Considerations for Creating and Preserving Value

By Alison Glober, Duncan Law, Bruno Artristian and David Francescucci

We’re dealing with several headwinds in the current environment, from soaring inflation and interest rates to ongoing supply chain issues that are creating the conditions for a potential economic slowdown. Combined with global unrest, a tight labour market, and significant tax reforms happening in Canada and globally, organizations that survived the worst of the pandemic are braced for yet more change.

Many organizations have been focused on sales and growth, modifying their approach to business to cope with the pandemic. But in this uncertain economic environment — and in response to a potential slowdown — organizations may find their debt more expensive to roll over. As a result, they’ll need to rebalance their focus from mostly sales and growth to also margin improvement and cash preservation strategies.

It’s often during challenging economic times that leaders are under pressure to reduce costs and improve their cash position. But this can come at a significant cost to the business if not done well. A carefully considered, strategic approach is required. Proactive organizations are building resilience and looking for internal levers to effect that resilience.

Weathering tough times through value creation

Although cost efficiencies are always top of mind, the potential for an economic slowdown has brought value creation into the forefront. That means bringing together data, insights, and execution capabilities to prioritize and deliver value efficiently and confidently.

Value creation isn’t about cost-cutting. Rather, it’s about uncovering sustainable efficiencies in how you operate and how work gets done to weather external forces beyond your control. It’s about becoming responsive and agile, with business, technology, finance, and operations working together in harmony.

Many Canadian organizations are taking on value creation initiatives as a way to protect the business, boost margins, and improve their cash position, so that, when the economy picks up again, they’ll be in a better position to fund future investments in areas such as digital transformation and customer experience.

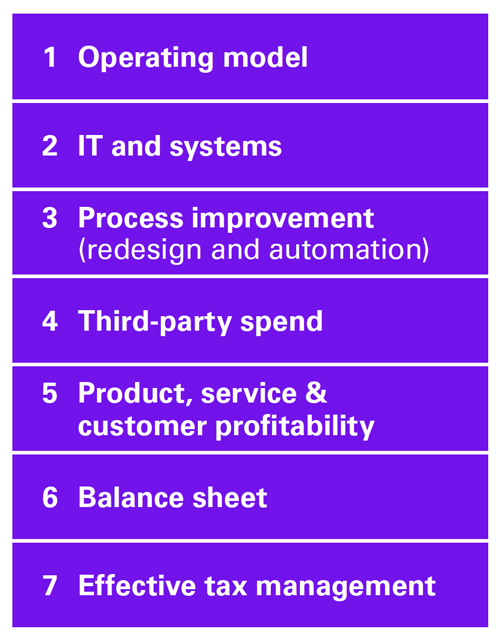

This article explores seven value creation levers and actions to help your organization start thinking proactively about its approach.

Based on CEO Outlook 2022 Survey and KPMG’s 2022 SMB Business Outlook Survey, compared to 2019 and 2020, CEOs are better prepared to weather short term challenges by boosting productivity (50 percent), managing costs (43 percent) and reconsidering digital transformation strategies (40 percent). In addition, 86 percent of CEOs believe a recession will happen over the next 12 months. Fully 73 percent of CEOs predict a recession will impact company earnings by up to 10 percent over the next 12 months. What’s more, 61 percent of SMB leaders say they’ve taken pre-emptive action to recession-proof their business.

Seventy-five of CEOs believe a recession will upend anticipated growth over the next three years. And 71 percent of CEOs believe a recession will make post-pandemic recovery harder.

The factors driving value creation: What questions should we ask ourselves?

Strategic Objectives

- How can we drive value after an M&A integration and deliver on potential synergies?

- How can we fund our longer-term sustainability needs?

- How can we reduce our costs in tandem with driving our business imperatives?

Financial Weakness

- How are we performing financially compared to competitors?

- How can we deliver more value to shareholders?

- How can we self-finance our business goals? Can we shift capital to growth areas?

- How can we decrease our operating margin?

- Do we have a competitive effective tax rate and can we optimize our cash tax position?

Market Dynamics

- How is our market being disrupted by innovation or technology?

- What changes are there to our industry’s competitive dynamics?

- What are the short-term and enduring changes to customer preferences?

Operational Weakness

- How can we make our processes more efficient?

- How can we raise the quality of our products or services to meet customer needs?

- How can we break down the silos between functional teams?

Key Value Creation Levers

These seven value creation levers are examples that organizations may wish to consider. To start, we recommend gathering and analyzing the right operational and financial data, and building an accurate picture of the operation, financial and tax positions, and cashflow.

These seven value creation levers are examples that organizations may wish to consider. To start, we recommend gathering and analyzing the right operational and financial data, and building an accurate picture of the operation, financial and tax positions, and cashflow.

Looking ahead to a changing reality

Considerations for organizations:

- What will our new reality look like once the economy bounces back?

- What is the desired future state of the business and how can we fund it?

- How is the current economic climate impacting our workforce and overall business performance?

- How can we uncover sustainable efficiencies in how we operate and how work gets done?

- How can we support top-line stability and continued bottom-line growth?

- How can we adopt automation and other technology tools to help us preserve and realize value?

- Should value creation include all functions and divisions, and to what degree?

- How can we encourage the adoption of value creation initiatives so they become sustainable?

In times of uncertainty, leading organizations are looking at ways to preserve and create value, focusing on working capital strategies to enhance liquidity, improve performance, and reduce costs. Value creation requires deep alignment of business challenges and technology opportunities, delivered at pace with cross-competency, market-speed operating models — allowing teams to deliver more with the same number of resources.

We can help organizations reduce complexity to enable faster decision-making and improve responsiveness to a changing — and uncertain — economic environment. We can also help to build capability that will help maintain and improve margins, and sustain improvements over time.

A strategic approach to value creation

Complete a rapid performance review of your organization to help boost profitability and EBITDA. Contact us to learn more.

- A rapid operational assessment, conducted in 3-5 weeks, can shine a light on the ‘art of the possible’ and prioritize initiatives for implementation.

- Rapid performance improvement upside identification

- Quantify the opportunity capture the value

- Implementation planning

- Medium and long-term

- transformational solutions

- 3 to 5 weeks 2 to 4 weeks 6+ weeks

- Rapidly establish cost/financial positions,

- driver and development

- Identify upside potential

- Prioritize opportunities

- Focus on a limited number of lower

- complexity opportunities

- Validate and confirm the full upside impact with medium- to long-term solutions

- Set-up PMO, steering committee and assemble project teams for different initiatives

- Launch new ways of working

- Investigate technology and automation solutions that will enable advanced analysis and reduce manual tasks

- Implement low-complexity opportunities, prioritizing actions to deliver value quickly (i.e. quick wins)

- Establish a transformational program with a dedicated steering committee to guide the transformational changes

- Select project champions and tie their performance to the success of the initiative

- Execute quick wins

- Apply technology and digital solutions to modernize procurement, distribution channels, customer interactions, and feedback

- Secure future business outcomes

Alison Glober is Partner, Operations Excellence, Management Consulting; Duncan Lau is Partner, Restructuring and Turnaround, Deal Advisory; David Francescucci is Partner, Transformative Tax Advisory; and Bruno Atristain is Partner, Operations M&A for KMPG Canada.