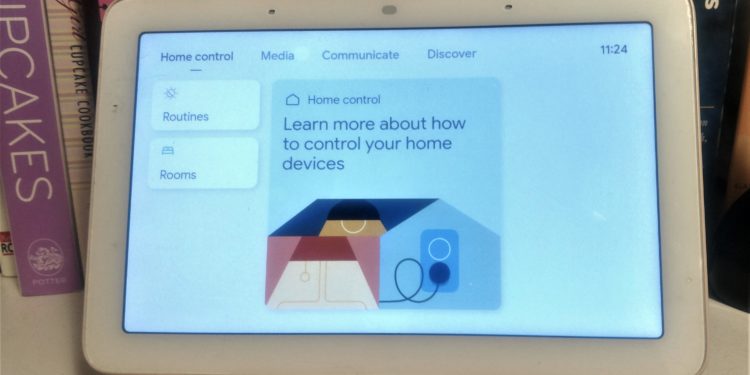

Juniper Research Forecasts Over 7X Increase in Smart Home Payments Transaction Value

HAMPSHIRE, UK–A new study from Juniper Research has found that the total transaction value of smart home payments, i.e. payments that occur via smart home devices, is expected to exceed USD164 billion in 2025: a dramatic over sevenfold increase from USD 22billion in 2020. Increasing use of voice assistants via …

Loans Issued via AI Underwriting to Reach USD315 Billion by 2025: Juniper Research

HAMPSHIRE, UK–A new study from Juniper Research has found that the value of unsecured loans issued via artificial intelligence (AI)-using underwriting platforms will grow by an astounding 1,200 percent over the next five years, from USD24 billion in 2020 to USD315 billion in 2025. This extraordinary growth will be driven, …

Icon Solutions Secures J.P. Morgan Investment

LONDON, UK–Icon Solutions, which specializes in payment solutions and consultancy services, has announced a strategic investment from J.P. Morgan. Icon Solutions will invest in its technology and geographic reach. The company has defined, architected, and built IPF, which is a cloud native, cost-effective, and collaborative payments platform that combines open …

Innovation To Spur Even Stronger Splitit Growth

MELBOURNE, AUSTRALIA and NEW YORK, NY—Payments solutions provider Splitit saw its revenue grow a record 318 percent between Q3 2019 and Q3 2020 to USD2.4 million. The company’s merchant sales volume (MSV) grew 214 percent year over year (YoY) over the same period to USD70.9 million. Consistent with previous quarters, …

Bluefin Announces $25 Million in Financing

ATLANTA, GA—Point of sale payment and data security technology provider Bluefin will be receiving USD 25 million in growth financing, in a round led by Macquarie Capital Principal Finance. Macquarie joins current investors Napier Park Global Capital and Camden Partners. The financing will fuel Bluefin’s product development, continued growth in …

Mastercard Launches Cyber Secure

PURCHASE, NY–Mastercard has released Cyber Secure, which is reportedly a first-of-its-kind, artificial intelligence (AI)-powered suite of tools that allows banks to assess cyber risks across their ecosystems and prevent potential breaches. With these capabilities, banks can identify and prioritize threats and vulnerabilities throughout their cyber environment. Additionally, acquiring banks can …

FCT, Opta to Provide Data-Driven Property Industry Products

OAKVILLE, ON–FCT, which provides title insurance and real estate technology, and Opta Information Intelligence Inc., a supplier of Canadian property location intelligence, have partnered to deliver data-driven products to the financial services industry. Through this exclusive partnership, FCT will leverage data assets, products, and resources to significantly increase the efficiency …

Business Environment for U.S. Equipment Finance Firms More Favourable in 2021: Foundation

WASHINGTON, DC–Although the outlook for the U.S. economy is uncertain, equipment finance industry leaders expect moderate portfolio growth in 2021. But performance will vary by sector. These findings and others are according to a new study, Equipment Finance in 2020: Special COVID-19 Impact Issue, released by the Equipment Leasing & Finance Foundation (Foundation). …

Forter, FreedomPay Partner to Fight Fraud, False Declines

NEW YORK, NY—Forter has partnered with FreedomPay to establish what may be the first joint network for online merchants and banks to instantaneously block fraud and enable legitimate consumers to operate freely. The partnership aims to address a major issue where multiple players (online merchants, credit card issuers, and banks) …

September U.S. Equipment Financing Down Year to-Year, To Date, But Up Month-to-Month

WASHINGTON, DC—There is both bad and good news in the latest Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25). It showed that the overall new business volume for the American equipment finance sector in September 2020 was $8.7 billion, down 13 percent year-over-year from new business …