Why compliance for blockchain/cryptocurrencies?

By Amber D. Scott Most compliance professionals first hear about cryptocurrencies, like bitcoin, and blockchain projects in terms of risk. Questions then arise: from whether these products can be used to launder money and finance terrorism (yes, as can every other payment method, but they aren’t great for this purpose), …

The value of robust surveillance

By Rick Snook In 1957 a bank robbery in Cleveland, Ohio, where a man and his accomplice forcefully approached a teller, stuffed over $2,000 in a bag and ran out to their getaway car, became the first ever to be captured on film and caught soon after. Fast-forward from that …

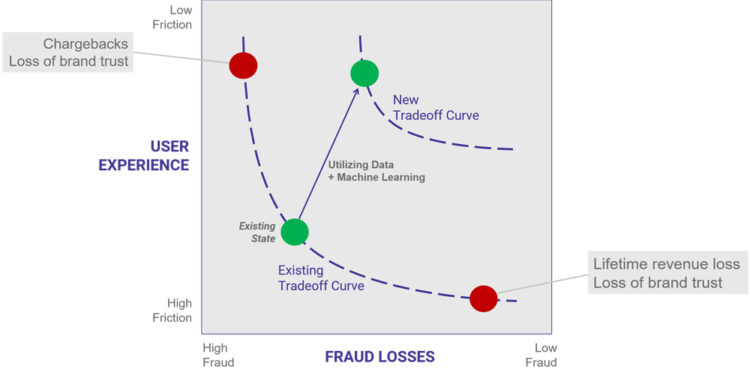

The truth about AI and fraud

By Rich Stuppy Many merchants are increasingly turning to machine learning (ML) and artificial intelligence (AI) to help make faster and smarter decisions to automatically approve good transactions and reject fraudulent ones. The problem is that many companies that claim to use AI are just using rudimentary ML based on …

The reality of RTP

By Jason Mugford Each year, payment processing inefficiencies cost Canadian businesses between $2.9 billion and $6.5 billion. Business-to-business (B2B) cross-border payments is one notable example of this as they are particularly time-consuming and can be prone to error. Treasury professionals across industries are frustrated by the legacy systems of correspondent …

Tackling the regulations challenges

By Roy Farah Ask any financial services professional, like those in a major bank or in a small credit union, and they will universally name their biggest challenge in one word: regulations. Canada has some of the strictest rules in the world, and while newer initiatives like open banking are …

Responding to evolving cyberthreats

By Roman Mykhaylyshyn New and constantly evolving technologies, including in the payments industry, are resulting in new products and services, and as such they have become an integral part of day-to-day lives: and this trend is far from over. However, as with most things, innovation comes with risks. With digital …

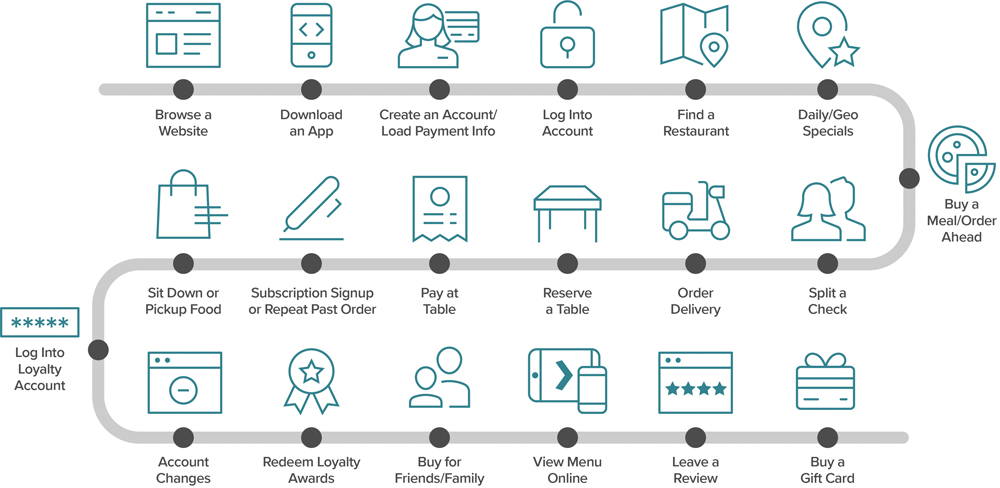

Rejuvenating payments

By Roger Sholanki The wellness industry is increasingly turning to new technologies to automate daily operations, increase customer satisfaction and drive business growth. One of the operational areas getting a technology makeover at spas, salons, gyms and other wellness businesses is payment processing. Flexible payment options, integration capabilities, mobile functionality …

Preventing ATM cash-outs

By Stacy Gorkoff The ability to detect ATM cash-out attacks as they are unfolding—not after the damage is done—continues to be a priority for IT operations and payments security teams. In today’s complex and ever-changing threat environment there remains no “silver bullet” that provides financial institutions blanket protection from fraud. …

How to outwit fraudsters

By Greg Brown Stealing a person’s hard-earned money is nothing new. However, in today’s world of almost instant payments, the methods used by fraudsters for payment fraud have evolved. While the digitization of payments has made making financial transactions more convenient for consumers and financial institutions (FIs), it has also …

Enabling faster (and secure) payments

By Arjun Kakkar Digital commerce is growing, but it still represents less than 15 per cent of the total global retail business value. One key reason is a far-from-seamless shopping experience. According to a study by the Baymard Institute, almost 70 per cent of U.S. shoppers end up abandoning their …