AI and analytics evolve, they will offer CFOs many opportunities to revolutionize financial operations, enhance decision-making, and gain a competitive edge.

For example, AI and analytics can be used to:

- forecast in near real-time

- simplify compliance and reduce errors

- support demand planning by analyzing external factors and market monitoring

- automate data entry, such as inputting invoices and tracking receivables

- improve invoice matching and devise payment and collection strategies

- respond to threats and opportunities more quickly by automating risk assessment

- generate tailored financial plans.

But AI also comes with wide-ranging risks and challenges, including around data privacy, cybersecurity, copyright, bias, and hallucination – wrongly presenting something as fact. CFOs must, among other things, implement strong security and privacy measures, and promote ethical AI practices.

It’s also critical to ensure finance software has AI embedded, allowing users to easily activate intelligent solutions and apply them to existing data to tailor applications. These measures will help to unlock the full potential of AI, using it as a powerful ally for the benefit of the organization. Rather than threatening the CFO role, it could elevate it further.

How the Sustainability Agenda Can Transform the CEO

Sustainability-related pressures on CFOs are growing – especially from investors, who are pushing for more ESG reporting. In our survey, only 11 percent of CFOs said climate change was a top three external challenge, and it ranked below traditional CFO challenges such as regulation, cost of capital, and rising costs. This likely reflects the growing urgency of economic issues such as inflation and supply chain disruption over the last two years. But the need to report on environmental, social, and governance (ESG) issues is still firmly on the agenda. CFOs say investors are pushing hard on sustainability issues – harder than customers, governments, employees, or regulators. Forty-two percent said the greatest pressure to transition to sustainable practices comes from investors. This compares with government and regulators (35 percent), consumers (12 percent), local communities (6 percent), and employees (only 2 percent).

The associated pressure to step up ESG reporting could further transform the CFO role. It could give them the opportunity to focus on impacts far beyond financials in guiding their company towards a more certain and sustainable future. But they need accurate, transparent, and consistent reporting to meet regulatory rules, satisfy investors, and explain progress towards sustainability goals.

They must also integrate data across the business to ensure ESG is embedded in business strategy. And they need smart systems to help them gather the right data to support ESG reports and avoid errors. Integrated accounting systems with sophisticated auditing functions will avoid exposure to compliance, reputational, and financial risks.

What investors want

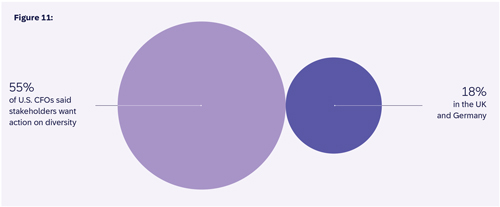

Stakeholders’ top two demands focus on reporting on physical risks associated with ESG – such as supply chain disruption or environmental disasters – and transition risks, such as the cost of moving to net zero greenhouse gas emissions. Initiatives such as using sustainable materials or improving diversity are further down some investors’ priorities, and phasing out or divesting unsustainable businesses is bottom of the list.

However, there are large geographical differences. Nearly three times as many U.S. investors are pushing on diversity issues compared to those in the UK and Germany. In contrast, finance leaders in the UK and Germany experience much more pressure for physical risk reporting. A growing number of studies evidence the link between corporate performance and diversity, equity, and inclusion (DEI). Global frameworks such as the Principles for Responsible Investing encourage shareholders to invest with DEI in mind.

The geographical differences in DEI focus may be due to the slightly more diverse population in the U.S. compared to the UK and Germany. The Me Too and Black Lives Matter campaigns have also thrust issues around gender equality and racism into the public consciousness globally, but particularly in the U.S., where they originated. Expectations on how companies should respond to such societal topics are high in the world’s largest economy. CFOs are grappling with other non-financial issues, such as talent management and human resources; this field demands a detailed analysis, which we provide in part six of this article. But first, in article five, we look at how CFO roles vary in different-sized companies.

Three Tough Issues for CFOs at Mid-Sized Firms

CFOs in mid-sized firms are focused on tightening budgets, but they also need help with forecasting and investment in innovation. The tough reality is that mid-size companies play in the same playground as their bigger peers – global economic pressures apply to everyone. But if they can sort out their internal challenges, mid-size firms can compete effectively.

CFOs at mid-sized companies, which we define as having between 500 and 2,000 employees, face similar external challenges to larger firms. For both categories, regulatory compliance, geopolitical tensions, and increasing costs of capital are the top three outward-facing issues.

Medium-sized firms have prioritized upgrades to their finance function to help them compete with their larger peers in all these areas.

However, the internal issues in mid-sized firms are different. While large firms want to innovate out of their problems, their smaller peers are keener to cut budgets. Let’s look in more detail at the three toughest inward-facing challenges for CFOs in mid-sized firms.

Tighter budgets

CFOs in all companies are thinking about how they can enhance their ability to react to changing circumstances. In our global CFO survey, the chief focus is on greater monitoring of market conditions, at 59 percent of mid-sized firms and 51 percent of larger firms. But nearly twice as many mid-sized firms are also tightening budgets compared to larger companies.

This links to the fact that mid-sized firms also feel strongly that operational inefficiency is a major internal test for the business – 38 percent ranked this as a top three challenge versus 12 percent at larger firms. There is one exception, however – more midsize firms want to increase remuneration to retain staff, perhaps reflecting the slightly larger issues they face with talent shortages.

Need for innovation investment

CFOs in mid-sized firms want to invest in innovation but are struggling and need help. Just 16 percent say they are investing in cutting-edge technology such as automation and artificial intelligence (AI), versus 42 percent in large firms. Consequently, 20 percent of CFOs at mid-size firms say lack of innovation is a top-three internal challenge versus only 6 percent of large-firm CFOs.

Integrated, cloud-based finance platforms can often be a key step towards the innovation they need by helping them streamline spend processes, cut costs, and make smarter business decisions. Some systems also now integrate AI to automate and streamline finance processes further. For example, these systems can innovate by helping finance connect and analyze seemingly unrelated pieces of information, to drive more powerful insights or dive into the details uniquely relevant to each business.

Forecasting

Medium-sized firms need help with forecasting. One benefit of being a smaller firm is that they can escape some of the worst effects of complexity. Only 43 percent say the growing complications of forecasting and budgeting are a top three internal challenge to their business, compared with 63 percent of CFOs at larger firms. However, CFOs in mid-sized firms say their forecasting is hindered by their lack of analytics capabilities, with 42 percent citing this as a problem. Again, integrated, cloud-based finance platforms can help. They include powerful, intelligent analytics to help take forecasting to the next level, make better strategic decisions, and add value to the business, all via easy-to-use interfaces. This can help mid-sized firms quickly catch up and compete with peers in larger companies.

The challenges and opportunities of managing uncertainty

The CFO’s new role as chief manager of uncertainty creates a host of challenges and opportunities. CFOs today must quickly pivot and take on new skills and capabilities, from redefining the relationship with HR to boosting the company’s focus on analytics, AI, and sustainability.

Managing heightened risk isn’t easy. But with the right skills and technologies, finance leaders can grasp exciting new opportunities. By its nature, it will never be easy to manage growing levels of risk. But with the right aptitude and technologies, finance leaders can overcome the challenges and enter an exciting new world of opportunity. Those who make the right moves and position themselves carefully, as laid out in this report, will reap the benefits with upgraded roles and careers. They will gain the platform they need to help guide their organization towards a more sustainable, profitable, and stable future.

Christopher Juneau is head of SAP Concur, Market Strategy.