By Wally Vogel

By Wally Vogel

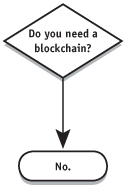

You have probably heard all the blockchain hype and are wondering when or if it will actually play a role in your day-to-day business. Blockchain has often been described as a solution looking for a problem. As a result, you may have seen guides to help decide when a blockchain is or is not required. Here’s one of my favourites:

Even though this diagram is a joke, it does sum up a view many have of blockchain and with some justification. Of course, you don’t “need” a blockchain today, but you didn’t “need” a cell phone in 1980 and you didn’t “need” an Internet connection in 1990. Do you need them today? You didn’t need them then because they were still in their infancy. But once the technologies developed, they could do more and the value of what they could do grew with the network effect as users adopted them.

Even though this diagram is a joke, it does sum up a view many have of blockchain and with some justification. Of course, you don’t “need” a blockchain today, but you didn’t “need” a cell phone in 1980 and you didn’t “need” an Internet connection in 1990. Do you need them today? You didn’t need them then because they were still in their infancy. But once the technologies developed, they could do more and the value of what they could do grew with the network effect as users adopted them.

Cellphones and the Internet went from being novelties to being useful to being indispensable. So it will be with blockchain, which is just transitioning from a novelty to being useful, and soon will become indispensable.

The one problem blockchain can solve today

How can Canadian businesses save $1 billion in office supplies and postage, free up over 250 million hours of unproductive time, avoid their most common fraud vulnerability and save 75,000 trees? The answer is to stop paying suppliers with cheques.

These numbers are significant, so let’s look at the data sources and check the math. According to Payment Canada, Canadian businesses issue over half a billion cheques per year. This means:

1.With cheque stock, envelopes, printer supplies and postage adding up to $1.50 to $2.00 per cheque that represents a total materials and postage cost of approximately $1 billion.

2.The “soft costs” of time to print, assemble, sign and mail cheques is estimated as high as $15 – $25 per cheque according to Scotiabank. Even at the low end of that estimate of $15 and deducting the $2 hard cost, that leaves $13 of soft cost (time spent). Assuming an average burdened labour cost of $25 per hour that extrapolates to 260 million hours spent on cheques.

3.Over 70 per cent of businesses reported being targeted by cheque fraud in 20184, making cheques the most common target for fraudsters.

4.Business cheques typically use a full page (with two stubs below) and an envelope and are often photocopied. That works out to about two sheets per cheque, over a billion sheets of paper per year. Since one tree makes about 8,333 sheets of letter paper5 that means approximately 75,000 trees are used for cheque payments in Canada each year. The environmental impact goes even further as cheques pollute at every stage, from tree planting and harvesting to papermaking and printing, transportation and mailing and delivery.

Previous problem-solving attempts

Electronic payment options like electronic funds transfer (EFT) have been available for decades, so why do most companies still pay most of their vendors by cheque? It’s simple: businesses want control and convenience.

Cheques offer control in that they can be reviewed, together with any detailed backup documents. They can be approved with a physical signature that is immutable and verifiable. They offer convenience in that the payor doesn’t need to know the supplier’s bank account number, and the attached cheque stub includes remittance details that help the supplier apply the payment.

Traditional bank EFT services have not been packaged to provide the same combination of control and convenience as cheques offer. While logging into a secure web portal to authorize an EFT provides control in the form of security, they typically do not integrate with the payor’s accounting system, and the lack of details and backup documentation to review means less control in terms of verifying the validity of the payable.

Further, bank EFT required collecting bank account information from suppliers, and this can be difficult. Making it even more so is the fact that the suppliers are inconvenienced by losing remittance details that they would have received with paper cheques. For these reasons, traditional bank EFT adoption has been low.

Several new FinTech payment services have emerged and offer an improvement over traditional EFT delivery in terms of convenience by integrating with the payors’ accounting systems and delivering e-mail remittance advice to the suppliers. However, these services effectively require the payors to delegate control to the FinTech providers: to trust their databases as the systems of record for payments and approvals, with less transparency on the end-to-end process.

A blockchain-based solution

The main features of blockchain are trust and transparency, meeting the critical need of businesses to control their payments in a way that no solution has before. Approvals are recorded with digital signatures, along with all other key events in transaction processing in an immutable audit trail in a shared ledger. The business can (if they wish) keep their own copy of the blockchain ledger with their transactions for full transparency. They gain the convenience of digital approvals by phone or laptop, without giving up any control. In fact, the control and security are much greater than with paper cheques, which can be intercepted in the mail and altered.

Does your business need a blockchain for payments? Yes.

If you are interested in reducing costs, saving time, eliminating fraud risk and helping the environment, then the answer is “Yes, you should eliminate cheques. And to do that while maintaining control and convenience you do need a blockchain for payments.”

And implementing a blockchain for payments will not only save you time and money with enhanced security today, it will also position you well for the future. The same blockchain ledger that is securing your digital approvals can also have selected fields shared with your trading partners. Imagine resolving any discrepancies as they arise, rather than spending hours trying to reconcile a vendor account at the end of the month. Imagine a year-end audit where not only are all the invoices and records digital rather than paper, but where each transaction is already validated and digitally signed by your customer or supplier to indicate their agreement. That is the future of blockchain for business as the technology matures and business networks grow.

Wally Vogel is a payments veteran, a Certified Engineering Technologist and a Certified Blockchain Professional. He has founded multiple software companies specializing in transaction processing for government entities and business enterprises and is currently serving as a director for Sparcblock, a Canadian company helping businesses streamline B2B transactions. Its SparcPay platform is a convenient and cost-effective way to pay suppliers electronically.