Moneris rolls out Open Payments for Transit

Transit authorities processing with Moneris now have the ability to accept a greater variety of cards issued outside Canada in their open payments solution TORONTO, ON–Moneris Solutions, the Canadian leader in unified commerce, has received certification from Discover and UnionPay to process transactions from their respective cardholders in an open …

Regal Partners with Flexa to Enable Digital Currency Payments for Movies and More

Using Flexa, Regal patrons in the U.S. can buy tickets and concessions today using dozens of digital currencies at over 500 theatres NEW YORK, NY–Regal, a subsidiary of Cineworld Group and the operator of one of the largest and most geographically diverse theatre circuits in the United States, today announced …

Reimagining the Future of Finance: How Financial Services Can Thrive in a Post-Pandemic World

By Aqsa Zubair The COVID-19 pandemic was life-changing in many ways. For business leaders, it forced a break from simply focusing on routine day-to-day tasks and emphasized the necessity for thinking future forward. For me, it solidified the hard-earned lessons I have always applied to my work. My experience growing …

Creating Hyper-Personalized Financial Services in the Age of Data

By Reg Marrinier The global pandemic has accelerated the rise of the digital economy, driving financial institutions to continuously contemplate the next big innovation to differentiate their service offerings. With huge stores of transactional data and client histories, financial institutions need to activate the value of data assets if they …

Why Purchase Data Drives Customer Engagement

By Jason Howard Who hasn’t looked at their bank statement at one point and thought, “wait a minute, what’s this transaction again?” And often, there isn’t enough information on our digital bank statements to help us make sense of our purchase history. In most cases though, these confusing statement descriptors …

How Finance Leaders Set the Pace for Businesses to Thrive

By Daniel Oh No preceding crisis in our lifetime could have prepared Canadian businesses for the impact of COVID-19, which transformed a swath of industries at an unprecedented scale. Yet even as vaccination rates increase and workers slowly return to the office, fewer than 40 per cent of businesses with …

Futurpreneur’s Black Entrepreneur Startup Program Opens New Doors

Futurpreneur has been celebrating the early success of its Black Entrepreneur Startup Program (BESP), which has provided critical financing, mentorship and business resources to Canada’s Black entrepreneurs during its first six months of operation. The program, which is a funding collaboration with Royal Bank of Canada (RBC) with additional loan …

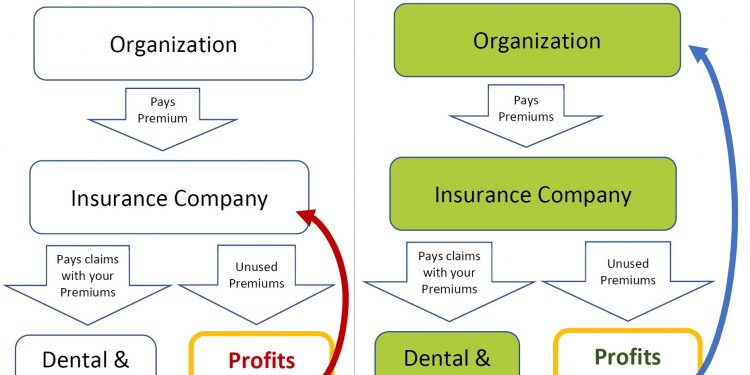

Are You Losing Out on Potential Funding?

By Trevor Chew Has your organization ever received a refund from its group benefits plan? If not, then you may be losing out on potential funding. If you only claimed 75 percent of what was paid towards group health benefits and the benefits provider kept 25 percent, would this represent …

How Foreign Currency Supports Charity

By Dennis Ullman and Scott Hutchings It is estimated that over $2 Billion in foreign currency is currently stored or saved in Canadian homes and businesses. This currency has no use or real value in Canada. As a result, foreign currency (notes and coins), pennies, and loose change are found …

Sage partners with Zapier to elevate the work of SMBs with the power of automation

Unlocking new ways to automate workflows and save an average of 10 hours per week on manual, repetitive tasks TORONTO, ON–Sage, the market leader in cloud business management solutions, announced the availability of Zapier, the workflow automation platform for business, on the Sage Marketplace in Canada, US, UK and Ireland. …