By TJ Hoarn

By TJ Hoarn

Having passed the one-year mark on the global pandemic, it’s clear that COVID-19 has stress-tested the inner workings of numerous industries and functions, including banks and how they fight fraud and financial crimes. Change always creates opportunities for fraudsters and financial criminals, and the pandemic has provided a field day of possibilities. In 2020, customer behaviours changed dramatically as lockdowns came and went; people worked from home, ordered food delivery of groceries and restaurant meals, and conducted much of their shopping online.

The good news is that today’s anti-fraud teams are rapidly evolving, and banks are deftly using centralized decisioning, automation and an integrated platform approach to drive effectiveness.

New research shows how banks are adapting

Analyst group OMDIA recently released the findings of a study of more than 100 banks in the U.S., Canada, UK, Brazil, Germany and the Nordics on how COVID-19 has impacted both fraud and financial crime strategies. The study, commissioned by FICO, examined how institutions are responding to challenges in both areas—in particular, assessing whether banks need to take a more centralized intelligence approach across AML compliance and fraud—and whether new artificial intelligence (AI) and machine learning (ML) technologies offer genuine benefits.

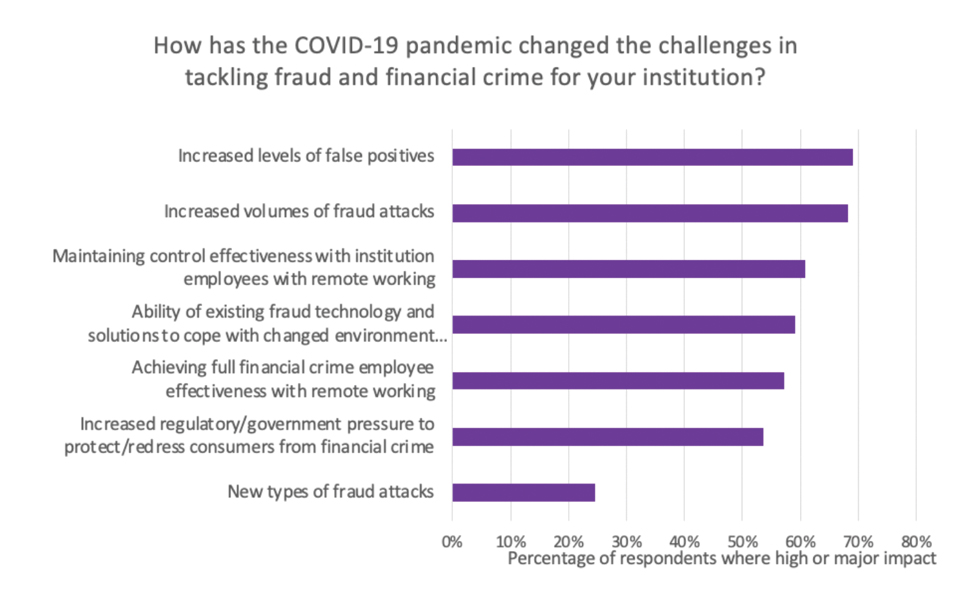

Throughout the pandemic, one of the biggest demands on fraud and financial crime operations has been the ability to quickly adjust. The increase in fraud attacks proved to be the biggest challenge for institutions, with 54 percent saying they needed to better identify emerging financial crime challenges. Some banks fell victim to systems that couldn’t adapt quickly enough (or at all) to new customer behaviour, which led to identifying some legitimate transactions as suspected fraud, to customers’ frustration. (See Figure 1 below.) This challenge was followed closely by banks’ struggle to maintain controls when most of their workforce suddenly became remote.

Throughout the pandemic, one of the biggest demands on fraud and financial crime operations has been the ability to quickly adjust. The increase in fraud attacks proved to be the biggest challenge for institutions, with 54 percent saying they needed to better identify emerging financial crime challenges. Some banks fell victim to systems that couldn’t adapt quickly enough (or at all) to new customer behaviour, which led to identifying some legitimate transactions as suspected fraud, to customers’ frustration. (See Figure 1 below.) This challenge was followed closely by banks’ struggle to maintain controls when most of their workforce suddenly became remote.

Other key findings from the survey include 43 percent of the banks identifying the need to see a full customer-level view when investigating alerts, and 38 percent wanting to increase the speed in responding to evolving threats.

What about AI?

One of the most exciting areas of recent technology innovation has been the development of artificial intelligence, as well as the maturing of machine learning. Importantly, recent advances have improved the ability to provide decision outcome “explainability,” addressing the “black-box” challenge of ML approaches, which has been an issue for regulatory support. OMDIA found that the AI/ML innovation maturity curve has generally moved from the innovator/early adopter phases to early maturity.

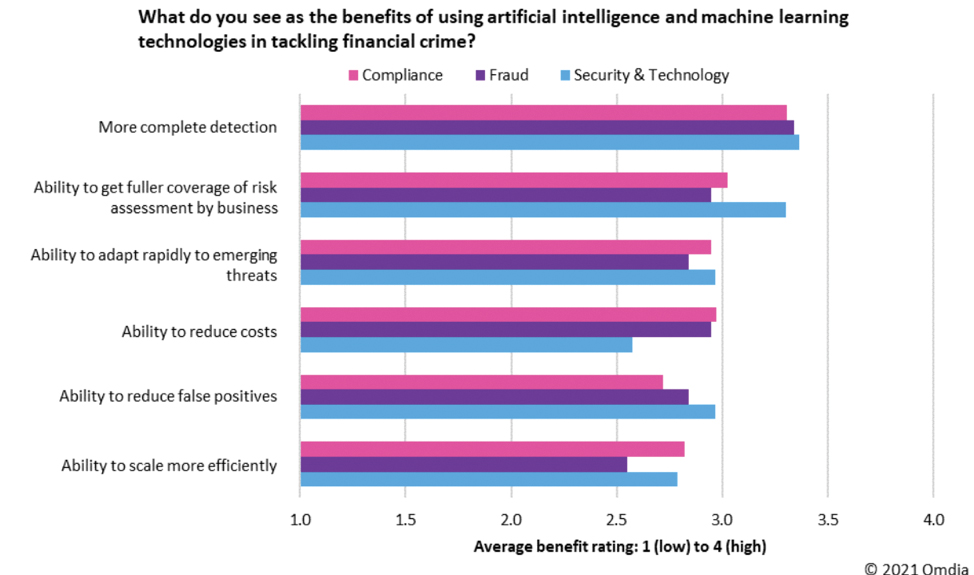

Reflecting this, the OMDIA study focused on assessing the benefits of using such technologies. AI and ML are providing benefits in driving fuller and more complete detection coverage, and in allowing institutions to rapidly respond to emerging threats. The benefits seen from using AI and ML in tackling financial crime are shown in Figure 2. Clearly, more complete detection is seen as a significant benefit by all financial crime functions.

Preparing for AI—and the unexpected

Preparing for AI—and the unexpected

The OMDIA study also investigated how banks are evolving their operations during the pandemic. In addition to AI adoption, collaboration between fraud and compliance organizations is now the norm, driven by both effectiveness and efficiency benefits. Concurrent with the pandemic, institutions are widely taking a strategic approach to integration; some 69 percent of the institutions surveyed now have strategic plans to integrate functions or share resources between AML compliance and fraud. Significantly, this strategic approach is translating into active plans, with institutions that are actively looking toward integration generally seeking to do so within three years.

Three years can seem like an eternity, given how COVID-19 has transformed much of the world in just a year. As more companies embrace AI adoption and integrate their fraud and compliance functions, it’s important to take advantage of the opportunity to learn from the lessons COVID-19 has taught the banking industry.

Here’s a checklist on how banks and their fraud teams can be better prepared for the next unprecedented event:

• Have a digital-first mindset: As banks strive to adapt to changes in consumer behaviour, especially at the fast pace seen during the pandemic, it’s imperative they adopt a digital platform that provides them with access to all customer data, regardless of location or format. Keeping up with evolving threats requires a system capable of feeding intelligence based on the right data at the right time.

• Adopt centralized data storage: A critical component of the data ingestion capabilities enabled by a digital-first mindset is having a centralized (or connected) data storage system in place. This enables banks to leverage customer data in a variety of ways in order to deliver a more secure user experience, through methods such as pre-book prevention or post-book detection and management.

• Consider the cloud: With the pandemic forcing companies across a wide range of industries to be more adaptable than ever, banks would be wise to consider using the cloud to power their digital operations. Cloud-based solutions help banks to increase server capacity and expand the scale of their digital services without having to worry about whether they have the infrastructure to do so, while also making it easier for employees to access the tools they need to do their jobs.

• Use automation to increase efficiencies: Some institutions lack the skilled talent needed to respond to recent spikes in fraud and financial crime in a timely manner. To make up the difference, companies should consider solutions that use robotic process automation (RPA) to alleviate some of the burden on existing personnel, allowing them to focus on high-value tasks while routine ones are automated.

• Incorporate analytics: The AI that powers RPA is also key to the increased collaboration between fraud and compliance teams mentioned above – but banks need to choose wisely. Whatever machine learning models they adopt need to be flexible, innovative, and deployable, with enough options available to ensure that banks and their fraud teams can adapt to the financial crime climate as quickly as it evolves.

While we don’t know when or how the next pandemic may strike, one thing is certain: today’s purpose-built solutions for fraud and financial crime threats are ready to adapt to ever-evolving threats, preparing institutions for the next unprecedented event.

TJ Horan is vice president of Product Management at FICO. He leads the fraud solutions business unit. He is responsible for developing the strategic direction for FICO’s fraud products, and is also a key strategic leader in the area of transaction decisioning and analytics