By Stephen Yun

By Stephen Yun

On May 4, 2023, the World Health Organization downgraded the COVID-19 pandemic, declaring that it was now an established and ongoing health issue that no longer constituted a public health emergency of international concern. Following this decision, the Public Health Agency of Canada stated that it would “continue its work with provinces and territories to implement a long-term, sustainable approach to the ongoing management of COVID-19.” What does the downgrade of the COVID-19 emergency mean for Canada from a payments perspective? Canadians continue to live with COVID-19 and have adjusted their lifestyles to this new reality. This paper looks at the major social and economic impacts of the pandemic on the lives of Canadians and their influences on overall payment habits and practices.

Social and economic impacts of the COVID-19 pandemic

To understand how and why the pandemic changed Canadians’ payment habits and practices, it is helpful first to understand the social and economic impacts of the pandemic on Canadians.

The COVID-19 pandemic triggered unprecedented financial support from the federal government to Canadians and businesses during the economic downturn, mainly through the Canada Emergency Response Benefit (CERB) and Canada Emergency Wage Subsidy (CEWS) payments. At one point in 2020, 11.7 million Canadians were receiving payments via CERB and CEWS, which meant about 40 percent of all Canadian adults were receiving government assistance. The government also provided continued access to credit and liquidity support for businesses. This was in response to the temporary restrictions imposed by the government on non-essential businesses, which led to job losses and reduced employment income.

These financial support payments were made through direct deposit or by cheque. For many Canadians, the payments represented a lifeline to pay their bills and keep businesses afloat. Receiving a payment from the government in a timely manner was vital; for this reason, electronic payments were preferred over paper payments. Direct deposit payments outnumbered cheque payments by a ratio of over 7:1.5 The Receiver General of Canada issued 10.4 million cheques and 78.4 million direct deposit payments related to CERB and CEWS payouts between March and December 2020. An impact of the pandemic is that it pointed out to Canadians the speed, convenience and reliability of receiving digital instead of paper payments.

Canadian population growth was adversely affected by the pandemic. In 2020, population growth fell to levels not seen since the First World War. The dip in population growth was due to a decrease in international migration and the net loss of non-permanent residents. The percentage of population growth from international migration decreased from a record high of 85 percent in 2019 to 68 percent in 2020. The largest net loss of non-permanent residents (-88,901) was caused by declines in students and work permit holders.

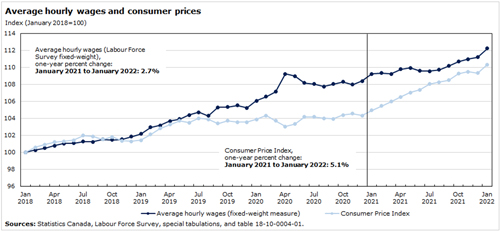

The pandemic contributed to more stress on consumer wallets as supply disruptions and pent-up demand stoked consumer inflation, which reached a 30-year high (+5.1 percent) in January 2022. Prices for food and shelter continuously increased over 2021 and were above the headline rate (+5.7 percent and +6.2 percent, respectively). Consumer inflation has outpaced average wage growth since the spring of 2021. For further details, see Figure 1.

The combination of financial challenges facing many businesses due to the winding down of pandemic emergency support programs, shrinking population growth and persistent consumer inflation led to an overall reduction in consumer and business spending. As a result, total payment transaction volume and value decreased and were below the pre-pandemic level from 2020 to 2021.

Figure 1: Average wage growth versus consumer inflation (January 2018-2022)

Line graph showing the average wage growth compared to consumer inflation between January 2018 and January 2022.

The pandemic also increased Canadians’ concern over public safety. According to a survey from Statistics Canada, Canadian Centre for Justice and Community Safety Statistics conducted in 2020, two in five Canadians expressed concern about the possibility of civil disorder. Concern was doubled among those expecting the pandemic to affect their personal finances, compared with those expecting no impact (61 percent vs. 32 percent). Social unrest concerns (e.g., hate crimes, assault, uttering threats, robbery, motor vehicle theft and shoplifting) were linked to income inequality among Canadians. Challenges to job and income stability remained persistent in lower-paying, high-contact sectors throughout 2021.

The payment behaviour of Canadians, while living under these social conditions, was impacted. In 2020 and 2021 there was an exceptional demand for cash — specifically large-denomination notes. It is suggested that precautionary motives were important drivers for the extraordinary cash demand during this period.

A look at Canadians’ pre-pandemic payment habits and practices

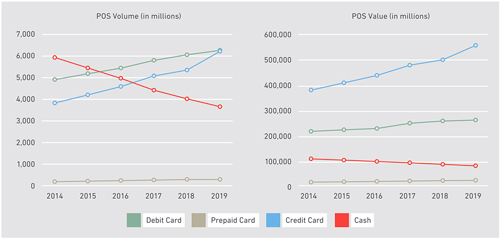

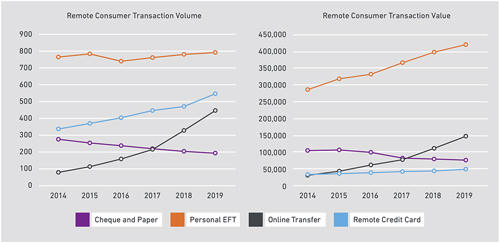

Looking back at the payment trends observed in the five-year period leading up to the COVID-19 pandemic (between 2014-2019), several notable patterns emerge. For further details, see Figures 2 and 3.

Point-of-sale (POS) environment

Cash payments were on a steady and sharp decline within the POS environment. Despite its decline, cash was still a common payment method in 2019, with 61 percent of Canadians reporting making a cash purchase to a business in a given week.

Electronic payment use continued to increase for POS payments, especially the use of debit and credit cards. Canadians preferred using debit and credit cards for their POS transactions because they were perceived to offer convenience, speed and rewards, which drove the use of these methods over traditional paper-based methods.

Another reason debit and credit cards were used more often by Canadians was the growth of contactless payments (card and mobile) at the POS. In 2019, 4.7 billion contactless transactions worth $156 billion were made, representing a 15 percent increase in volume and a 20 percent increase in value compared to the previous year. The significant rise in contactless transactions was driven by increased consumer and merchant familiarity with contactless payments and the ability to pay with contactless cards. While contactless card use was popular, mobile contactless had a slower uptake in Canada, even though more Canadians now had devices with near-field communication capabilities.

Remote environment

Bill payment transactions accounted for the largest proportion of consumer-initiated remote transactions. Electronic funds transfer (EFT) was the primary payment method used by Canadians based on transaction volume and value. Consumers generally opted to use EFT transactions to set up recurring payments to entities (for example, using online banking to pay household bills). EFT was also used when consumers set up pre-authorized debits (using their deposit accounts) to pay for mortgages or auto loans. However, EFT numbers were being impacted by a migration towards the use of credit cards to pay bills.

While credit cards were mainly used in the POS environment, cardholders were using credit cards to remotely pay for a number of their bills, making up 15 percent of the total bills paid in Canada in 2018. Consumers used credit cards for paying recurring expenses, primarily because of rewards programs offered with credit cards. Between 2014 and 2019, the number of remote credit card payments increased by 55 percent. Much of this growth came at the expense of cheques and EFT.

Usage of online transfers continued to increase among Canadians in paying both people and businesses, overtaking cheques beginning in 2018. In 2019, online transfers accounted for 23 percent of the total volume of consumer remote transactions, while consumer cheque volume decreased to 10 percent (compared to 16 percent in 2015).

Figure 2: Point-of-sale transaction volume and value (2014-2019)

Two charts. The chart on the left shows point-of-sale transaction volume in millions from 2014 to 2019. The chart on the right shows point-of-sale transaction value in millions from 2014 to 2019.

Figure 3: Remote consumer transaction volume and value (2014-2019)

Two charts. The chart on the left shows remote consumer transaction volume from 2014 to 2019. The chart on the right shows remote consumer transaction value from 2014 to 2019.

Impact of the COVID-19 pandemic on Canadians’ payment habits and practices

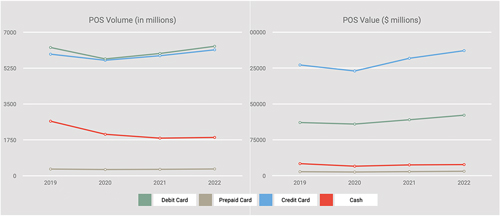

Looking back at the payment trends observed in the three years since the start of the COVID-19 pandemic (between 2020-2022), several notable patterns emerge. For further details, see figures 4 and 5.

Point-of-sale environment

The COVID-19 pandemic accelerated the decline in cash usage as many Canadians avoided handling cash and touching payment terminals at the point-of-sale over concerns of virus transmission. In the first year of the pandemic, cash transaction volume and value at the point-of-sale decreased by 24 percent and 21 percent, respectively, from 2019. Following 2020, POS cash payments continued to decline, but the rate of decline slowed as public health measures lifted and the economy reopened. Cash payments rebounded for several reasons:

- Canadians were less concerned about the risk of transmission of the COVID-19 virus by handling paper currency and coins.

- Cash users returned to using cash for pre-pandemic use cases such as paying rent, meals, entertainment and professional and personal services.

- Canadians shifted towards using digital payments.

Contactless growth was supported by the increased availability of contactless and digital payment options, an increase in the contactless transaction limit from $100 to $250 for credit cards and the introduction of new payment alternatives, like QR codes by PayPal. In fact, when it came to making purchases, 37 percent of Canadians said they avoided shopping at places that didn’t accept contactless payments. Contactless payments continued to be used frequently by Canadians after the first year of the pandemic. Almost nine in ten Canadians (89 percent) tapped any card (i.e., credit, debit or prepaid) at least once in a given month when making a store purchase in 2022.

The pandemic led to sharp growth in e-commerce payments in 2020, with 477 million transactions worth $56 billion (up from 420 million transactions valued at $47 billion a year ago). Close to half of all Canadians (47 percent) used e-commerce platforms more frequently to purchase a wider range of products throughout the pandemic. Despite the return to in-store shopping, e-commerce transactions increased in 2022. E-commerce sales accounted for 6.5 percent of retail sales in 2022, up from a share of 6.2 percent in 2021.

Both debit and credit card payment transaction volume and value continued to build on the gains made in 2021 and returned to pre-pandemic levels in 2022, following a significant dip in 2020 caused by the pandemic.

Debit card transaction volume and value at the point-of-sale declined by nine percent and three percent, respectively, between 2019 and 2020. Debit cards continued to slightly lead credit cards in terms of volume.

Credit card transaction volume and value at the point-of-sale each declined by five percent during the same period. Credit cards made up the bulk of POS value.

Overall, the volume and value decline in card payments were less pronounced than that of cash captured above.

Remote environment

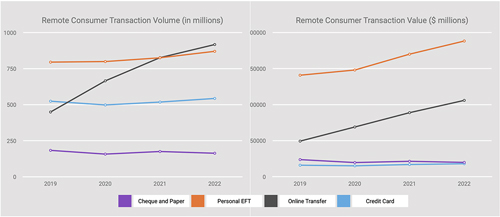

The COVID-19 pandemic had a low impact on personal EFT transaction volume and value in 2020. During the first year of the pandemic, personal EFT volume increased by one percent and personal EFT value increased by five percent. Both volume and value continued to grow and by 2022, personal EFT volume hit 870 million transactions worth $565 billion. It accounted for 35 percent of total remote consumer transaction volume and 57 percent of total remote consumer transaction value. EFT usage among consumers continued to be driven by recurring payment and online bill payment use cases.

Credit card transaction volume softened due to the pandemic in 2020, decreasing by five percent from 2019. It quickly rebounded and surpassed the pre-pandemic level in 2021 and continued to grow in 2022. Consumers carried on with using credit cards to pay recurring expenses and other household bills such as insurance, internet service, cell phone, subscriptions, memberships and home services (e.g., daycare, contractors).

Online transfers continued their growth in 2020, increasing significantly by 48 percent in volume and 40 percent in value and represented 31 percent of the total remote consumer transaction volume in Canada (compared to 23 percent in 2019).

New use cases emerged for online transfers during the pandemic, replacing cash and cheques. Due to physical distancing guidelines, many Canadians pooled grocery shopping responsibilities with family, roommates and neighbours. Interac reported that Canadians used Interac e-Transfers to split grocery bills and big-box store purchases more often than before the start of the pandemic. Another use case for online transfers during the pandemic was sending financial support to family and neighbours.

In 2022, online transfer payment volume surpassed personal EFT usage for the first time, mainly driven by the continued growth of Interac e-Transfer payments. Interac e-Transfer remained the most popular and preferred method for peer-to-peer money (P2P) transfers in Canada by a large margin, driven by its perceived ease of use and convenience, helped in part by the daily limit increase from $3,000 to $5,000.

Even though Interac e-Transfers were being used more for P2P transfers, the level of use started to plateau in 2022 with more Canadians saying their use had stayed the same since the pandemic started (62 percent in 2022 versus 51 percent in 2020). So, the number of new use cases for Interac e-Transfers linked to the pandemic did not significantly increase in 2022, likely because many Canadians perceived the pandemic to be largely over, or they had exhausted new use cases.

Canadians made fewer cheque payments due to the pandemic.

Personal cheque usage continued to decline in 2020, with a 14 percent decrease in volume and a 17 percent decrease in value from 2019. The overall decline was driven by the increased use of electronic payment methods such as EFTs, and online transfer payments by Canadians. The pandemic contributed to a rise in electronic payments at the expense of cheques, as many Canadians opted not to exchange cheques over concerns about virus transmission through surface contact.

However, the rate of decline in personal cheque usage slowed between 2021 and 2022. The year-over-year change in cheque volume was +11 percent for 2021 and -7 percent for 2022. Cheque value increased by nine percent in 2021 and decreased by seven percent in 2022.

Although personal cheque use was fairly low with 42 percent of Canadians stating they rarely used cheques (i.e., less than once a month) and 39 percent never used cheques, some Canadians returned to using cheques for the same payment use cases as before the pandemic (e.g., rent, home services, gifts).

Figure 4: Point-of-sale transaction volume and value (2019-2022)

Two charts. The chart on the left shows point-of-sale volume in millions from 2019 to 2022. The chart on the right shows point-of-sale value in millions from 2019 to 2022.

Figure 5: Remote consumer transaction volume and value (2019-2022)

Two charts. The chart on the left shows remote consumer transaction volume in millions from 2019 to 2022. The chart on the right shows remote consumer transaction value in millions from 2019 to 2022.

Future outlook

The pandemic accelerated the decline in cash usage at the point-of-sale, which had already been in steady decline. Contactless and electronic payments will continue to increase their hold on consumers as the preferred method for point-of-sale purchases for a number of reasons, such as receiving loyalty rewards, convenience, speed, ease of tracking spending and safety/security.

However, the end of cash is still far off. Besides being used to make day-to-day payments, especially for small-value transactions, many Canadians hold onto cash for precautionary motives. Most Canadians have no desire to go completely cashless. Only 13 percent of Canadians state that they have gone completely cashless. Older (55 and over) and middle-aged (35-54) Canadians are much more likely than young Canadians (18-34) to want to continue using cash. Sixty-one percent of older Canadians and 57 percent of middle-aged Canadians have no plans to go completely cashless.

Population projections suggest that millennials, or people aged 25 to 40, will become the largest population segment in the country by the next decade. Generation Z, or people aged 9 to 24, may outnumber Baby Boomers in 2032. Cash usage is expected to rapidly decrease in Canada due to this demographic shift as both these generational cohorts prefer using electronic over paper payments.

As we emerged from the pandemic, more Canadians were comfortable using digital payments on an everyday basis and are embracing digital payment innovations that make their payment experiences more frictionless. More Canadians are comfortable with shopping online to buy different products such as clothing, groceries, restaurants/fast food and electronics. More Canadians are becoming comfortable with sending payments using wearables, social media channels, QR codes and smart devices, as well as using biometrics to authenticate store payments. Over one-third of Canadians would likely adopt emerging payment innovations such as invisible payments and scan, pay and go when shopping at a store, or one-click pay when shopping online. A significantly larger proportion of older Canadians are also now using digital payments compared to 2020. This includes using contactless cards and mobile wallets to make a purchase and having their payment details stored on a website or in a payment app.

In the near future, the payment innovations that Canadians are most likely to adopt include the following:

Mobile/digital wallet

A mobile wallet is an app on your mobile device that stores your payment information. It is like a physical wallet where you keep your credit, debit or prepaid cards, but in digital form.

The first mobile payment app to appear in Canada was the Suretap mobile wallet, launched in 2012 by CIBC. Since then, Canadians have been slow to adopt mobile wallets for making payments. But, that is now changing, driven by several factors.

Banks, big tech companies and fintechs all have released their own mobile wallet versions that are device-agnostic (i.e., operate on iOS and Android devices).

These payment apps have become more sophisticated in securing the user’s payment information. For example, a mobile wallet may encrypt your payment information and store it in the cloud. The cloud is an Internet-based secure network. Many payment apps utilize biometric or multi-factor authentication for payment authorization and tokenization for payment processing (i.e., a unique transaction code is used in place of your card number, which is never shared with a merchant).

Some mobile wallet providers such as Apple and Google have also introduced their digital wallet products (e.g., Apple Wallet, Google Wallet), which represent the next step in the evolution of the mobile payment app. A digital wallet app allows an individual’s smartphone to truly be a virtual wallet by allowing the user to empty the entire contents of their wallet – not just their debit or credit cards but also their health card, driver’s licence, loyalty rewards cards, transit card, boarding passes, tickets, etc., – which makes the mobile/digital wallet a much more compelling value proposition. And, it is likely that the future generation of mobile/digital wallets will have other services built in, like couponing, loyalty and geo-based offers.

In 2022, smartphone penetration in Canada was 81 percent, consisting of 27 million smartphone subscribers. By 2027, smartphone penetration is expected to be 83 percent with smartphone subscriptions reaching 31 million. Also, it is expected that 83 percent of all smartphones will be NFC-enabled, allowing them to be used for contactless mobile payments in-store, by 2027.

Over four in five smartphone owners (82 percent) have at least one payment app installed on their smartphones (e.g., Apple Pay, Google Pay, PayPal). The proportion of smartphone owners who made a payment using their smartphone in the past six months increased by seven percent to 74 percent compared to 2021. The incidence of mobile payments increased across most categories (e.g., bill payment through a mobile banking app, online payments, P2P payments, in-store payments) over the past year.

By 2027, the number of mobile transactions is expected to reach two billion transactions, representing a compound annual growth rate of 14 percent over this period. The number of transactions will increase as mobile payment transactions become more frequent and the average value of a transaction drops due to a greater proportion of in-store and in-app purchases.

Virtual payment cards

A virtual payment card is a digital representation of your physical card (i.e., debit, credit or prepaid cards). Like a physical payment card, it can be stored on a mobile wallet.

Plastic debit and credit cards still lead all other payment methods for in-store purchases while mobile/digital wallet is quickly establishing itself as a preferred payment method for making online purchases in Canada. The rise of virtual payment cards is closely tied to the fortunes of mobile/digital wallet use in Canada.

Virtual payment cards are beginning to gain more consideration as the Canadian payment ecosystem moves towards a cashless society where digital and contactless payment methods are becoming mainstream. Several global providers currently offer virtual payment card services in Canada including banks and fintechs (e.g., RBC, Wise, Stack, KOHO, Wealthsimple).

Virtual payment cards offer several advantages over their plastic counterparts:

A virtual payment card works like your regular physical card, but instead of being a piece of plastic, it’s available through your smartphone. So, you don’t need to carry a physical card around with you.

Once approved for a virtual payment card, you can immediately start using it instead of having to wait for a plastic payment card in the mail.

Many virtual cards produce one-time use card numbers for each transaction to protect your financial information.

Virtual card numbers offer a secure way to make online payments because they can be set for one-time transactions or multiple use, which provides an added layer of security when it comes to protecting your online payment transactions.

A virtual payment card can be used to make online purchases, transfer money, or linked to a mobile wallet app like Apple Pay or Google Pay. By adding a virtual payment card to a mobile wallet, you can make contactless payments in physical stores.

Pay-by-bank

Pay-by-bank is a payment method that allows customers to make online purchases directly from their bank accounts, without the need for a credit or debit card. It enables customers to use their online banking credentials to authorize a payment and transfer funds from their bank account to the merchant’s account. This payment method is offered by payment providers that partner with banks to facilitate the payment process.

Many Canadians made more retail purchases online even after public health measures were lifted and stores reopened. They are looking for ways to make their online payment experiences more frictionless and, safe and secure. Pay-by-bank represents an online payment method that “ticks several boxes” for consumers.

It offers enhanced security, as consumers do not need to provide their credit or debit card details to make a payment. This reduces the risk of fraud and helps to protect consumer financial data.

It offers faster payment processing times. Transactions are processed in near real-time, which means consumers can track their spending and bank account balances more effectively.

It may be more convenient for consumers who do not have a credit or debit card or who prefer not to use one when making online purchases.

Pay-by-bank may especially appeal to consumers focused on managing their finances while paying down revolving debt. Some Canadians avoid using credit cards altogether to stay out of debt or a debt build-up. But it may be hard to convince consumers to switch to pay-by-bank when they are already comfortable with using debit cards as a way of using funds on hand for making online payments.

In fact, Interac stopped offering Interac Online, which is effectively a pay-by-bank service, in 2023. It continues to offer Interac Debit for online payments made through in-app or a mobile wallet. The reason for this move was because Interac Online transaction volume has been trending down, while Interac Debit transaction volume has been trending up. Interac Online transaction volume decreased by 19 percent from 2021 to 13.8 million transactions, with 16 percent of Canadians indicating that they used Interac Online in a given month when making a purchase online via their computer or mobile device (down from 21 percent in 2021).

Future consumer uptake of pay-by-bank may come down to incentivizing Canadians for choosing this payment method. PYMNTS Intelligence data determined that the uptake of pay-by-bank in retail may be especially desirable for consumers when rewards are offered. The data showed that 25 percent of consumers who made a pay-by-bank transfer for the first time in the last year did so because they could earn rewards with cash back being the most preferred (47 percent). Retailers and businesses may be motivated to offer rewards to customers for using pay-by-bank over credit and debit cards for purchases or bill payments because of the cost savings from avoiding interchange fees.

Being able to pay for in-store purchases using account-to-account transfers is also something that many consumers want in Canada. Forty-five percent of Canadians indicated they would be interested in being able to make a payment to a merchant using Interac e-Transfer for an in-store purchase. So, consumer interest and adoption of pay-by-bank may extend to both online and in-store payments.

Conclusion

The social and economic impacts of the pandemic on the lives of Canadians will be felt for years to come. The pandemic heightened Canadians’ concern over public safety. Lower immigration during COVID-19, combined with structural pressures related to population aging, will continue to impact labour market imbalances, which will reduce overall productivity and economic output. High inflation, especially for food and shelter, coupled with modest wage increases will cause affordability to worsen in the near term. Social and economic mobility particularly for new Canadians and young families will be adversely affected as a result of these financial barriers to home ownership.

These outcomes have and continue to influence Canadians’ overall payment habits and practices. Social unrest and economic hardship and uncertainty is causing consumers to cut back on personal spending as well as store more cash for precautionary motives. The pandemic pointed out to Canadians the speed, convenience, safety and reliability of using digital instead of paper payments. It also accelerated consumer adoption of digital payments. Credit and debit card payments continue to lead all other payment types within the POS environment in transaction volume and value and continue to grow. EFT continues to lead all other payment types within the remote environment with AFT credit and debit leading the way. Online transfers continue to be the fastest growing payment type of all with Interac e-Transfers leading the way.

Even after health restrictions were lifted and the economy reopened, more Canadians continue to shop online for a wide variety of goods and services. This consumer shift towards digital payments has led to an increased demand for more digital payment options and frictionless payment experiences. In turn, this will fuel continued growth, competition and innovation within the Canadian payment market. DISCLAIMER: This article is written to reflect the interests and views of the author and is not intended as an official Payments Canada statement or position.

Stephen Yun is Senior Analyst, Market Insights, Payments Canada. Yun’s areas of focus include the Consumer Payment Methods and Trends and Payment Behaviour Tracking studies and leveraging research insights to create a consumer/business payment narrative and drive business action for his business partners. Stephen has more than 20 years of experience leading marketing and customer experience research. He holds MBA and BBA degrees from the Schulich School of Business (York University) specializing in marketing and finance.