By Arjun Kakkar

By Arjun Kakkar

Digital commerce is growing, but it still represents less than 15 per cent of the total global retail business value. One key reason is a far-from-seamless shopping experience. According to a study by the Baymard Institute, almost 70 per cent of U.S. shoppers end up abandoning their shopping carts. Of these, about a fourth of users who were not just browsing abandon checkout due to a long or complicated checkout process. In Canada, six out of ten people surveyed say that a smoother checkout experience motivates them to choose one online retailer over another.

This hassle shoppers undergo extends to payments. In the U.S. last year, 97 per cent of physical store orders were approved by Mastercard. Yet barely 82 per cent of online orders were authorized. This gap would be acceptable if it reflected elevated fraudulent attempts online, but that is not the case. According to a U.S.-based study, 25 per cent to 35 per cent of declined card not present transactions are false declines.

Changing the rules

The resulting global cost of friction in online commerce could be well above a trillion dollars, according to estimates of my company, Ekata. What’s stopping us from capturing this massive opportunity?

The biggest reason is the lack of trust between consumers and businesses. From the consumer’s standpoint, they may not trust the merchants or payment providers enough to start sharing data. In Canada, more than half the respondents to a recent survey were concerned about the security of open banking, which allows third parties to make payments on behalf of customers and get secure access to customers’ financial transaction data.

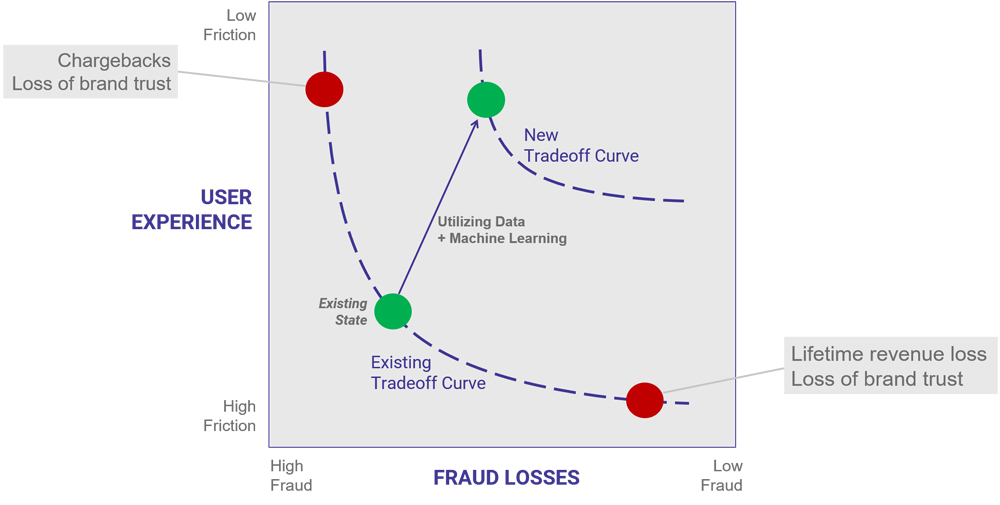

Meanwhile, merchants and payment providers struggle with the balancing act between the customer experience and fraud prevention. If you focus more on improving the user experience by giving consumers unrestricted access, you risk high fraud and chargeback costs.

Canada and other countries are moving to faster payments. But faster irrevocable payments also require faster fraud monitoring. If consumers can move money quickly, so can criminals, making it more difficult to trace the final destination accounts.

On the other hand, if you focus on reducing fraud losses, you give your consumers a lousy user experience and lose lifetime revenue. Most importantly, in both these cases, the merchant loses customer trust.

Fortunately, we can mold this dichotomy to lower friction and fraud by utilizing data and machine learning.

A practical faster fraud prevention approach

A practical faster fraud prevention approach

We recommend three interrelated imperatives.

- Utilize relevant data across the ecosystem. The first step is to utilize all data that could help with risk signalling, including the device, behavioural, identity (including name, e-mail, IP, phone and address) and transaction data. In our experience, risk signals based on customer networks are invaluable. Industry players should also collaborate to share data that aids risk decisions.

In a world where fraudsters are increasingly sophisticated in recreating customer identities, data from multiple sources will help find unique markers that identify the human behind a digital identity. Sourcing the data is only a part of the challenge, even after ensuring security and privacy. The more significant struggle is in putting this data to good use. - Use machine learning (ML) modelling before authorization to assess risk. The unique needs of real-time fraud detection, including large and diverse data sets, real-time decisions and continuous learning cycle times, make it an ideal candidate for ML models. We observe it in practice: our customers that use ML models realize disproportionately higher benefits versus those who use rule-based systems.

That said, ML for fraud is a challenging problem. It is hard to get model training data since more than 99 per cent-plus of cleared transactions are not fraudulent. The data may not be labeled right since some of the “friendly fraud” or legitimate transactions may be marked as fraud. If your model is doing its job well, only the hard-to-find fraud will go undetected, and subsequent models you build on this new data will start getting worse at detecting the easier fraud. Finally, another problem with ML when you use diverse data sources is “preprocessing” or preparing data for modelling. These are hard but solvable problems, but you do have to invest in long-term capabilities to capture the power of ML in fraud.

Merchants and payments providers also need to assess risk before account opening or payment authorization. The additional information is useful to determine the signup process. Without such a process, merchants tend to put all customers into a single high-risk high-friction bucket. For example, Europe’s new Payments Services Directive 2 (PSD2) directive requires “Secure Customer Authentication” or SCA, a high-friction authentication in case the payment service provider has not assessed the transaction risk. - Understand the customer’s context to drive better user experience. Each merchant and payment provider need to earn consumer trust. It starts with ensuring security and privacy. Luckily, regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada, give us an excellent framework for taking responsibility for consumer data. They put the consumers back in charge of their data, and consumers will only share their data with the brands they trust. As a result, brands that consumers trust have a differentiated market advantage. For example, PSD2 has a provision that may let consumers whitelist a business and avoid the need for future high-friction authentication.

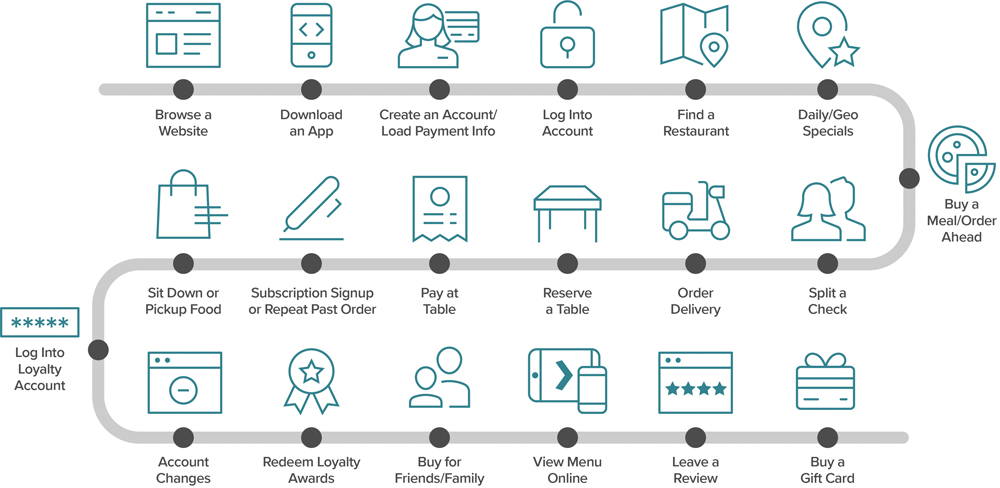

An excellent user experience also drives consumer trust. To build a better online user experience, you need to understand the context that brings consumers to your app and purchase your product. But there is no silver bullet to achieve this goal, and the context keeps changing even within each customer’s journey. The context during the purchase experience (which products does the customer care about?) differs from that during payment (which payment option to offer in an uncluttered interface, e.g. Amazon Pay for Prime members). Remember, there is almost always a person, not a segment behind the digital data.

The common thread is the need for reliable data that improves the consumer experience and helps catch fraud. It is not a zero-sum game for online commerce players in the overall goal to create customer value and grow the share of online commerce. Those who will collaborate will win. Together.

Arjun Kakkar is vice president, strategy and operations, Ekata (www.ekata.com). He works with Ekata’s operating teams to drive customer value across e-commerce, payments, marketplaces and online lending verticals. Before Ekata, Arjun was a Principal with Booz & Company. He has a B.Tech. from IIT Bombay and an MBA from The Wharton School.