TORONTO, ON–The financial health of Canadian defined benefit (DB) plans was volatile in the second quarter of 2024, with plans’ overall funded positions at the end of the quarter in a position similar to that at the beginning of the quarter.

The Mercer Pension Health Pulse (MPHP), a measure that tracks the median solvency ratio of the defined benefit pension plans in Mercer’s pension database, was 118% at March 29, 2024, rose to 123% as at April 30, 2024, slipped to 122% as at May 31, 2024 and declined to 118% as at June 28, 2024. The solvency ratio is one measure of the financial health of a pension plan.

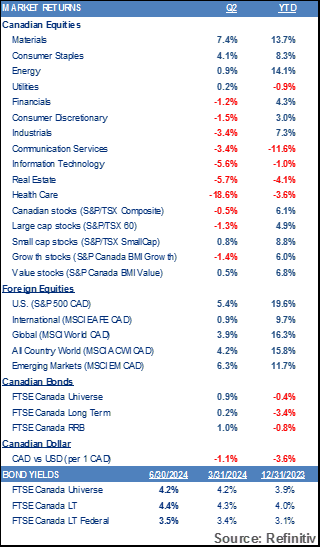

Throughout Q2, most plans saw positive asset returns from fixed income assets, US equities and international equities, which were generally offset by negative asset returns from Canadian equities and increased DB liabilities. Together, these trends resulted in an overall maintenance of solvency ratios. DB pension plans that used fixed income leverage may have experienced stable or improved solvency ratios over the quarter.

In addition, the number of plans with solvency ratios above 100% at the end of Q2 is generally consistent with the result at the end of Q1.

“The overall financial health of DB pension plans in Canada remains strong,” said Jared Mickall, Principal and leader of Mercer’s Wealth practice in Winnipeg. “However, the interest changes and market volatility during this quarter is a good reminder that a DB plan’s funded position can change quickly and plan sponsors should plan accordingly.”

On June 5, the Bank of Canada reduced the overnight rate to 4.75% from 5.00%, and it expects inflation to continue to move towards the 2% target1. Canadian inflation declined from 2.9% in January to 2.7% in April and increased to 2.9% in May2. While inflation continues to be within the upper end of the Bank of Canada’s inflation-control target of 3%, the path for inflation to get to 2% is expected to continue to be volatile. While the overnight rate declined by 0.25%, interest rates on Canadian bonds with longer terms increased during the quarter. Further, the overnight rate continues to be higher than interest rates on Canadian high-quality bonds at longer terms. Due to the long-term nature of DB pension plans, DB pension plan stakeholders will be keen to monitor Canadian inflation and the movement of long-term interest rates on Canadian bonds.

On June 5, the Bank of Canada reduced the overnight rate to 4.75% from 5.00%, and it expects inflation to continue to move towards the 2% target1. Canadian inflation declined from 2.9% in January to 2.7% in April and increased to 2.9% in May2. While inflation continues to be within the upper end of the Bank of Canada’s inflation-control target of 3%, the path for inflation to get to 2% is expected to continue to be volatile. While the overnight rate declined by 0.25%, interest rates on Canadian bonds with longer terms increased during the quarter. Further, the overnight rate continues to be higher than interest rates on Canadian high-quality bonds at longer terms. Due to the long-term nature of DB pension plans, DB pension plan stakeholders will be keen to monitor Canadian inflation and the movement of long-term interest rates on Canadian bonds.

While the funded position of Canadian pension plans remains strong, a new report by the Canadian Institute of Actuaries has shed light on trends that may impact their long-term sustainability. The report, which examines mortality among Canadians, concludes that life expectancy in Canada is generally expected to improve at rates greater than those currently used predominantly by the pension industry. While this is good news for Canadians, it signals challenges ahead for DB pensions as lifetime pensions may need to be paid for longer, which could mean higher DB liabilities by 2% to 4%, in general. DB pension plans are advised to understand how the results of the new mortality improvement research may apply to their plan.

“Canadian DB pension plans have long been talking about longevity risk, and what it means for the funding of their plans,” continued Mickall. “It’s incumbent on DB pension plans to examine their funded positions, conduct a strategic review of the risks their plans face, and take action.”

The recent overall volatility in the financial health of DB pension plans over Q2 is a reminder that Canadian interest rates can change, inflation risks persist, markets continue to be volatile, and the life expectancies of plan members and their spouses may be longer than currently budgeted. For DB pension plans in a surplus, planning for future financial headwinds would be a natural primary consideration as part of an effective risk management strategy. Surplus usage to provide for benefit improvements or contribution holidays continue to be valid uses, and their financial impacts should be explored and understood.

It would also be prudent to review a pension plan’s risks to be retained or transferred (e.g. annuity purchase). While a strategic annuity purchase is top of mind for many DB pension plans, a tailored investment strategy is a viable, and in some cases the only feasible, alternative to annuitization. A regular review of a pension plan’s investment policy continues to be appropriate and such reviews may be expanded to include sustainable investment beliefs.

Canadian defined contribution (DC) pension plans are also advised to understand the results of the research on mortality among Canadians as it brings into focus the risks that a member may outlive their DC account as they manage their financial affairs. A timely review of the DC pension plan would align with the expected release this summer of updated Guidelines for Capital Accumulation Plans by the Canadian Association of Pension Supervisory Authorities.

From an investment standpoint

A typical balanced portfolio would have posted a return of 1.7% over the second quarter of 2024. Earlier in the quarter, the market had a more cautious outlook due to reduced expectations of interest rate cuts, driven by strong economic and inflationary data. However, as corporate earnings remained robust and developed market central banks implemented their first interest rate cuts, both equities and fixed income rallied. In a departure from recent trends, emerging markets outperformed developed markets, benefiting from strong growth numbers and a lower rate environment.

Global equities continue to perform well, supported by the resilience of developed economies and the ongoing strength of the US economy and consumer data. Consumer growth remained strong, bolstered by robust income growth and accumulated savings from the pandemic period. As inflationary pressures eased, major central banks began implementing interest rate cuts, boosting optimism in equity markets and leading to decreases in yields and positive fixed income returns. Limited reduction in US inflation readings as well as strong consumer spending data released at the end of June pulled back both bonds and stocks reducing the size of the quarterly gains.

Uncertainty was high this quarter in the UK and Eurozone due to geopolitical tensions and surprise elections in the UK and France. Consequently, these regions underperformed the U.S. which has maintained high production levels and strong corporate earnings. Emerging markets, particularly Brazil and India, demonstrated growth and resilience. In China, PMI data has indicated a transition into expansionary territory, while the government has proposed policies to support the weakened property market. As a result, emerging markets ended the quarter strong and surpassed the performance of developed markets.

In June, Canada became the first G7 central bank to reduce its overnight rate. This decision was based on four consecutive soft readings on core inflation and a narrower range of price increases, leading to the conclusion that “monetary policy no longer needs to be as restrictive.” As a result, fixed income markets experienced strong performance, driven by declining yields in response to expectations of additional interest rate cuts. The sentiment changed during the last week of June given the increase in the Canadian inflation reading, causing yields to increase again and quarterly bond gains to dampen.

Despite the quarerly volatility, overall Canadian debt markets posted positive returns. The Canadian dollar depreciated this quarter against all major currencies with the largest depreciation against the GBP and USD followed by the Euro.

Unlike the Bank of Canada, the U.S. central bank was not yet ready to cut interest rates and remains cautious about a near-term pivot. They emphasize the importance of positive data trends before taking further action. Many developed central banks have implemented the first interest rate cut as the ECB, Bank of Canada, and Bank of England all began the rate cut cycle. While the initial rate cuts in G7 countries have occured, central banks stress the need for supporting data prior to further actions.

Global commodities had a strong performance this quarter, led by gold and oil. Real Estate continues to face challenges compared to equity markets due to the sensitivity to interest rates. Although sentiment within global property markets has improved, it is expected that interest rates will need to decrease before there is an increase in activity within the sector.

The Canadian equity market fell this quarter, a sharp contrast to other equity markets. Healthcare, Real Estate, Communication Services and Information Technology were the main detractors. Positive performance was seen in the Materials and Consumer Staples sectors, driven by strong commodity prices and demand. Home prices continue to remain high due to strong demand outweighing limited supply in the market.

“Emerging market equities are trading at a fairly large discount relative to developed market equities providing an opportunity for regional diversification and outperformance in the periods to come. However, it is important to partner with highly skilled managers who can effectively diversify portfolio, capture alpha, and provide necessary downside protection when needed.” says Nataliya Stasyuk, Principal at Mercer Canada.

Another consideration for Canadian pension plan sponsors amidst this backdrop of market volatility is the new economic working group, chaired by Stephen Poloz, which as part of the Government of Canada’s Budget 2024 was implemented to explore how to catalyze greater domestic investment opportunities for Canadian pension funds. The working group is to identify priority investment opportunities that will grow Canadians’ pension savings – that meet Canadian pension plans’ fiduciary and actuarial responsibility, spur innovation, and drive economic growth.

The group has several areas of focus, including digital infrastructure and AI, physical infrastructure, building homes on public lands, and consider removing the 30 percent rule for domestic investments. All Canadians will have an interest in the working group’s findings.

The federal government also proposes to amend the Pension Benefits Standards Act, 1985 to enable and require the Office of the Superintendent of Financial Institutions to publicly release information related to the investments of large federally regulated pension plans. The information to be disclosed would be set out in regulations and would include the distribution of plan investments by jurisdiction and, within each jurisdiction, by asset class. Federally regulated pension plans will be keen to monitor these developments and whether they are included.

The Mercer Pension Health Pulse

The Mercer Pension Health Pulse tracks the median ratio of solvency assets to solvency liabilities of the pension plans in the Mercer pension database, a database of the financial, demographic and other information of the pension plans of Mercer clients in Canada. The database contains information on approximately 450 pension plans across Canada, in every industry, including public, private and not-for-profit sectors. The information for each pension plan in the database is updated every time a new actuarial funding valuation is performed for the plan.

The financial position of each plan is projected from its most recent valuation date, reflecting the estimated accrual of benefits by active members, estimated payments of benefits to pensioners and beneficiaries, an allowance for interest, an estimate of the impact of interest rate changes, estimates of employer and employee contributions (where applicable), and expected investment returns based on the individual plan’s target investment mix, where the target mix for each plan is assumed to be unchanged during the projection period. The investment returns used in the projections are based on index returns of the asset classes specified as (or closely matching) the target asset classes of the individual plans.

Mercer believes in building brighter futures by redefining the world of work, reshaping retirement and investment outcomes, and unlocking real health and well-being. Mercer’s more than 20,000 colleagues are based in 43 countries and the firm operates in over 130 countries. Mercer is a business of Marsh McLennan (NYSE: MMC), the world’s leading professional services firm in the areas of risk, strategy and people, with more than 85,000 colleagues and annual revenue of $23 billion. Through its market-leading businesses including Marsh, Guy Carpenter and Oliver Wyman, Marsh McLennan helps clients navigate an increasingly dynamic and complex environment.