By Trevor Chew

By Trevor Chew

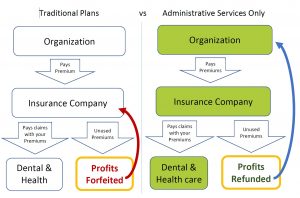

Has your organization ever received a refund from its group benefits plan? If not, then you may be losing out on potential funding.

If you only claimed 75 percent of what was paid towards group health benefits and the benefits provider kept 25 percent, would this represent significant funding to your organization? Now times that amount by the number of years your organization has had a traditional group benefits plan. What if they also asked you to pay more into the group benefits plan even though you only claimed 75 percent of what was paid into it?

It is very rare for an organization to claim more that it pays in group benefits, and if they do, they will likely experience a cost increase to their group benefits plan upon renewal. Group benefit providers, have a target loss ratio, that helps them determine if the plan needs to increase in cost upon renewal and whether the plan is profitable for them to administer. Typically target loss ratios can range anywhere from 68 percent and up, depending on the size of the organization. If you claim more than the target loss ratio, you will likely experience in increase in cost at renewal.

Risk factor fees, non-pooled charges, commissions and profit, experience-related pooling fees, and card fees can all be imbedded into a traditional health benefits plan. This can make traditional group health benefits, expensive and costly. Should the organization claim less than the loss ratio, then there may be opportunity to lower the cost at renewal, but the benefits provider keeps what you didn’t spend that year as their profit. Most health benefits are under used, especially during the pandemic, but a traditional plan would still keep premiums you didn’t spend, forfeiting them to the insurance company. Most traditional health insurance plans are mostly just administrating claims. Annual costs to the employer are usually the sum of the claims plus about 30 percent-40 percent, with costs often increasing each year.

What if there was an easier way to stop the yearly group benefits from increasing without the administrative burdens and constant change in providers? What if you got a refund for money your plan didn’t spend?

What if there was an easier way to stop the yearly group benefits from increasing without the administrative burdens and constant change in providers? What if you got a refund for money your plan didn’t spend?

Administrative Services Only (ASO) plans, have been available to large organizations in the past, but have recently become available to smaller organizations of 5 or more. These plans help organizations effectively buy less insurance and get refunds for deposits not spent. This allows the organization to self-insure an appropriate amount for health and dental needs through its own deposits and buys insurance for only catastrophic risks the organization wouldn’t be able to afford on its own. The results are better benefits for staff, savings for the organization, and ability to get refunds each year instead of yearly increases.

ASO plans feel just like a traditional plan to the employees, but provides greater flexiability:

You can customize the type of coverage you want

Pay for what your employees use

Know exactly where every dollar is spent

Get refunds of unused funds

Insure only what you need to and self-insure the predictable expenses.

Fair and transparent renewal process

ASO plans have similarities to car insurance, where there is a deductible, you would pay out of pocket to help keep the cost lower. ASO plans have a customized amount of funds held in reserve to cover self-insured predictable expenses. This amount is determined based on your past claims experience and what you would expect claims to be for several different categories like dental, medication, eye care, etc. If the reserve fund amount was $3,000, then it would cover the first $3,000 of claims using the savings in the reserve fund. If this $3,000 wasn’t spend at renewal, it could be refunded to the organization, used to lower ongoing deposits or could be used towards future deposits. Any claims over the reserve fund would be covered by insurance. This allows you to buy less insurance, while getting the opportunity for refunds of unused amounts. With low usage in dental and paramedical services, many ASO plan holders saw a significant refund during the pandemic lockdowns. Why pay for what you don’t use?

If your organization has a traditional benefits plan and you would like to know the potential savings, here is a list of what ASO providers will typically ask for in order to determine your savings:

o Census data: Gender, occupation, number of single and/or family coverages, salary, birth date

o Past and present claims experience reports. Last 3 years, if any.

o Copy of current plan design showing the benefit maximums as well as co-insurance levels for all classes.

o Renewal information if you have an existing benefits plan, showing renewal rates.

Please feel free to reach out for more information and resources or if you have any questions.

Trevor Chew, CKA®, CFP® is the president of Legacy Financial Canada Inc., a holistic financial planning firm.