By Brian Raine

By Brian Raine

The payments environment in Canada and internationally is in flux. But credit unions are not just keeping pace with that change, they are now leading it.

Bringing the benefits of low transaction fees, digital interfaces and convenience to all credit union members. Central 1 continues to focus on providing the technology and innovation through leveraging the collective scale of the broader credit union system.

Central 1 recognizes that speed to market and innovation are paramount. Achieving this optimum outcome means balancing in-house development with external partnerships.

Growth and changes

This opportunity now includes international payments, which are expected to grow four to five per cent in the coming years, according to a report by SWIFT and McKinsey & Company: A vision for the future of cross-border payments. Although cross-border flows represent only one-sixth of total transaction value, international payments revenues total up to $200 billion globally.

This expansion is being fuelled by increasing international commerce, migration and changing economic trends. In addition, the payments landscape is experiencing disruption that is changing the dynamics of international payments. These disruptors include:

Innovation from FinTech companies putting pressure on financial institutions;

Changing consumer demands focused on cost, simplicity, transparency and convenience; and

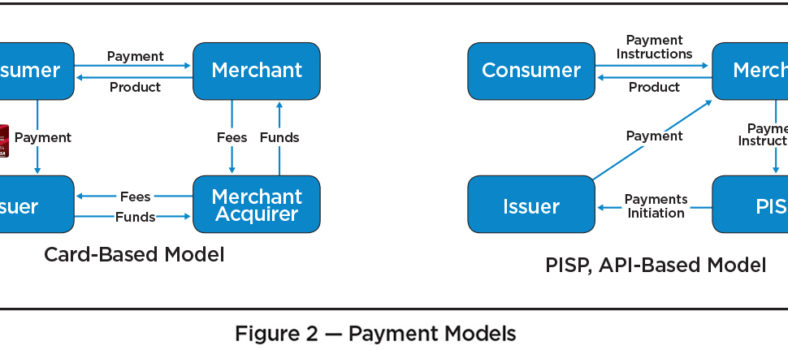

Regulatory pressures such as open banking, which is coming to Canada. Open banking enables bank customers to share access to financial data with third parties in exchange for services and products. Other markets including Europe and Australia are further along the open banking journey than Canada.

In Europe, traditional banks had a large market share of international payments. Specializing in foreign exchange conversion was a high-margin business. However, the market has shifted. Innovation from FinTechs has increased pressure on banks and has resulted in a migration to lower margins for foreign exchange transactions.

The same trend in Europe is happening in Canada. This means the Canadian market is ripe for disruption. International transfers are currently concentrated, with the big banks capturing a significant market share. FinTechs are now challenging the traditional ways of international payments in Canada, providing customers with better rates, faster transactions and more transparency.

Credit unions and international payments

It’s no surprise that credit unions are broadly not thought of as international payments players. In contrast to larger financial institutions, credit unions are independent and locally owned. But the reality is that for many Canadians, credit unions are their trusted financial institutions that provide numerous financial services: including international payments.

Approximately one in five Canadians is a member of a credit union. Credit unions hold a 7.1 per cent share of deposit-taking domestic asset market, according to the Canadian Credit Union Association.

There are approximately 252 credit unions serving an estimated 5.7 million members outside of Quebec. Critically, there are 395 credit unions that are the only financial institutions operating and serving in smaller communities across Canada. Credit union members are almost twice as likely as bank customers to live in communities of fewer than 10,000 people, at 22.3 per cent, reports the Ipsos Customer Service Index Survey. Meanwhile almost half of bank customers (46.8 per cent) live in large urban cities of one million or more people.

Meeting customer needs

There are various reasons why Canadians are transferring money abroad. These international payments include:

Buying overseas property or a holiday home abroad;

Paying for overseas tuition fees for a child or grandchild;

Overseas investments or divestments;

Sending money to friends or family who live overseas;

Paying for accommodations or luxury holidays overseas;

Supporting a family member who is travelling abroad;

Paying for a destination wedding abroad;

Overseas mortgage payments;

Paying for work to be completed overseas;

and Paying for bills abroad.

But on their own, many credit unions don’t have the scale to develop their own products and services for many of their members’ needs.

In July 2018, Central 1 partnered with Agility Forex Limited to give credit unions a cutting-edge solution to continue to compete against potential new products and competitors.

Central 1’s venture capital corporation, C1 Ventures, secured a 28 per cent ownership stake in Vancouver, B.C.-based Agility Forex, a FinTech company that has developed the proprietary technology that enables a crisp user experience and efficient processing of transactions directly to customers. The strategic partnership supports Central 1 in meeting clients’ needs by providing innovative solutions.

Just over a year later, in September 2019, Central 1 launched International Transfers, a made-in-Canada solution for Central 1 clients. It gives Canada’s credit union members the ability to move money cross-border any day, at any time.

The launch of International Transfers has the potential to immediately impact four million Canadians as it gives credit unions a competitive advantage by enabling seamless cross-border, multi-currency payments that few large financial institutions offer in Canada. Currently available to all credit unions in British Columbia and Ontario, it is being expanded to other provinces.

Stacked against the competition that charges on average $25 per transfer, the new service provides credit unions with a zero-dollar base cost for transfers above $500 CAD, a low fee of $2.50 for lower transfers and no transfer limits.

In the two months since launching, International Transfers has received a tremendous amount of interest from credit unions that want to provide this valuable service to their members. To date we have delivered it to nine credit unions with an additional 21 progressing through onboarding process.

Central 1 and Agility Forex is now developing International Transfers for commercial clients — targeted to small and medium-sized enterprise clients — which are the credit unions’ “sweet spots”. For many businesses the only option for paying suppliers aboard has been the traditional wire. This product will allow them to avoid wire fees and directly settle large payments into the accounts of their supplier quickly and easily.

The financial services industry is faced with a growing number of changes driven out of everything from payments, regulation and digitization. Rather than seeing this as a challenge, credit unions are embracing change and the opportunity to deliver innovation, competition and drive differentiation.

Brian Raine is vice president, Treasury and Portfolio Management, Central1.