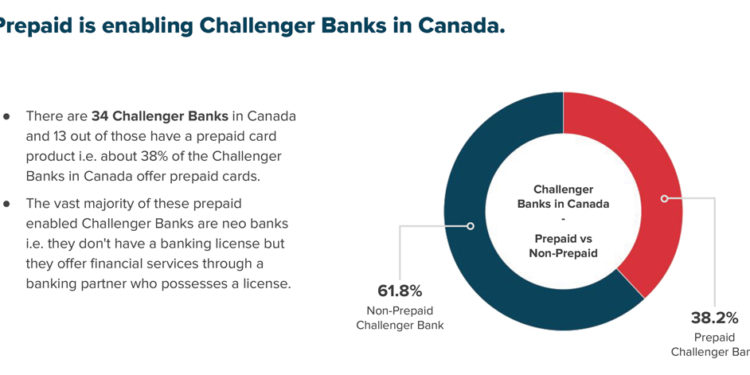

Canada’s Prepaid Payments Industry Growing, Attracting Innovation Among Homegrown and Global FinTechs

By Jennifer Tramontana The COVID-19 pandemic has had a seismic impact on the Canadian financial ecosystem and has shifted the way Canadians transact. While Canadians are still seeking choice, convenience and security in payments, Canadians are shifting to more frequent contactless, digital payments preferences. According to a survey from Payments …

Why Are Scams on the Rise in An Increasingly Digital Society?

By Scott Zoldi With the world well into its second year of the COVID-19 pandemic, the inner workings of banks’ fraud and financial crimes operations continue to be stress-tested. Change always creates opportunities for fraudsters and financial criminals, and the pandemic has provided a field day of possibilities, especially scams. …

CFO CV

Tania Clark has joined the Business Development Bank’s Board of Directors. Honourable Mary Ng, Minister of Small Business, Export Promotion and International Trade, responsible for the Business Development Bank of Canada said Clark brings a wealth of experience as director, invaluable to BDC as it continues to play a vital …

Talking Points

Royal Bank of Canada Launches RBCx to Support Visionary Technology. It’s a platform to accelerate the entrepreneurial journey at every stage of growth, giving access to capital solutions, innovative products and services, and operational expertise to help technology companies scale up. RBCx is for entrepreneurs who are disrupting business models, …

RBC ADDS REWARDS POINTS TO DEBIT TRANSACTIONS THROUGH VANTAGE

BANK’S PERSONAL DEBIT CARDS EARN RBC REWARDS TORONTO, ON–RBC Vantage is the bank’s new system which ties everyday banking into a comprehensive suite of benefits for RBC clients. RBC Vantage gives clients, for the first time, the ability to use their debit cards to earn RBC Rewards points and provides …

Canadian businesses believe burnout will hurt companies’ bottom line this year, new Sage study in Canada finds

Business leaders share concerns for employees’ wellbeing; a hybrid work model; and investing for recovery TORONTO, ON–Sage, the market leader in cloud business management solutions, uncovered the impact of burnout on Canadian businesses in a new commissioned report – 2021 Forward Together. The report found: Among businesses hurt by the …

Payments Canada welcomes inclusion of the Retail Payments Oversight Framework

OTTAWA, ON–Payments Canada applauds the inclusion of the Retail Payments Oversight Framework (RPOF), and its oversight by the Bank of Canada, as part of the 2021 federal budget, A Recovery Plan for Jobs, Growth and Resilience. “The implementation of the Retail Payments Oversight Framework is a welcome addition to Canada’s …

FICO Research Highlights Challenges for Fraud, Financial Crime Teams Amidst Pandemic

SAN JOSE, CA–Global analytics software provider, FICO, released new research that highlights the key challenges North American fraud and financial crime teams faced amidst the COVID-19 pandemic. The majority of senior executives (68 percent) said that remote working had a major impact on maintaining effective fraud and financial crime prevention …

More Than 30 Percent of Canadians Would Favour a Cashless Society

The argument for a cashless society has been around for a while, but the rapid rise of the Coronavirus crisis has intensified the debate again amid concerns about banknotes and coins transmitting the virus. In addition to this, the increasing decline of high street bank branches and ATMs has made …

Why Philanthropy is a Good Investment: It’s not always obvious

By Mark Halpern, CFP, TEP, MFA-P The COVID-19 pandemic added new levels of stress and uncertainty to the lives of most Canadians. No corner of society worldwide has been left untouched by the effects of the pandemic, especially the non-profit sector. The pandemic hit charities on all fronts. The weakening …