How To Utilize Payment Platforms To Drive Engagement & Earn More Revenue

By Susan Perlmutter The pandemic has changed how we live, work, and the way we communicate. The financial industry, particularly, has faced some difficult issues, including payment processing delays, loan approval backlogs, and overall accessibility. Financial institutions have been inundated with customer service inquiries and have scrambled to provide timely …

Mortgage Automator Partners with DocuSign to help private lenders collect signatures from investors and borrowers remotely

TORONTO, ON–As many industries try to figure out new ways of operating during the current Covid-19 pandemic, Mortgage Automator announced a new integration with DocuSign that will help private lenders gather required signatures remotely, prioritizing health and safety of all parties involved. This integration allows private lenders to connect their …

EY survey finds board-business dynamic is contributing to cyber risk

Disconnect leading to one-third of Canadian organizations unable to articulate potential threats; 34% of Canadian organizations have yet to fully articulate their cyber risks TORONTO, ON–A disconnect between cybersecurity efforts and business functions is putting more Canadian organizations at risk as information gaps leave leaders with a limited understanding of potential …

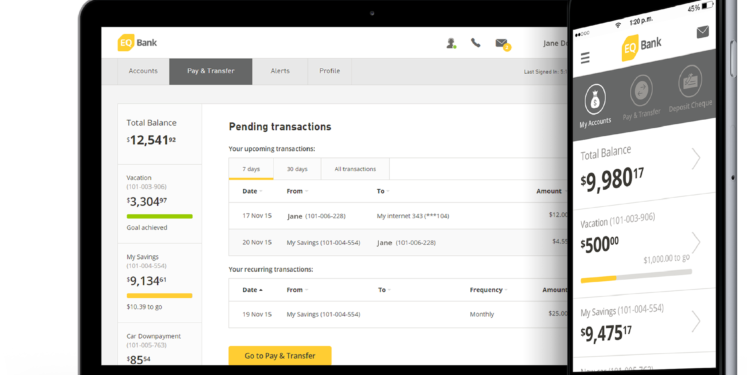

Accelerated customer growth, demand for digital banking help drive EQ Bank deposits over $3B

TORONTO, ON–EQ Bank, the digital platform offered by Equitable Bank Canada’s Challenger Bank™, announced it has surpassed $3 billion in deposits, driven by the recent acceleration in customer growth. In the last three months alone, despite uncertain times, EQ Bank has seen daily sign-ups triple for new accounts. Challenging the …

Hub International Acquires Ontario-Based usefulideas

TORONTO, ON–Hub International Limited (Hub), a leading global insurance brokerage, announced today that it has acquired JM Rose Insurance Agency Limited, d/b/a usefulideas® (usefulideas®). Terms of the transaction were not disclosed. Headquartered in Toronto, Ontario, Canada, usefulideas® is a full-service business consultancy, employee benefits and group retirement firm. Joanne Rose, …

Flexiti Signs Multi-Year Agreement with Visions Electronics to offer Point-of-Sale Financing Technology

TORONTO, ON–Flexiti Financial, a provider of point-of-sale consumer financing solutions for retailers, announced that Visions Electronics, a leading retailer for electronics with locations across Canada, has launched its point-of-sale financing technology. Flexiti’s financing solution is now available in all 43 retail locations in addition to their e-commerce site, which launched …

COVID-19 accelerating the move to digital payments across Canada

Interac shopping data shows spike in consumers and businesses choosing digital payments as economy begins to reopen TORONTO, ON–According to new data released by Interac Corp., payment transaction records show that today, more than ever, Canadian consumers and businesses are adopting digital methods to spend, send and receive money. A …

The Changing Face of Canada’s Accountancy

By Richard Perri The ancient mantra “the only certainty is uncertainty” is proving true for Canada’s accounting sector. It is experiencing both market disruption and pressure on workplaces to evolve business models to remain competitive in today’s environment. As a leading human resources and payroll technology provider, ADP Canada wanted …

The Future of ATMs

According to new research by RBR, the number of automated deposit terminals (ADTs) installed worldwide grew by 4% to reach a record 1.4 million in 2018. In a busy world where time is of the essence, both business and retail customers no longer expect to have to queue for the …

The Need for Secure Digital Identities

By John D’Apolito Trust, security and confidence in partners are the fundamental underpinnings of supplier/procurement relationships, especially today’s digital supply chain. For without current information, such as potential red flags or insights into ethical practices, partners will be cautious. These trading relationships require secure digital identities. Enhanced digital identities are …