Cambridge Global Payments Opens Platform

TORONTO, ON–Cambridge Global Payments is launching an enhanced version of the Application Programming Interface (API) platform that will open it up for third-party and software developers around the world. The latest version of the foundational platform, Payments API 2.0, will help expand the developer experience, by assisting developers to create …

Canadians’ Spending, Payments Still Pandemic-Impacted: Payments Canada

OTTAWA, ON–The COVID-19 pandemic continues to cast its long, dark shadow over Canadians, and that has impacted their spending and payments habits, though there is the hope of vaccines on the horizon. Payments Canada has released new data on Canadian payment trends since the onset of COVID-19, showing that Canadians …

Electronic Payments Surge, Cheque, Cash Retreat: Payments Canada Report

OTTAWA, ON–Evolving technology and payments innovation continues to transform the way Canadian consumers and businesses make payments, according to new data from Payments Canada’s just-released annual Canadian Payments: Methods and Trends report. In pursuit of more convenient, faster and secure payment experiences, Canadians continue to adopt new and evolving digital …

COVID-19 to Accelerate Online Sales 33 Percent Globally by 2025: Juniper Research

HAMPSHIRE, UK–A new study from Juniper Research has found that transaction values for physical goods sales online will grow from USD3.3 trillion in 2020 to USD4.4 trillion by 2025, with this 33 percent growth hastened by the COVID-19 pandemic. The pandemic has fundamentally altered customer behaviours towards eCommerce, with these …

Mastercard adds A2A, Eventually Cross-Border Payments to Mastercard Track Business Payment Service

PURCHASE, NY–Mastercard continues to deliver on its multi-rail payments strategy with the addition of account-to-account (A2A) payments functionality to its business-to-business (B2B) Mastercard Track Business Payment Service. This launch represents the next phase in Mastercard’s journey to modernize business payments by solving persistent pain points that buyers and suppliers experience …

Staples Canada launches new Staples Card with Flexiti

Toronto, ON–Staples Canada has launched a new financing solution in time for the holiday season, in collaboration with Flexiti Financial. With the new Staples Card, cardholders have access to flexible zero percent interest (OAC, terms and conditions apply) financing plans to help make their purchases for home, school and business …

Rapyd Launches Cross Border Payment Fraud Prevention Solution

MOUNTAIN VIEW, CA–Rapyd has launched Rapyd Protect, a fraud solution that has been designed to protect businesses and consumers against fraud across countries and payment methods. With the growing use of alternative payment methods (APMs) globally, Rapyd Protect provides a smart defence against global fraud while empowering merchants to confidently …

Payments Canada Selects Mastercard’s Vocalink for RTR

OTTAWA, ON–Payments Canada has selected Mastercard’s Vocalink as the clearing and settlement solution provider for the country’s new real-time payments system, the Real-Time Rail (RTR). This announcement follows an extensive procurement process that included the Bank of Canada and the Department of Finance. The partnership will draw on Mastercard’s expertise, …

Interac Collaborates with Walmart to Expand Debit Payment Options

TORONTO, ON–Interac Corp. is now working with Walmart Canada to offer its customers enhanced methods of paying with debit online and in-store. With a target timing of spring 2021, Walmart shoppers will soon be able to checkout using Interac Debit for in-app and in-browser payments on proprietary wallets. Walmart has …

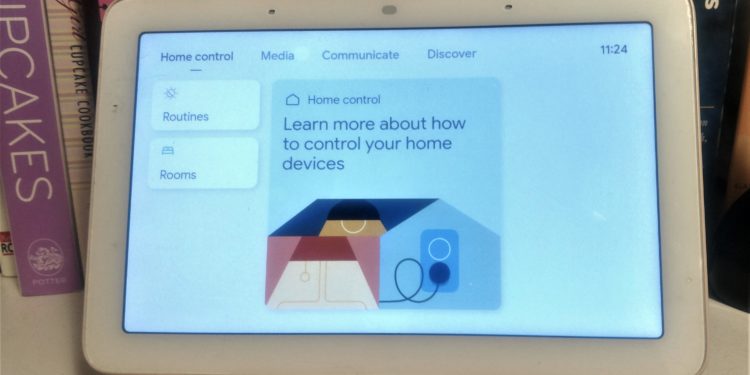

Juniper Research Forecasts Over 7X Increase in Smart Home Payments Transaction Value

HAMPSHIRE, UK–A new study from Juniper Research has found that the total transaction value of smart home payments, i.e. payments that occur via smart home devices, is expected to exceed USD164 billion in 2025: a dramatic over sevenfold increase from USD 22billion in 2020. Increasing use of voice assistants via …