By Brandon Spear

By Brandon Spear

Looking back on 2021, the global B2B payments landscape experienced notable changes in sales channel strategies as e-commerce accelerated. As B2B customer journeys become more digitally influenced, a merchants’ payments offerings and capabilities need to evolve to better secure the sale. Recent research from Forrester Consulting revealed that 60 per cent of merchants cited payment speed and security as top-of-mind concerns for customers moving forward to protect sales and customer experiences.

B2B retailers face immense competition, amplifying the need to offer payment solutions that will drive revenue and support customer loyalty. Whether its through a salesperson, online or in-store, B2B buyers expect the same, seamless payments experience. Omnichannel selling has become a critical part of the customer experience and can differentiate a B2B seller from its competitors. It has also become a more successful way to prospect and secure new business than traditional, “face-to-face only” sales approaches according to McKinsey & Co.

B2B retailers face immense competition, amplifying the need to offer payment solutions that will drive revenue and support customer loyalty. Whether its through a salesperson, online or in-store, B2B buyers expect the same, seamless payments experience. Omnichannel selling has become a critical part of the customer experience and can differentiate a B2B seller from its competitors. It has also become a more successful way to prospect and secure new business than traditional, “face-to-face only” sales approaches according to McKinsey & Co.

To help meet these rapidly changing customer expectations, Canadian merchants and manufacturers should address these four areas to ensure their offline and online payment processes deliver the best possible customer experience.

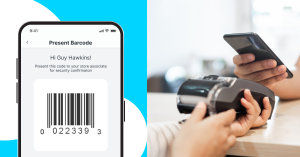

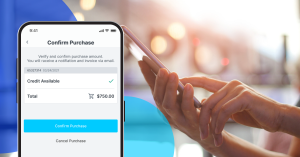

1. Offer more payment options: This gives buyers the freedom and choice to pay in their preferred method. According to the same Forrester Consulting research noted above, more than 90 per cent of merchants expect that improving payment options for B2B customers will improve customer satisfaction, speed up transactions, free up internal resources, and increase business success – showing an inherent need for B2B sellers to adapt payments processes. A recent industry example includes TreviPay’s one-click mobile app solution for B2B commerce which allows buyers to access their trade financing in-store via an intuitive mobile app, eliminating the need to issue multiple credit cards to numerous purchasers within the organization, which also helps reduce the risk of fraud. Our first partner to enable the TreviPay mobile app solution for B2B buyers is Staples Canada, which has been leveraging the new offering in all 305 stores across Canada with an average $6.5K CAD credit line per user since the program launched in August 2021. Without any need for POS hardware upgrades, this has allowed Staples’ authorized purchasers to shop seconds after credit approval rather than waiting on a physical card to arrive in the mail.

2. Extend buy-now-pay-later (BNPL) to B2B: The BNPL trend has gained traction amongst B2C consumers, especially for those who are interested in stretching their buying power and/or personal budgets. B2B buyers have long required BNPL-like solutions – such as trade credit and payment terms – for their large enterprise purchases. Now, B2B retailers and manufacturers must modernize those BNPL transaction experiences with digital and mobile purchasing options for B2B shoppers, or risk losing them. We can also expect growth opportunities in sales, cart size, conversion and loyalty for B2B sellers who adopt BNPL offerings.

3. Automate AP and AR processes: A lack of accurate, real-time data on payment flows is driving up the cost of payments. Ninety-six per cent of CFOs recently surveyed by PYMNTS say they are digitizing AP and AR processes to benefit customers and vendors. Other digitization benefits cited from the survey include automating a manual process, as well as providing a more efficient and more transparent process to build lifetime customer value. For accounts receivable, this could include automated onboarding to save a merchant time and cost by eliminating the need to email forms, lengthy credit decisions and inefficient procedures such as creating PDF invoices or performing manual bank reconciliations.

4. Protect against digital identity theft: As a result of the pandemic and shift to e-commerce preferences, more customers are acquired online. This causes a growing risk of B2B business identity theft and other forms of fraud. Recent data from Payments Canada found that around one in five Canadian businesses reported experiencing payment fraud. The most common type of fraud experienced was ‘someone contacting the business pretending to be someone else and requesting money’ (29 per cent). As B2B companies continue to expand their online offerings in 2022, supporting safe and secure payments remains a key priority in payments innovation. Leveraging data to offer instant decision processes and credit can strengthen the relationship between buyers and sellers by providing sophisticated fraud detection processes and maintaining a strong track record for risk decisions.

B2B merchants and manufacturers must be closely in tune with the revolutionary changes to customer experience, engagement and convenience embraced by the rising digital generation and accelerated by COVID-19. Those that embrace digital expectations and implement supportive payments solutions in the new normal will provide a better customer experience. This can establish stickiness and loyalty with customers, and offer cost savings, increased revenue potential and better cash flow.

B2B merchants and manufacturers must be closely in tune with the revolutionary changes to customer experience, engagement and convenience embraced by the rising digital generation and accelerated by COVID-19. Those that embrace digital expectations and implement supportive payments solutions in the new normal will provide a better customer experience. This can establish stickiness and loyalty with customers, and offer cost savings, increased revenue potential and better cash flow.

Brandon leads TreviPay with expertise in managing large, diverse global teams. His strength is discerning and focusing on the most important challenges facing an organization at a particular point in time and unifying all stakeholders behind accomplishing a set of specific goals. Brandon has a unique ability to connect across all levels of an organization, motivate staff with diverse skill sets, while ensuring a common alignment and results.