Netstock Announces the Release of its AI-Powered Predictive Planning Suite

Netstock’s AI-powered solution will empower SMBs to adapt, flex, and accelerate supply chain planning to outpace their competitors BOSTON, MA — Netstock, a leading supply chain planning solution provider for small and medium-sized businesses, has released its AI-powered Predictive Planning Suite, a purpose-built supply chain planning and inventory management solution. …

DXC Technology Predicts Five Ways Software Will Accelerate Sustainability in the Next Five Years

Software-driven innovation will be an enabler for the radical transformation needed to create a climate-secure future LONDON, UK–DXC Technology, a leading Fortune 500 global technology services company, has forecast five ways software will help create a more sustainable future in the next five years. “Technology has an outsized role in …

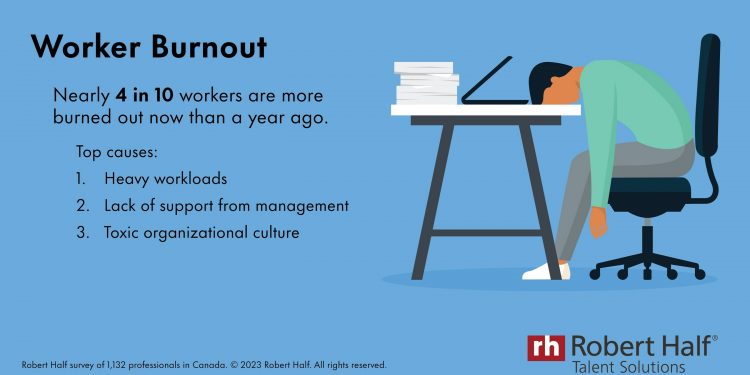

Nearly 4 in 10 Professionals Report Rising Burnout

40 per cent say their department is understaffed; Nearly a quarter say their manager has taken no action to alleviate work-related stress TORONTO, May 31, 2023 /CNW/ – Burnout is a problem that just won’t go away, new research from talent solutions and business consulting firm Robert Half shows. In …

Manulife Securities continues to advance technology platform

OAKVILLE, ON–Manulife Securities, a company of Manulife Investment Management, announced enhancements to its advisor experience with Envestnet’s Unified Managed Platform. “As a leading provider of holistic wealth advice in Canada, we feel both a responsibility and a privilege to offer the most robust technology possible to our advisors and clients,” …

Info-Tech Research Group Reveals Its LIVE 2023 IT Conference Keynote Speakers

Info-Tech LIVE provides attendees with practical insights to drive technology-led transformations, impact business outcomes, and accelerate their professional careers TORONTO, ON–Global IT research and advisory firm Info-Tech Research Group has announced some of the highly anticipated keynote speakers who will be headlining its annual three-day conference, Info-Tech LIVE. The event, …

Equitable Bank continues funding diversification

TORONTO, ON–Equitable Bank has completed an offering of €300 million of legislative Covered Bonds due May 28, 2026 (the “Covered Bonds”). The bonds were issued under the Bank’s Global Legislative Covered Bond Programme, which recently increased in size from a capacity of $2 billion to $3 billion, reflecting the growth …

Why Customer-Centric Pricing Is Fundamental to Acquisition and Retention

By Greg Demas President at Nomis Solutions As competitive forces, the economic environment and rapidly evolving consumer expectations continue to transform the banking industry. Attracting and building customer relationships is no longer a game won by presenting low rates and fees on a visually-pleasing website. The banking industry has sunk …

ILIXIUM: Seamlessness With Security

by Michael Brooke ILIXIUM was founded in 2010 in the United Kingdom. It’s part of the Payen Group Company, an intelligent cross-border payment solutions business. Their core beliefs are Collaboration, Innovation and Process Simplification. ILIXIUM works hard to remove barriers, increase player acceptance and deposits, and help its customers grow …

Biometric payments appeal to nearly half of Canadians but data security remains top of mind

by Kristina Logue, Chief Financial Officer, Payments Canada New technology and innovations in the payment space are transforming the way Canadian consumers and businesses make and process payments. According to data from Payments Canada’s annual Canadian Payment Methods and Trends Report, Canadian businesses are writing fewer and fewer cheques while …

Banks in Canada Support Canadians Affected by Alberta Fires

TORONTO, ON–Banks in Canada have pledged support to organizations providing on-the-ground relief and help to those affected by fires in Alberta that have devastated communities in the province. To support Albertans, several banks are collecting financial donations in bank branches for Canadian Red Cross relief efforts and making corporate donations …