By Susan Sanei-Stamp, Senior Vice-President, Financial Services Sector, Léger

By Susan Sanei-Stamp, Senior Vice-President, Financial Services Sector, Léger

Canada is experiencing one of the largest intergenerational wealth transitions in its history. As much as one trillion dollars is shifting across generations, and this movement of capital is already reshaping expectations, behaviours, and the pressure on financial institutions to demonstrate relevance and trustworthiness. This is not a future event. It is happening right now. And there is new research, from Léger, into this pressing topic.

To understand how Canadians are thinking about wealth and develop relevant strategies to connect with them, their views must be grounded in the reality they face every day. Today’s financial landscape is evolving. Inflation has moderated toward more normal levels, and after a period of aggressive tightening, the central bank has begun reducing rates. However, underlying inflation pressures and economic uncertainty mean the path ahead remains fluid. Canadians have been adapting by rethinking major life choices such as home ownership, shifting spending habits, and relying more heavily on digital banking. Within this environment, one thing stands out: Canadians are paying close attention to the financial sector.

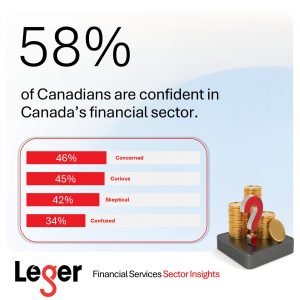

Léger’s Financial Services research reveals that a majority of Canadians (58%) expresses confidence in the sector, suggesting broad trust in its stability. Nearly half are curious (45%), showing an openness to exploring new options and potentially even reconsidering how they manage their money. This curiosity represents strategic white space where brand stories can resonate and innovations can gain traction.

These positive sentiments towards Canada’s financial services sector exist alongside other, less reassuring ones. Overall, there is also concern (46%), skepticism (42%), and confusion (34%) held towards the sector at large. This split-screen view matters. The transfer of wealth is unfolding in a climate where trust, comfort, and expectations vary widely. This is a moment where the sector could benefit from reexamining and/or optimizing brand experiences from messaging to product development, from frontline enablement to back-office KPI tracking, and everything in between. It is also a moment during which the sector could consider how it communicates with younger Canadians, specifically those between 18-34 years who are most likely to experience these less positive sentiments.

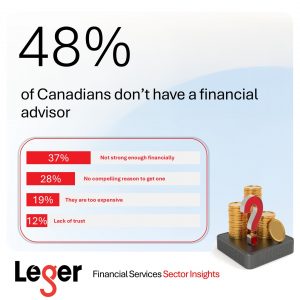

The generational perspective matters. Léger’s Financial Compass report on The Great Wealth Transfer finds that nearly two-thirds of Canadians (63%) believe their financial decisions differ significantly from those of their parents, and this rises among Millennials. While this may feel intuitive, separate Léger research shows that many younger adults still strive to own their own homes, pursue partnerships, and raise families. Even so, about half of Canadians are navigating this environment without a financial advisor (48%), and many do so without a financial strategy (42%).

Why Many Canadians Do Not Currently Work with Advisors

Understanding what holds Canadians back from engaging with advisors is essential. Two perception-driven barriers stand out from the Financial Compass report additional sector-specific research conducted by Léger.

The first is how Canadians perceive themselves. About 4-in-10 (37%) feel their financial situation is not strong enough to warrant having an advisor. This belief is not only especially

The first is how Canadians perceive themselves. About 4-in-10 (37%) feel their financial situation is not strong enough to warrant having an advisor. This belief is not only especially

pronounced among women without an advisor (39%) but also among higher-net-worth Canadians who currently do not have an advisor (32%). These are groups with both the need and the potential to benefit from professional advice, yet self-perception becomes a limiting factor. And it begs the question: what other financial services benefits are they talking themselves out of?

The second barrier relates to how Canadians perceive advisors. Many (28%) say they do not have a compelling reason to get an advisor, suggesting a general lack of understanding of what advisors do or can do. One-in-five (19%) presumes advisors are too expensive. One-in-ten (12%) do not trust advisors to know what is best for them, and 8% do not know where to find a good advisor. These gaps in understanding and confidence can influence behaviour just as meaningfully as financial circumstances. This presents an opportunity for targeted, relevant messaging.

It also matters what Canadians want from financial advice. They want financial guidance that feels personal, relevant, and grounded in real understanding. They want advisors who clarify the value of the relationship and help them make well-informed decisions. Most The Financial Compass report reveals that most Canadians (80%) say it is important that their values be reflected in the advice they receive. This signals a relationship moment for the sector at large, not just for client-facing advisors.

Insights to Consider When Stepping Through This Moment

This is a moment that requires listening and asking the right questions to understand clients and prospective clients. And a moment to playback what is being heard in more human and engaging ways. In the context of wealth transfer, receiving an inheritance can influence decisions and potentially reshape a financial path. When Canadians believe their decisions differ from those of their parents, relying on legacy service-delivery playbooks could become risky. Understanding the values that guide Canadians is essential; the sector has an opportunity to lean in and truly see who they are speaking with and what matters to them.

External perspectives converge on another key point: the shifting demographic landscape of inheritors. For the first time in Canadian history, women are expected to hold the majority of wealth in the coming years. This shift is expected from longer life expectancy and their likely position as both primary and secondary inheritors. Léger’s research shows that currently, one-third of Canadian women expect to receive an inheritance (32%).

External perspectives converge on another key point: the shifting demographic landscape of inheritors. For the first time in Canadian history, women are expected to hold the majority of wealth in the coming years. This shift is expected from longer life expectancy and their likely position as both primary and secondary inheritors. Léger’s research shows that currently, one-third of Canadian women expect to receive an inheritance (32%).

The research also identifies that younger generations are also entering inheritance pathways sooner. A third of Gen Z (32%) and a third of Millennials (33%) report already having received an inheritance. The research also reveals notable vulnerabilities for these younger Canadians: they are less likely to have an advisor, less likely to have a financial strategy, and more likely to worry about how they might handle gifted monies.

Self-identified BIPOC Canadians are also more likely to anticipate receiving an inheritance than other Canadians. Advisors and financial services providers who understand the needs of these younger and more diverse inheritors can help build the knowledge and confidence required to manage new responsibilities.

These shifts are shaping a financial landscape that is more diverse, values-driven, and intentional. People appear to be making financial decisions that connect to identity, life direction, and personal responsibility. There is an opportunity, therefore, to make financial advice more effective by acknowledging these themes. Clear communication, correction of misconceptions, and a supportive planning environment could reduce uncertainty and strengthen engagement. Why? Because the research is clear: many segments poised to inherit substantial wealth do not feel deep loyalty to their current financial institutions. Overall, 44% of Canadians are at risk of changing their primary bank.

Legacy Decisions Carry Personal Significance

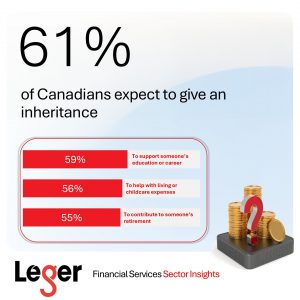

Legacy planning is not simply about transferring assets. Canadians connect legacy to personal meaning, family relationships, and a sense of responsibility. Among those planning to leave an inheritance, many expect to do so to support someone’s education or career development (59%), help with living or childcare costs (56%), or contribute to someone’s retirement and long-term security (55%). These motivations show that legacy decisions reflect human priorities as much as financial ones and signal a need for planning pathways that go beyond calculations.

The research also reveals a notable gap between those who expect to give an inheritance (61%) and those who expect to receive one (35%). Even in families that talk openly about money, some beneficiaries are unaware that they are in line for an inheritance. This gap risks their ability to plan. The wealth management category has an opportunity to step up and help families establish shared understanding before the transfer occurs, reducing uncertainty and supporting better outcomes.

The research also reveals a notable gap between those who expect to give an inheritance (61%) and those who expect to receive one (35%). Even in families that talk openly about money, some beneficiaries are unaware that they are in line for an inheritance. This gap risks their ability to plan. The wealth management category has an opportunity to step up and help families establish shared understanding before the transfer occurs, reducing uncertainty and supporting better outcomes.

On the receiving side, women, particularly younger women who will hold a growing share of wealth, tend to search for financial information online, yet make their decisions in person. And when women were asked what they would do with a windfall, nearly half over a third (4537%) say they would invest it, but fewer than a third (29%) would seek advice. This highlights the importance of early, relevant, and consistent relationships.

On the giving side, most Canadians who plan to give an inheritance expect to do so through a will (89%). Yet one-in-five says they would not seek advice from anyone, which underscores the need to educate and guide both givers and receivers.

There is also a third group to consider. Many Canadians sit in inheritance loops, experiencing both giving and receiving, sometimes at overlapping life stages. These loops, as revealed in the Léger report, reflect the complexity of financial life and may shape expectations of the advice experience.

Digital Research Is Growing, but Decisions Remain Human-Centred

Another potential risk to financial relationships is the increasing use of digital tools for financial exploration. About half of Canadians (46%) use a computer for financial research, a quarter (26%) use a smartphone, one-in-five uses a phone app (18%), and one-in-ten (12%) follows banks or advisors on social platforms. Digital tools clearly support early discovery.

However, when making actual financial or investment decisions, Canadians prefer human interaction. Half (53%) prefer to decide in person, and only 28% would consider advice from artificial intelligence. Millennials show openness to virtual meetings, yet they also prefer real-person guidance for decisions.

These patterns suggest that digital tools enhance learning, while financial professionals have the opportunity to help interpret information and support confident decisions. Early, consistent engagement can be the difference between a client coming in with preconceived answers versus entering into a meaningful dialogue.

How the Sector Can Respond

Léger’s research identifies some areas for the sector’s consideration:

• Support client confidence and clarify the advisory value proposition. Canadians need to understand what advisors do and how the relationship supports financial confidence.

• Engage families earlier. Benefactors and beneficiaries could benefit from aligned expectations. Digital tools could help initiate those conversations with advisors and other frontline staff helping to guide outcomes.

• Prepare for changing wealth demographics. Younger Canadians and women represent a growing share of future beneficiaries. Tailored guidance, products, and solutions could support their needs.

• Blend digital learning with human insight. Canadians research online, but they make decisions with people. Institutions could strengthen both points of engagement.

Looking Ahead and Stepping Beyond Traditions

Looking forward, the research identifies three major trends shaping how the next generation of Canadians, particularly Millennials and younger Gen X, think about wealth.

• First, their decisions are diverging from those of their parents. Most Canadians (63%) say their financial decisions differ significantly from their parents, and this increases among Millennials.

• Second, they are placing growing importance on non-traditional assets. About a quarter of Canadians say this, rising to 4-in-10 among Millennials.

• Third, they want alignment between their money and their values. Over half of Canadians (55%) say investing in socially responsible companies or portfolios is important to them, and this sentiment is especially strong among women.

As the sector looks ahead, it is important to recognize how the landscape will differ from today and prepare to meet emerging needs. Canadians are already redefining how they think about wealth. The institutions that listen, evolve, and respond with relevance could be better positioned to earn trust during this pivotal moment – and beyond.

Léger’s Financial Services Team analyzes attitudes, financial behaviours, and emerging trends in Canada’s Financial Services sector. The team provides research-based insights to help organizations understand and respond to the evolving expectations of Canadians, and is led by Susan Sanei-Stamp, an industry veteran with experience both within the insights consulting sector and directly supporting strategies within Canada’s largest retail bank. More insights can be found here: https://leger360.com/finance/