By Tyler Anderson

By Tyler Anderson

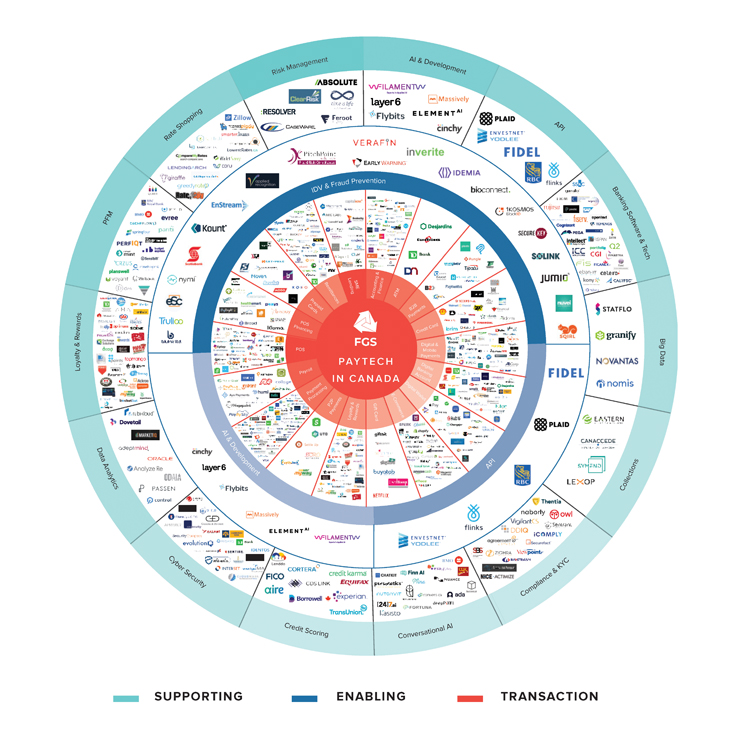

Payments in the Canadian ecosystem have evolved beyond the financial service providers. Everyone from early-stage start-ups to tech giants and to other non-financial players wants to be involved in the quickly growing payments ecosystem.

At FinTech Growth Syndicate (FGS), we have had a front row seat to the exciting opportunities on the horizon for payments and can understand why so many individuals are excited about this space. Not only does offering a payments solution enable companies to become further entrenched in their customers’ lives, but it also creates a stickiness that other initiatives cannot.

The Canadian PayTech ecosystem

The Canadian PayTech ecosystem

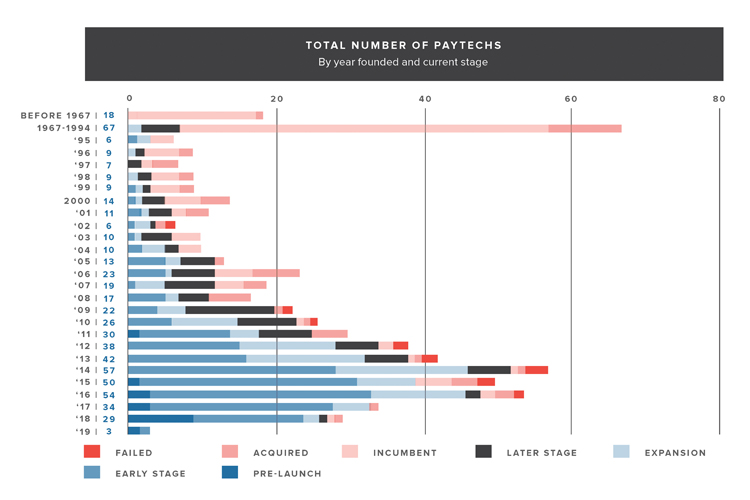

FGS reports that there are approximately 633 PayTech companies operating in Canada with 420 of them headquartered in the country. This market supports, enables and is directly involved in the transfer of value between stakeholders. PayTech has also seen a variety of funding deals completed in 2019: 244 deals totalling $2.68 billion in funding for PayTech companies across Canada.

New entrants into the PayTech vertical is on the upswing in Canada as 33 per cent of all PayTechs are currently considered early-stage companies. Over the last few years, we have witnessed the rate of failed companies on the decline as new start-ups have made headway into the market over the previous three years. We can take this as a sign that PayTech is here to stay, and as these companies mature, we will see a rise in investment, partnership and growth in the ecosystem.

Tech giants such as Apple and Amazon are also paying close attention to the payments space and have increased investments into their payments offerings. An example of this is the Apple Card, introduced by Apple earlier this year. The credit card is designed to be used with Apple products such as an iPhone. Similarly, Amazon has Amazon Pay: a payment solution for an enhanced checkout experience for their customers.

Messaging platforms are also innovating in the payments space. Two prime examples of this is WhatsApp Pay in India and WeChat Pay in China. As payment technology is advancing, it is changing the way we conduct, facilitate and process payments. A cultural shift is happening as people demand solutions that are integrated into all facets of their lives.

Payments modernization

Payments modernization

Payments modernization has been a hot button topic in Canada that the organizing body Payments Canada is currently tackling. The initiative is aiming to simplify and enhance payment interactions, as well as position Canada as a leader in financial services on a global scale. However, it is no simple task, involving updating and re-thinking many different aspects of our current payments system. Below is an outline of the various payment systems that are being innovated as part of the project.

Real-Time Payment Rail (RTR)

RTR is the supporting infrastructure. It will enable real-time (and faster) consumer and business payments and transfers while also creating new and innovative ways to make payments. Banks offering overlay services and other payment service providers (PSPs), e-commerce web sites, mobile players and so on, will have the ability to connect to the RTR and bring their overlay services.

ISO 20022

The payments modernization initiative will also include the global and open standard, ISO 20022. The ISO 20022 standard will allow necessary payment details and associated remittance information to travel together in the same payment message: meaning richer information with every payment.

Open Banking

International developments in PayTech have had a significant impact on Canada’s PayTech initiatives. As a result, Canadian legislative bodies have begun to consider the adoption and implementation of an open banking system, which would allow third-party access to consumers’ financial data through their banks. In January 2019, the Department of Finance Canada released a consultation paper on open banking. Its purpose was to understand Canadians’ views on open banking and to determine the overall desirability of the system.

Upcoming trends and predictions

Upcoming trends and predictions

Like anything in the world of technology, it can be challenging to predict the future. However, here are some of the trends FGS has been tracking and hope to see come to life shortly.

- New entrants into the Canadian ecosystem. As international boundaries continue to blur, PayTech success stories from other countries, such as Revolut and Paytm, will continue to enter the Canadian market.

- Remittances on the rise. As the Canadian government is inviting an ever-increasing number of skilled immigrants, the demand for remittance products will continue to rise. It is estimated by the Canadian International Development Platform that the total remittances flow out of Canada was $24.6 billion in 2017, with the largest flows being to China and India.

- Tech giants versus traditional banks. As tech giants further expand their payments offerings and expand into new markets, banks will begin to have a more difficult time keeping market share. Since most of these giants have a foothold across the Canadian border in the U.S. moving to Canada is very lucrative for them. Considering their customer stickiness and vast resources at their disposal, it won’t be difficult for them to sideline their banking competitors.

- Payments modernization in action. The roll-out of payments modernization initiatives will lead to ever-increasing digital payments adoption within the country.

- Consolidation of the industry. As different categories of companies make waves in the space, the market will start to consolidate and see significant acquisitions. This is also true when large corporations acquire financial institutions or PayTechs only for gaining access to the licences and meeting all official requirements to operate in the payments space. For example, Every, a challenger bank for small businesses, was acquired by Wave to add financial services offering to Wave’s suite of products.

- The social side of payments. The social payments space will find adoption in the country. While social payment solutions like Venmo, WeChatPay and Alipay are not yet standard in Canada, as these companies make strides towards Canada, these platforms will spread like wildfire.

- Actualized point-of-sale financing. This almost untapped market in Canada will begin to take off shortly. Currently, an increasing number of companies are offering this service, and non-Canadian companies, such as Klarna, are operating in the Canadian landscape. These companies have been able to provide consumers with the freedom to pay for their purchase after 15 days interest-free, and then subsequently convert the charge into installments.

- Consolidation of loyalty programmes. The loyalty space in Canada is very crowded; almost every major brand has a loyalty programme. This has led to Canadians holding multiple loyalty cards: and often forgetting to use them at the time of purchase. A solution that can aggregate all the loyalty programmes for the customer is desperately needed. Users should not only be able to track all of them in one place but should also have the ability to exchange loyalty points from one brand for another. This need will lead to the creation of an open and comprehensive ecosystem of loyalty programmes. Imagine shopping for groceries at Loblaws and using Starbucks rewards points to pay for them.

It has never been a more exciting time to be a PayTech in Canada. As the space continues to evolve, we predict we will see new technologies emerging and different categories of players innovating to compete for their piece of the payments pie.

To learn more about PayTech in Canada, download our Canadian PayTech Report 2019 (www.fintechgrowthsyndicate.com/paytechreport).

Tyler Anderson is chief operating officer of FinTech Growth Syndicate (FGS) (www.fintechgrowthsyndicate.com). Tyler has spearheaded and grown many projects through from ideation to commercialization. Tyler oversees operations at FGS and is a Business Model Canvas and Value Proposition design expert.