Canada Life cuts group health insurance premiums to support Canadians and business customers during COVID-19

“Issuing premium credits is the fastest way to give group customers immediate relief”: Macoun WINNIPEG, MB–The Canada Life Assurance Company is cutting group health insurance premiums for its employer-sponsored group benefits plans to support Canadians and small- and medium-sized businesses facing hardship as a result of the global COVID-19 outbreak. …

Fleet Complete Offers Free Service until July 31st to Customers with GM Vehicles

To help with the impact of COVID-19 on businesses in North America; offer aims to help fleet owners establish remote fleet management operations and comply with guidelines TORONTO, ON–Fleet Complete, the fastest-growing global provider of connected vehicle solutions, today announced its fleet assistance program with free service until July 31, …

BMO Special Report on the Post-Pandemic Economy: Building a Bridge

TORONTO, ON–BMO Financial Group eleased an in-depth report on the long-term global structural shifts accelerated by the COVID-19 pandemic and current economic crisis. “We’re in the midst of one of the most significant social and economic challenges we’ve ever faced, where we must – now and in the coming months …

OSC temporarily waives all late fees for market participants

TORONTO, ON–The Ontario Securities Commission (OSC) is providing temporary relief to market participants by waiving all late fees that accumulate between April 17, 2020 and June 1, 2020. This is estimated to result in over $300,000 of relief to issuers, registrants and insiders during the relief period. “The current pandemic …

BDC to increase support to Canadian oil and gas sector companies

MONTREAL, QC–As part of a Team Canada response to the COVID-19 crisis, the Government of Canada, through BDC, Canada’s bank for entrepreneurs, and Export Development Canada (EDC) will make available additional financial capacity to help support Canada’s oil and gas sector. The commercial support, being developed by BDC and EDC, …

RBC clients can now access the Export Development Canada Business Credit Availability Program

The EDC BCAP Guarantee fee of 1.8% will be deferred for clients for the first six months TORONTO, ON–RBC announced the launch of the Government of Canada’s Export Development Canada (EDC) Business Credit Availability Program (BCAP). The EDC BCAP provides eligible mid-sized and large RBC business clients with a loan …

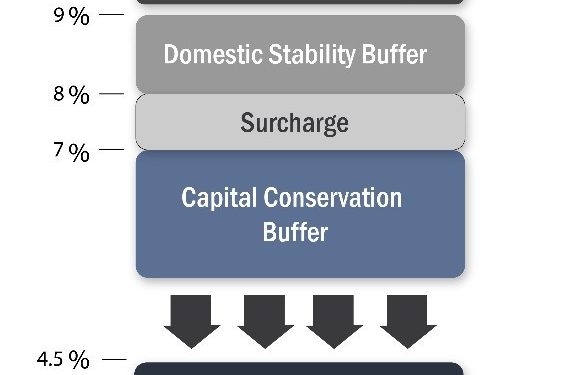

Insights on Canadian bank capital and dividends amid crisis

OTTAWA, ON–The current economic instability caused by the COVID-19 pandemic has raised questions around the world about how best to approach bank capital requirements and the resulting implications for bank dividend policies. This statement provides an overview of the existing regime in Canada. All of the countries represented on the …

NaviPlan Adopted by First West Credit Union,

Canada’s Fifth-Largest Credit Union Gives Retail Banking Members Access to Digital Financial Planning Solutions MILWAUKEE, WI–The First West Credit Union has integrated the NaviPlan platform into the digital banking service offering for members and clients at the Canadian financial institution’s 51 branches across British Columbia. “We continue to enhance our …

Canadian securities administrators adjust implementation date for client focused reforms

TORONTO, ON–The Canadian Securities Administrators (CSA) published a relief order that provides registrants with an additional six months to comply with the conflicts of interest provisions in the Client Focused Reforms. Registrants will now have until June 30, 2021 to implement these changes. The CSA also published a second relief …

Advanced technologies such as AI, blockchain and continuous authentication to transform the connected era in 2030

Frost & Sullivan Analyzes the Future of Privacy and Cybersecurity SANTA CLARA, CA-Frost & Sullivan’s recent analysis, The Future of Privacy and Cybersecurity, Forecast to 2030, finds that by 2030, there will be a complex global network of 200 billion devices, with over 20 connected devices per human. As the …