By Jay Fischbach

By Jay Fischbach

Technology is helping move the world of payments away from the complex, slow operational model to a more centralized and digital process. As a consequence, regulators are seeking a means to continue to keep up with the pace of innovation, particularly in foreign exchange.

Regulations across the global foreign exchange market have always proven to be a challenge in both establishing policies and maintaining them internationally as countries set up, monitor and report their own regulations. All the while, international cross-border payments continue to exceed $200 billion each year, reports McKinsey & Company.

Digital transformation and industry innovation are now adding further difficulties and pressures when it comes to data security and regulating digital cross-border payments. Global transaction regulations to stop money laundering and fraud add a layer of complexity to back-end cross-border payment processing.

As we move into 2020, financial institutions (FIs) are expected to conduct more digital payments than ever before and, as a result, we will continue to see tighter and more stringent industry regulations. Through these changes we must consider and address the key considerations for establishing a successful innovation model while ensuring institutions are meeting customer and business demands.

Digital transformation

The cross-border payments model is now shifting towards a future rooted in technology, innovation and connectivity, all of which are establishing a framework for a new era of cross-border payments.

The question is, as digital solutions and market consolidation between global payments processing and FinTech platforms are increasing, how will the industry react?

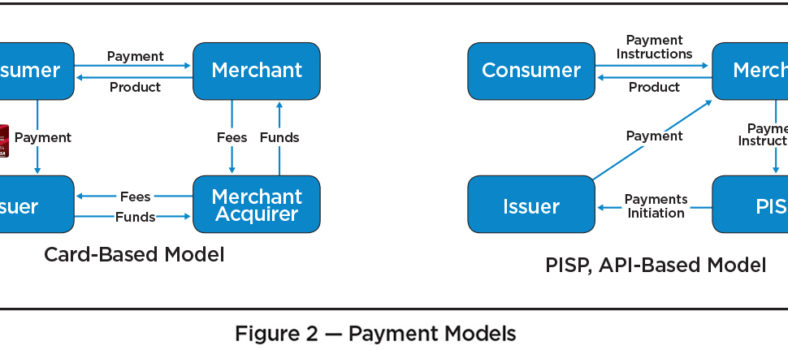

The rise of FinTechs in the cross-border payments industry is unparalleled. The immense growth is driving new business models and new strategies. FinTech companies have been seeking methods to breach the industry by simplifying outdated operational processes. Payments providers are now turning to solutions such as open and closed DLTs (distributed ledger technology), improvements to automation, optimization and payment tracking.

On the other side of this “bitcoin”, regulators are also leveraging digital transformation in order to solve key challenges. For example, KYT (know your transaction) allows for large volume transaction monitoring to identify high risk transactions on a continuous basis. Further, some of these new firms allow FIs and regulators to assess risk of exposure to illicit activity specific to token issuers at point of issuance/redemption, and all transactions in between involving the tokens. Artificial intelligence (AI)-driven predictive analytics also enable regulators to access additional insights into current and potential future problems within the industry.

Regulation changes will need to be addressed in order to monitor and control digital cross-border payments and virtual currencies. Regulators are working to find a balance between enabling industry expansion through services, such as FinTechs, without compromising customer data and leaving the industry open to manipulation. Monitoring areas such as KYC (know your customers) and AML (anti-money laundering) are at the top of the priority list for regulators. Implementing digital solutions to secure digital identities and make payment transactions more transparent play a key role.

Transparency

Gone are the days of vague and irregular cross-border payments processing, which was at one time acceptable to customers and institutions alike. Now, every country has its own unique set of regulatory requirements and rules surrounding payments.

Customer expectations surrounding transparency and traceability are also changing and are helping to drive these regulations, especially in the FX (foreign exchange) space. Customers want to see where their money is going, how it is getting there, who is receiving it and the fees associated with each “touch” in the transaction chain. These fundamental shifts in customer perspectives and knowledge, combined with technological innovation, lends them to be the ideal catalysts driving transparency.

In parallel to transparency, we are also seeing more customers demanding accessibility to their cross-border payments and the accompanying data. This is especially true as transaction transparency is a large focus for the industry as demonstrated through the SWIFT GPI initiative. This solution not only improves transparency, but it enables users to see how and why they are being charged and by which institution.

The regulatory framework has also moved into the crypto space, where previously there was significant anonymity. The travel rule has been mandated on crypto currency exchanges, which means wallet details at a minimum will need to be encapsulated within messages. This adds further transparency to transactions, which should be a positive for the industry.

Cybersecurity

The financial industry continues to be a critical part of Canada’s economic infrastructure. The Macdonald-Laurier Institute recently identified the key risks to Canada’s financial systems. Products, such as SWIFT for payments, the EFT systems and online banking/online brokerage are susceptible to cyberthreats. Therefore, identifying cybersecurity needs for institutions as well as establishing regulations in response to potential threats will be critical in 2020 and beyond.

Personal information disclosure is now required and mandatory for regulatory purposes to protect against fraud. The rising concerns over security in cross-border payments primarily stem from mobility and digitization. Yet, new regulations and compliance technologies, such as digital identities, can support and facilitate the need for higher security in the payments industry.

Security is affecting customers all over the world and in varying industries. In the financial industry, it’s ultimately about managing and securing your digital identity. The primary focus for regulatory bodies as we head into 2020, especially for FIs, will likely focus on data security, anti-fraud and AML.

Cross-border payments pose unique challenges for regulatory bodies and technology due to their complexities. Industry barriers continue to be removed with more players entering payments industry. In 2020 we will begin to see more regulations come into place as technological solutions continues to drive the industry forward to a more forward thinking and innovative marketplace.

Jay Fischbach is chief operating officer at the Exchange Bank of Canada.