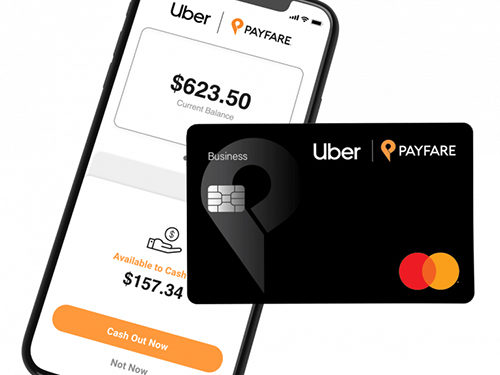

Supporting Canada’s Growing Gig Economy Through Financial Inclusion

Adjusting how gig workers are paid can help on-demand platforms, while providing a much-needed path to financial health for this growing portion of the workforce By Marco Margiotta Canada’s gig economy is growing, and it’s growing quickly: a new study from Payments Canada shared that gig workers now represent more …

As NFTs Storm the World, Digital Identity Security Must Scale Alongside the Trend

By David Lucatch While you may not know what an NFT (Non-Fungible Token) actually is, or why the trend caught fire so rapidly that it effectively reshaped the digital world in merely a matter of weeks, but you’ve probably heard some rumblings about the digital artwork that recently sold for …

Ten predictions for the Payments Industry in 2030

By Fabio Carvalho COVID-19 has changed the way consumers look at commerce and payment options. It has provided the impetus to overcome consumer inertia, and has created an unprecedented global appetite for changes to how we pay, with businesses adapting to make payment transactions fast and safe for both customers …

Outsourcing Payments —Is it Right for Your Firm?

By Alex Amoriello While the payments industry is traditionally known as a dynamic and adaptable industry, the COVID-19 pandemic has shed light on some of the complex and time-consuming processes within it. With resources and teams tighter than ever, and businesses looking for convenient ways to conduct any and all …

The Future of Conversational Commerce and Contactless Payments

By Jason Cottrell After over a year of not touching anything — door knobs, items on a store shelf, other people — it’s perhaps no surprise that Amazon is trialing a new, contactless payment method that requires nothing more than the swipe of a hand in front of a sensor. …

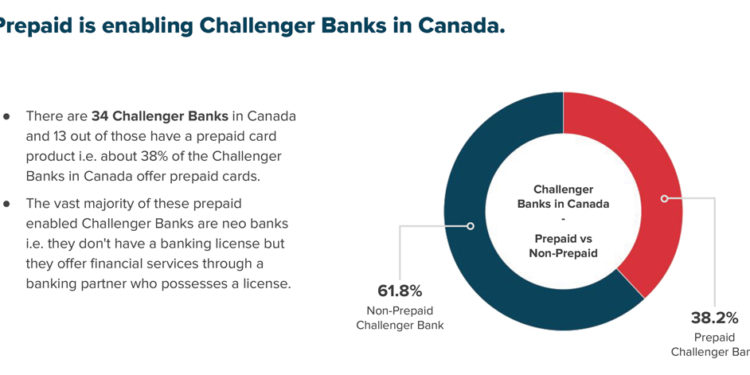

Canada’s Prepaid Payments Industry Growing, Attracting Innovation Among Homegrown and Global FinTechs

By Jennifer Tramontana The COVID-19 pandemic has had a seismic impact on the Canadian financial ecosystem and has shifted the way Canadians transact. While Canadians are still seeking choice, convenience and security in payments, Canadians are shifting to more frequent contactless, digital payments preferences. According to a survey from Payments …

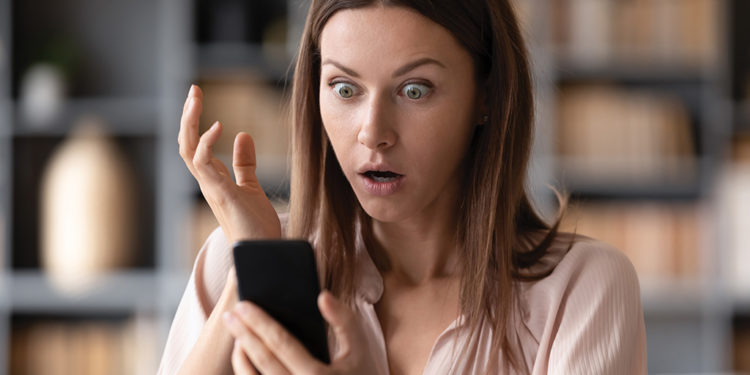

Why Are Scams on the Rise in An Increasingly Digital Society?

By Scott Zoldi With the world well into its second year of the COVID-19 pandemic, the inner workings of banks’ fraud and financial crimes operations continue to be stress-tested. Change always creates opportunities for fraudsters and financial criminals, and the pandemic has provided a field day of possibilities, especially scams. …

CFO CV

Tania Clark has joined the Business Development Bank’s Board of Directors. Honourable Mary Ng, Minister of Small Business, Export Promotion and International Trade, responsible for the Business Development Bank of Canada said Clark brings a wealth of experience as director, invaluable to BDC as it continues to play a vital …

Talking Points

Royal Bank of Canada Launches RBCx to Support Visionary Technology. It’s a platform to accelerate the entrepreneurial journey at every stage of growth, giving access to capital solutions, innovative products and services, and operational expertise to help technology companies scale up. RBCx is for entrepreneurs who are disrupting business models, …

RBC ADDS REWARDS POINTS TO DEBIT TRANSACTIONS THROUGH VANTAGE

BANK’S PERSONAL DEBIT CARDS EARN RBC REWARDS TORONTO, ON–RBC Vantage is the bank’s new system which ties everyday banking into a comprehensive suite of benefits for RBC clients. RBC Vantage gives clients, for the first time, the ability to use their debit cards to earn RBC Rewards points and provides …