With Work-at-Home agents on the rise, here’s how to secure payments

…and Improve CX By Gary E. Barnett For most consumers, the idea of handling a transaction or conducting business through a call center brings a reassuring sense of security and confidentiality. This is especially true with larger, more established brands; customers trust that stringent regulations, employee background checks and oversight …

Cashless Countries

Canada is leading the way to becoming the most cashless country in the world Canada has been named the country most likely to banish the banknote in exchange for electronic payments. Hong Kong is the world’s second most cashless economy, followed by Singapore. European countries account for seven of the …

Fraud, Financial Crimes and the Impact of COVID-19

By TJ Hoarn Having passed the one-year mark on the global pandemic, it’s clear that COVID-19 has stress-tested the inner workings of numerous industries and functions, including banks and how they fight fraud and financial crimes. Change always creates opportunities for fraudsters and financial criminals, and the pandemic has provided …

Five Treasury Trends to Watch in 2021

By Amol Dhargalkar To succeed in the 2021 marketplace, corporate treasurers must rethink their financial risk management objectives, strategies, and policies while addressing their team’s changing role within the organization. Recognizing these five trends can help treasurers prepare for success in the year ahead. Corporate treasury teams face a dramatically …

How the Pandemic Changed the Accounting Business: Remote, and Digital

By Eileen Foroglou “Necessity is the mother of invention” may be cliché, but the pandemic brought the concept to life for most industries, including accounting and finance. Over the past few years with the push toward paperless offices, workers were encouraged to go digital with the technology invented for the …

Navigating Inflation’s Choppy Waters in the Equipment Finance Industry

By Gary W. LoMonaco As we hopefully approach the end of the pandemic, most of us are weary of seeing and hearing the word, “unprecedented.” In the case of COVID-related inflation, it is a truly appropriate way to describe the pandemic’s present and future effects on the economy. We haven’t …

Equipment Finance Future Leaders Spotlight

The CFLA’s Future Leaders Spotlight is a monthly feature of emerging talent in the Canadian asset-based financing and leasing industry. Brandon Stone President, QuipFinance.com What brought you to the asset-based finance and leasing industry? I was in consumer finance but stumbled across a used commercial truck dealership who was having …

e-Signatures and e-Leasing in the COVID-19

Prior to COVID-19, adopting e-signatures and e-leasing was on the list of to-dos of many equipment finance companies, but it became a priority when the pandemic struck and a return to normalcy remained unclear. During an Equipment Leasing and Finance Association webinar, “e-Signing and e-Leasing in the COVID-19 World: Taking …

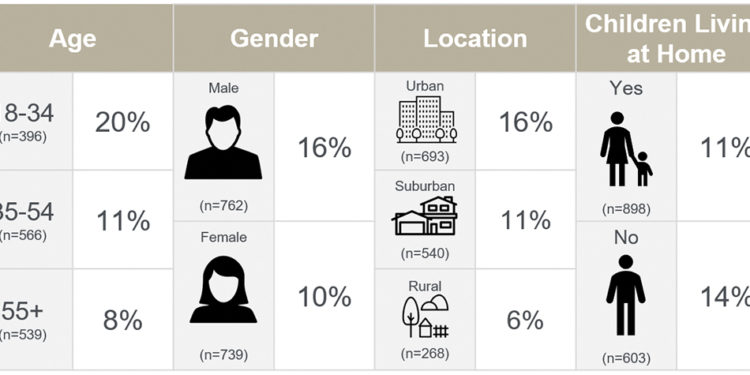

Canada’s gig economy has been fuelled by the pandemic

Workers and businesses are challenged by payments mismatch New research shows that the COVID-19 pandemic has led to an increase in the number of Canadians who participate in short-term contracts or freelance work, such as rideshare drivers, freelance writers and graphic designers, or contractors. These gig workers now represent more …

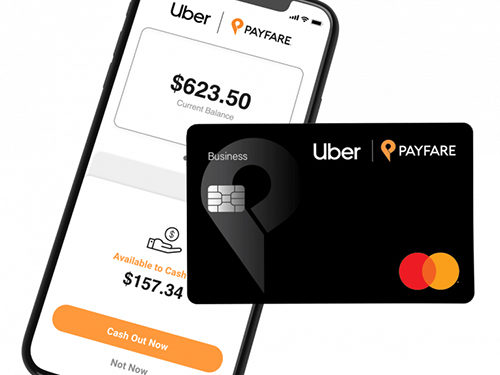

Supporting Canada’s Growing Gig Economy Through Financial Inclusion

Adjusting how gig workers are paid can help on-demand platforms, while providing a much-needed path to financial health for this growing portion of the workforce By Marco Margiotta Canada’s gig economy is growing, and it’s growing quickly: a new study from Payments Canada shared that gig workers now represent more …