Three Ways to Support Earned Wage Access in Canada

By Marco Margiotta Around the world, employers are experiencing first-hand the impacts of what’s being called the ‘Great Resignation,’ emerging from the COVID-19 pandemic. For our neighbours to the South, 4.5 million Americans quit their jobs in November 2021, which matches a series high from last September. This trend has …

Four Areas to Address to Meet Digital B2B Commerce Expectations

By Brandon Spear Looking back on 2021, the global B2B payments landscape experienced notable changes in sales channel strategies as eCommerce accelerated. As B2B customer journeys become more digitally influenced, a merchants’ payments offerings and capabilities need to evolve to better secure the sale. Recent research from Forrester Consulting revealed …

Want Happy Staff? Three Tips for Managing Compensation

By Daniel Oh Businesses have faced a great deal of upheaval over the past two years, whether it’s the rise in remote work or shift to online commerce. One thing that hasn’t is their biggest and most important asset: their people. The primary way a business can show its people …

Divides and Dividends Study

It is no longer business as usual. The long-held belief that companies exist solely to serve the needs of shareholders is being challenged. Employees, customers and investors increasingly see private enterprise as a vital player in a much wider sociological, ecological, and economic system—and business leaders are now expected to …

Canada’s Executives Face an Opportunity in Sustainability

By Shawn Cooper Canadians have seen their communities change drastically in the last few years due to the COVID-19 pandemic and heightened worry about climate change and social justice, motivating them to make sustainable changes in their everyday lives. Employees, customers, and investors are starting to expect more from the …

Canada’s Bridgegate: Disruptions from Canada’s Protests Further Expose the Vulnerability of Supply Chains

By Vaibhav Tandon Beyond economic and public health upheaval, the past two years will also be remembered for mass protests in several parts of the world. Some were sparked by familiar themes like democratic liberties, climate change, and racial justice, while others arose against government lockdowns, vaccines and mask mandates. …

PwC Canada Study Shows ESG Reporting Falls Short Across Canada’s Top 150 Public Companies

PwC Canada unveiled its inaugural Canadian ESG reporting insights study, analyzing the current and trending challenges Canadian organizations face with their ESG reporting practices. This comprehensive analysis explores ESG reporting maturity across 150 of Canada’s top organizations. Relying exclusively on publicly available information, PwC assessed elements such as strategy, materiality, …

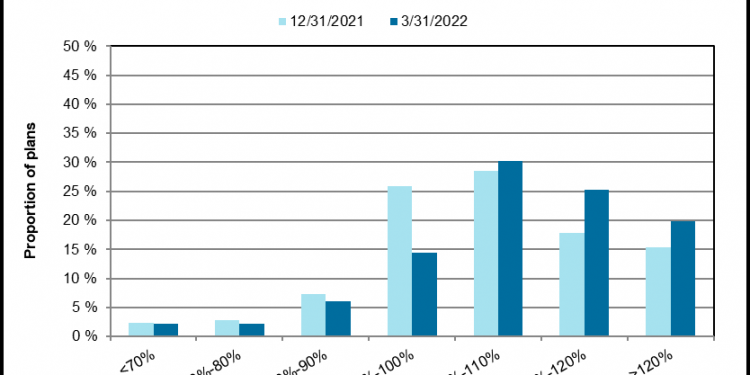

Despite ongoing volatility, financial positions of DB plans improve in Q1 2022

TORONTO, ON–Notwithstanding the heightened volatility of the financial markets, which has been exacerbated by the unprovoked attack by the Russian Government against the people of Ukraine, the financial position of most defined benefit (DB) pension plans improved during the first quarter of 2022. Along this path, the Mercer Pension Health …

Raneiri leads Reach to new $30m Canadian Investment for Growth

Expansion continues, benefits online merchants, marketplaces and increase conversions, lower foreign payment processing costs and gain international customers CALGARY, AB–Reach, the leading global ecommerce payments enabler, has secured a $30 million Canadian investment, as it bids to accelerate its mission of unlocking a global customer base for merchants through a streamlined payments, tax …

Leveraging Canadian Payments Trends to Support Financial Inclusion

By Robert Hyde The COVID-19 pandemic deeply impacted the Canadian payments industry and accelerated the migration to digital and contactless payments. Canadians continue to seek more choice and flexibility in how they make payments without sacrificing security and convenience, but the pandemic has further underscored the need for more services …