More Canadian Workers Paying “Time Off Tax”: ADP Canada study

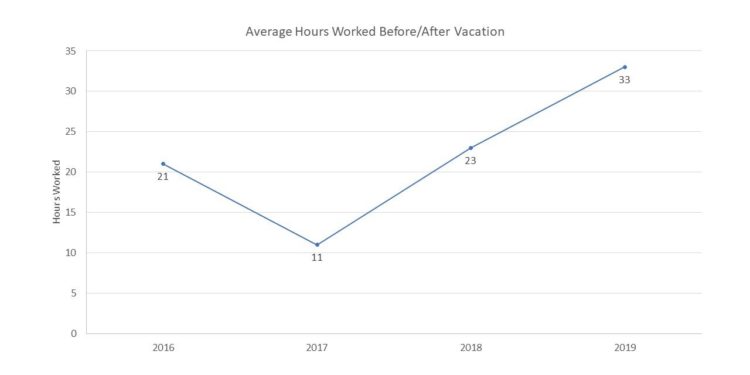

Canadians are working an average of four extra days to make up for time off TORONTO, ON—-An increasing number of working Canadians anticipate putting in extra hours before or after a vacation this year, according to ADP Canada’s most recent Workplace Insight Study. Now in its fourth year, the study …

Fleet Complete Continues Global Expansion with Acquisition of CSI Fleet

Acquisition of a leading Mexican telematics provider accelerates recent expansion into Mexico TORONTO, ON–Fleet Complete, the fastest-growing provider of IoT solutions in the connected commercial vehicle space, announced today its acquisition of Centro de Soluciones Inalámbricas (CSI), a leading fleet telematics player in Mexico. Terms of the transaction were not …

CIBC adds 200 specialized advisors, new technology to support Canadian entrepreneurs

TORONTO, ON–CIBC added more than 200 business banking specialists in the last 18 months in support of its relationship-based strategy that focuses on helping business owners achieve their ambitions. In addition to expanding its dedicated business advisory teams, CIBC has equipped its advisors with market-leading tools to support entrepreneurs at …

Maple Leaf Foods, BMO Capital Markets make First Sustainability-Linked Loan in Canada

Reflects shared commitment to sustainable future and carbon neutrality TORONTO, ON–BMO Financial Group has provided Maple Leaf Foods Inc. with the first sustainability-linked loan in Canada. The amendment to the existing credit facilities will allow Maple Leaf Foods to reduce the interest rate on the lending facility if it meets …

KPMG announces strong FY19 global revenue growth

Global revenues increase by 6.2% to reach record of US$29.75bn as multi-year collective strategy implementation continues at pace LONDON, England–KPMG has record revenues of $29.75 billion for the fiscal year ending 30 September 2019 (FY19), representing a 6.2% increase in local currency terms on FY18. Revenue growth driven by solid …

Great Hill Partners Makes All Cash Offer to Acquire VersaPay Corporation

TORONTO, ON–VersaPay Corporation and Great Hill Partners, a leading growth-oriented private equity firm, say the VersaPay and an affiliate of Great Hill have entered into a definitive arrangement agreement whereby Great Hill will indirectly acquire all of the issued and outstanding common shares of the company. Under the terms of …

EQ Bank partners with TransferWise on international money transfers

First of its kind collaboration in Canada offers customers a better way to move money overseas; TransferWise for Banks provides EQ Bank with direct API integration TORONTO, ON–EQ Bank, the digital platform offered by Equitable Bank (TSX: EQB and EQB.PR.C), Canada’s Challenger Bank™, announces a partnership with TransferWise, the global technology …

Canadian securities regulators announce review of framework for self-regulatory organizations

TORONTO and VANCOUVER, BC–The Canadian Securities Administrators (CSA) will undertake a review of the regulatory framework for the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA). “The regulatory framework for these self-regulatory organizations has been in place for several years, and the …

Study unveils Canada’s 32 publicly traded companies with cryptoasset holdings; estimates combined crypto holdings at more than CAD$100M

Despite lack of standardized guidance for cryptoasset holdings, the majority of the Canadian public companies applied a principles-based approach TORONTO, Dec. 12, 2019 /CNW/ – With the rapid proliferation of the cryptoasset market, there is still significant ambiguity in professional financial communities regarding this new asset class. Today, Chartered Business …

Opening the borders to opportunities

Canadian credit unions take steps to expand international payments By Brian Raine The payments environment in Canada and internationally is in flux. But credit unions are not just keeping pace with that change, they are now leading it. Bringing the benefits of low transaction fees, digital interfaces and convenience to …