By Andrew Eppich

By Andrew Eppich

The COVID-19 pandemic has forced businesses across Canada to digitally transform. According to Equinix’s Global Tech Trends Study, nearly half — 46 percent — of digital leaders in Canada have accelerated their digital transformation plans as a result of COVID-19.

That includes the financial services industry, which has been forced to rethink its approach to digital infrastructure in order to enhance customer engagement, improve real-time trading, and protect itself against future disruption.

This transformation is particularly necessary if Canada’s financial institutions want to join their international counterparts in embracing three pandemic-driven trends that will ensure their ongoing resilience: Banking as a Service; Open Banking; and the evolution of Open Banking, Open Finance.

How infrastructure transformation enables Banking as a Service

In many ways, Canada’s banking industry is ahead of the curve when it comes to digital services. Bank of Montreal launched its first digital platform in 1996, and its Big Five counterparts had all followed suit by the early 2000s. Today, according to the Canadian Bankers Association, 76 percent of Canadians do most of their banking digitally.

Canada is also ahead of the curve when it comes to contactless digital payments: 34 percent of Canadians with a credit or debit card use contactless payments on a regular basis, according to Payments Canada, with the pandemic accelerating the technology’s use. A recent Interac survey found 53 percent of Canadians using digital payments more frequently since March 2020.

The country has been slower, however, to adopt trends such as Banking as a Service, which is enabling banks, FinTechs, and digital startups around the world to create new business models by offering financial services through the cloud. Successfully delivering these services requires interconnection – secure, direct, low-latency data exchange between partners – and interconnection requires not just digital transformation, but infrastructure transformation.

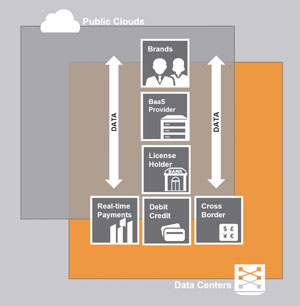

For example, the diagram depicts a BaaS model running on hybrid digital architecture, with a mix of on-premises, public/private cloud, and co-location. In this fictional scenario, the bank is partnering with a FinTech provider to deliver financial services on behalf of a brand such as a retail or hospitality company. While the bank handles any card transactions in-house, it remains free to collaborate with other FinTechs for real-time and cross-border payments.

For example, the diagram depicts a BaaS model running on hybrid digital architecture, with a mix of on-premises, public/private cloud, and co-location. In this fictional scenario, the bank is partnering with a FinTech provider to deliver financial services on behalf of a brand such as a retail or hospitality company. While the bank handles any card transactions in-house, it remains free to collaborate with other FinTechs for real-time and cross-border payments.

In markets such as Europe, these types of partnerships are steadily growing into BaaS ecosystems incorporating banks, FinTechs, clouds, networks, payment rails, fraud detection, and other service providers. Interconnection is critical to the reliability of these ecosystems, by ensuring low-latency data securely flows between partners and their digital infrastructure across every region in which their services are offered.

With the right interconnection strategy, banks and FinTechs can establish a digital core they can use to easily scale and create new BaaS business models for any brand.

Bracing for Open Banking – and Open Finance

Under open banking, third parties are authorized to use application programming interfaces (APIs) to access financial information, which they can then use to develop associated services and apps. Open banking is not yet available in Canada, but the Canadian government is considering the best way to enable its safe introduction, and it’s important that businesses prepare their infrastructure for when it arrives.

European businesses have been able to provide open banking services since 2015, when the European Parliament adopted the revised Payment Services Directive, known as PSD2. While still at the early stages, PSD2 has enabled third parties across Europe to access payment account information and conduct payments on behalf of their customers. It is mature enough to be paving the way for open finance.

It is open finance that will be the true game-changer, a complete mobile and digital experience that will help consumers and businesses better manage their finances and financial services. For consumers, it could mean seamlessly transferring funds between products to maximize the interest they receive, or receiving e-mail or text warnings advising them of how a prospective purchase could affect their finances.

For businesses, open finance represents an opportunity to collaborate with new partners on developing and delivering personalized financial services at an unprecedented scale. Any business that collects transactional data could be involved: telcos, hospitality and tourism companies, and retailers, for example, could all become reliable sources of customer data.

Without interconnection, however, the transition to open finance will be tricky. The greater the number of connected endpoints, the greater the chances that data could be delayed or lost.

Yes, COVID-19 accelerated digital transformation. But it’s only by adopting the infrastructure needed to successfully power that transformation, and using it to securely interconnect with third parties, that financial service providers will be able to take full advantage of the pandemic’s greatest opportunity: Using BaaS, open banking, and open finance to support the development of new and exciting insight-driven, revenue-generating services.

Andrew Eppich is Managing Director, Equinix Canada.