TORONTO, ON–Geopolitical/policy risk, macroeconomic risk and technology/cyber risk rank as the most significant risks facing Canada’s financial sector, according to a new survey released by the Global Risk Institute in Financial Services (GRI).

GRI’s Canadian Financial Services Risk Outlook Survey 2026, which draws directly on the views of Chief Risk Officers from across Canada’s financial services sector, finds that a small group of risks continues to rank highest across both short-term and medium-term outlooks, shaping how they are prioritizing attention and resources.

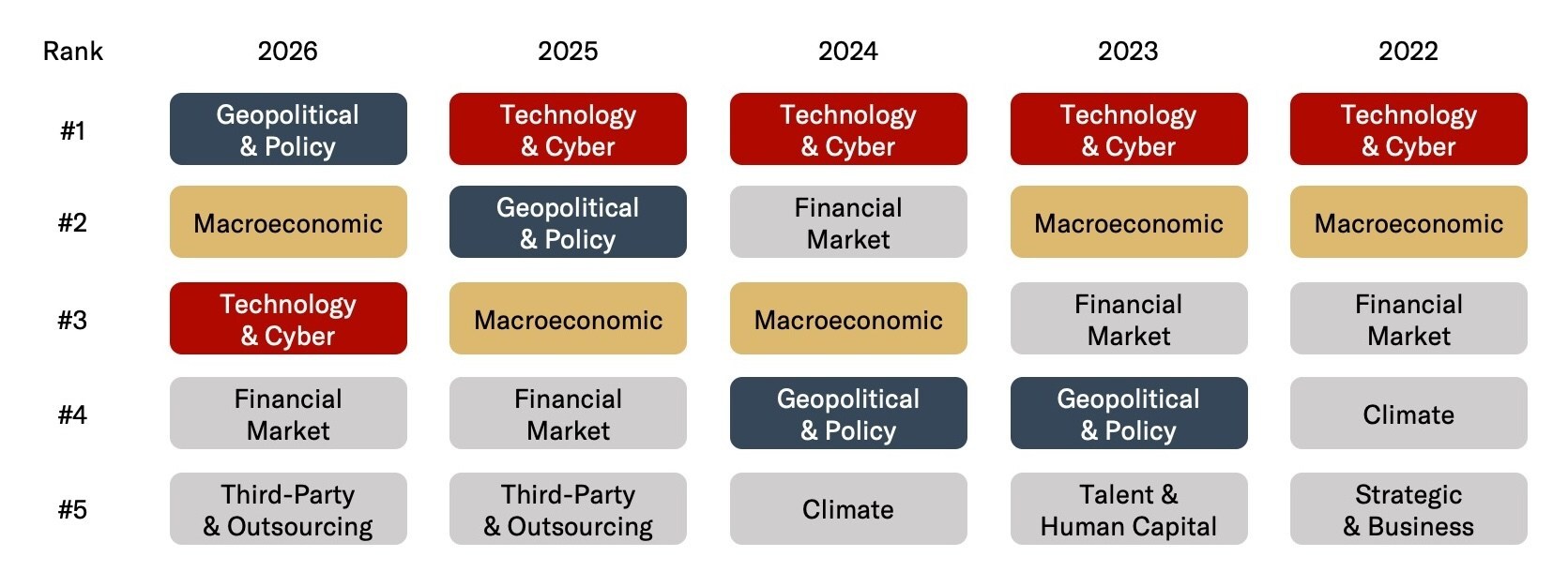

Evolution of Top Risks Over Time: Ranking of Short-term Risks.

“What stands out in this year’s survey is not just which risks rank highest, but how consistently these risks appear across time horizons and segments,” said Sonia Baxendale, President and CEO, GRI.

“The findings reflect how risk is being assessed at the highest levels of decision-making across the financial services sector,” added Baxendale.

Key Takeaways from the 2026 Survey:

Shorter-term caution contrasts with stronger medium-term confidence

- 53% of respondents expect stable to moderate improvement in the sector over the next 12 months. That figure rises to 78% over the five-year horizon.

- Across both time horizons, zero respondents anticipate significant improvement for the sector.

Operational risks are increasingly strategic

- Technology/Cyber and Third-party/Outsourcing risks rank among the top five risks.

- Respondents identified these exposures as central to longer-term resilience and competitiveness.

Confidence in resilience is strong, but constrained by external forces

- Most institutions report being well prepared to manage risk internally.

- Respondents noted limited organizational-level control geopolitical, policy and macroeconomic-driven risks.

Governance and foresight matter more than prediction

- Scenario analysis, stress testing and board-level engagement were identified as key tools for managing uncertainty.

- Respondents emphasized preparedness over precise forecasting.

Innovation is outpacing oversight, elevating sector risk

- Rapid technological change was cited as advancing faster than existing governance and regulatory frameworks.

- Respondents highlighted the potential for unintended sector-wide consequences.

Results from the survey indicate that geopolitical/policy risk, macroeconomic risk, and technology/cyber risk have consistently ranked among the top short-term risks since 2022. Financial market risk and third-party/outsourcing risk also remain recurrent features of the top five. The evolution of rankings over time highlights continuity in the risk landscape, with shifts in emphasis rather than the emergence of new risk categories.

Evolution of Top Risks Over Time: Ranking of Short-term Risks. Risks are ranked based on the proportion of weighted responses received, reflecting participants’ assessment of the most significant threats over the short term. (CNW Group/GRI)

While risks related to operational resilience, regulatory compliance, talent and reputational risk remain present, respondents indicated that they are currently overshadowed by the scale and interconnected nature of geopolitical, economic and technological pressures.

“Overall, the survey findings underscore the importance of governance and decision-making frameworks required for organizations and the sector to operate effectively under heightened complexity and interconnectivity,” concluded Baxendale.

The Canadian Financial Services Risk Outlook Survey 2026 was conducted among Chief Risk Officers and other senior risk executives across Canada’s financial sector between December 4, 2025 and January 9, 2026, including banks and investment services, insurance, government and regulatory bodies, pension organizations and specialized finance and lending institutions. Participants assessed risks over one- and five-year horizons.

The Global Risk Institute in Financial Services (GRI) is a premier organization that defines thought leadership in risk management for the financial services sector. We bring together leaders from industry, academia and government to draw actionable insights on risks globally. We are a non-profit, public and private partnership with over 50 government and corporate organizations from asset management, banking, credit unions, insurance and pension management. Our goal is to be a critical resource to government and the financial industry to mitigate and adapt to risks, focused on ensuring the stability of the financial ecosystem.