By Brendan Read

Open banking promises to provide Canadian consumers and businesses with the ability to control the use of their banking data and access digital banking tools or financial technology (FinTech) services, according to Senator Colin Deacon. He is a member of the Standing Senate Committee on Banking, Trade and Commerce.

These FinTech services “will enable them to more safely and affordably access credit, manage their retirement, pay bills on time: to name just a few of the benefits,” said Senator Deacon. And as such it may spark innovation, new solutions and growth in Canada’s burgeoning FinTech industry. It will also stimulate competition and productivity growth within our entire banking sector, better preparing it for global disruption that he believes is inevitable.

But according to the Senate committee, Canadians who use open banking tools also presently “have little control over their personal financial data and many use third-party banking apps that place them at greater risk of identity theft and fraud”. To be fair, current customer agreements with Canadian banks provide their customers with little control over their personal financial data, and these incumbent banks have not been immune to data breaches.

Courtesy Senate of Canada

In a new report, Open Banking: What it Means for You, the committee recommended that the federal government must take several steps to enable Canadians to use open banking securely.

- Immediate term: providing oversight for open banking, including screen scraping and funding consumer protection groups to help them research on the benefits and risks; and

- Longer term: developing an open banking framework. Also, aligning the Personal Information Protection and Electronic Documents Act (PIPEDA) with global privacy standards, including giving consumers the right to control how organizations share their personal financial information.

The full text of the report can be downloaded at https://sencanada.ca/content/sen/committee/421/BANC/reports/BANC_SS-11_Report_Final_E.pdf.

To fully understand open banking, its benefits and its challenges, including its impacts on Canada’s payments system, Payments Business recently interviewed Senator Deacon. An entrepreneur who has worked with tech start-ups, he understands both the opportunities and the risks of innovative technologies and practices.

Payments Business (PB): What exactly is open banking?

Senator Colin Deacon, member of the Senate Committee on Banking, Trade and Commerce.

Senator Colin Deacon (CD): At its core, open banking is the structured sharing of data by consumers with and between their financial service providers (e.g. banks and FinTechs). It opens the financial services market up to the sort of disruptive, customer-focused innovation that we’ve grown to expect in so many other areas of our life. But, most importantly, it puts consumers in control of their data and the financial services they use. Kirsten Thompson (Dentons) says that “open banking” is better called “consumer directed banking” and I think she nailed it.

PB: What are the benefits to consumers? Businesses?

CD: The biggest benefit is that the data sharing is safe, discrete and reversible; consumers and businesses can grant and revoke precise levels of consent at any time. The premise of open banking is that the customers (e.g. consumers or businesses), not service providers, have the right to be in control of their data, for their own benefit. This stands in stark contrast to current conditions.

We can’t even begin to imagine the innovative solutions that will be created. I believe, totally and completely, in the abundance of opportunity that is created when you open systems up to “the crowd”. All of a sudden, problems that we did not fully appreciate or understand are being solved: and highly creative, effective and cost-efficient solutions are disrupting the market.

In particular, I see open banking helping marginalized communities because now entrepreneurs from those communities are free to identify AND solve problems that are important to and serve the needs of their particular community.

Think about rural and remote communities that have been experiencing declining levels of banking services. With open banking, they will have even better services available to them, safely and securely, on their mobile devices or laptops, 24 hours a day, seven days a week from anywhere.

And if you don’t think we can find solutions that will serve the most marginalized Canadians, consider that 96 per cent of Kenyan homes have an account with M-pesa, a mobile banking service. If you focus intensely on the specific needs and realities of a given group of customers, wonderful opportunities can emerge.

PB: How will open banking mesh with Payments Canada’s payments modernization initiative?

CD: Open banking consists of two changes to the banking sector. Firstly, it would allow third parties with the permission required from the customers to access banking data, or, more simply, the ability to “read” them. Secondly, it would allow third parties to initiate payments from bank accounts or have the capacity to “write” them. In Canada, open banking discussions have focused mainly on third parties being enabled to access banking data, but both functionalities will be required for Canadians to receive the optimal benefits of open banking.

Payments Canada told our Committee that it is leading a payments modernization initiative that is designed to promote innovation in payments processing, which will include real-time settlement and clearing of payments. It stated that “combining the ability to reliably access financial data with the ability to initiate payments or transfer funds between institutions will increase the range and competitiveness of new financial services.” Achieving that “read” and “write” objective is key.

The Canadian Bankers Association told us that the goal of payments modernization is the same as open banking. So, it sees payments modernization and open banking as aligned and interconnected. That’s good.

Payments Canada’s promise of real-time settlement and clearing of payments said to me that it is heading in the right direction; my only questions then relate to when it will be able to reliably deliver that functionality. Payments Canada suggested that the federal government set an “ambitious timeline” for implementing open banking. This tells me that it believes that its new platform will be completely functional before the first iteration of an updated regulatory framework will be in place.

I also see the opportunity to look well beyond the domestic market. In the tech start-up world, where I come from, the market focus is always international. I sure hope someone in Payments Canada is working on how we scale to become the preferred global payment services provider.

PB: What factors are moving Canada towards it?

CD: Market realities and advancements in technology. Global competition is rising incredibly rapidly. Competing and emerging markets now have more advanced banking and payments options than Canada, and we are increasingly falling behind. As these other markets accelerate, the gap widens, making Canada’s financial services industry a very high cost, low value banking market in relative terms.

When you look at how well respected our banking system is, our incredible technical capabilities, huge global successes, reliance on exports, the sophistication of our population and our initial global leadership on privacy legislation, it’s crazy that we are so late to the open banking transition.

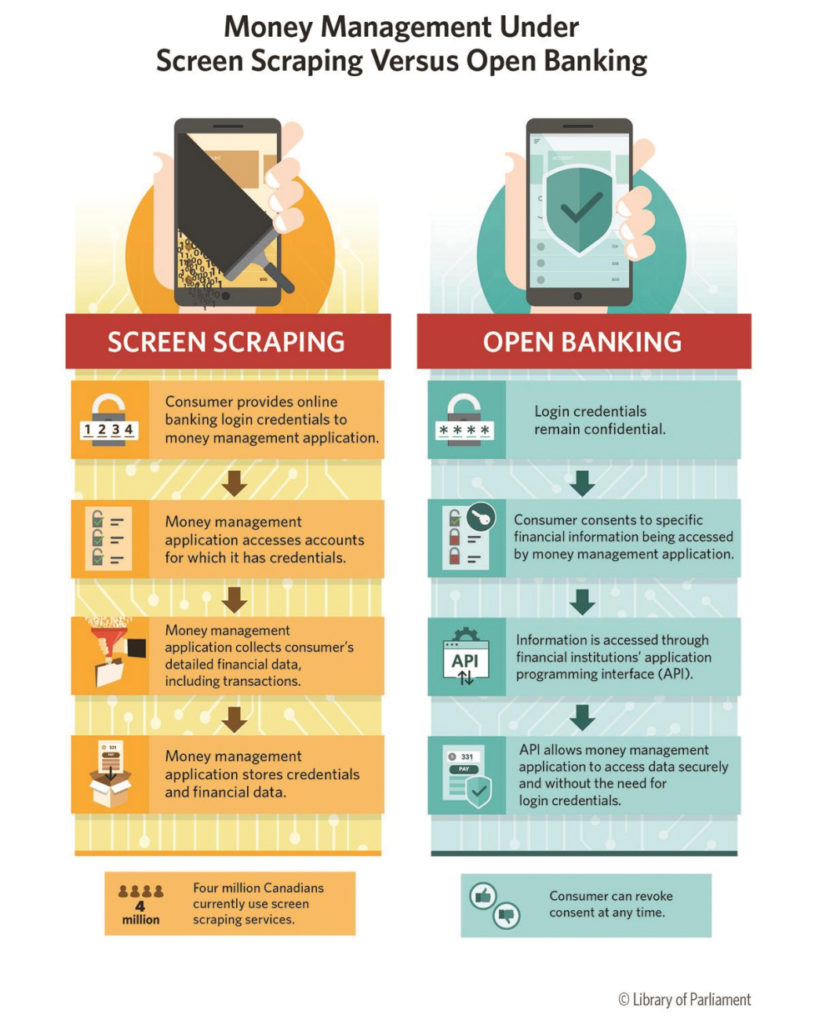

There are, of course, plenty of Canadians who have already transitioned into using open banking; almost four million are estimated to use one or more FinTech apps that use screen scraping to access their banking data. This unregulated workaround exists purely because of the current lack of an established system. It’s crucial that we get the right regulations in place quickly so that these consumers are properly protected while accessing these services, and can contribute to the momentum of new FinTech technologies.

Our Senate report summarized the key factors demanding action in the creation of an open banking framework in one sentence. “Canadian consumers need open banking regulations as soon as possible for three main reasons: to keep their personal financial information safe; to be provided more choice and improved financial products and services; and to help keep the Canadian financial sector strong and internationally competitive.” The importance of this last point cannot be overemphasized.

PB: Where does Canada stand with other countries on the adoption curve and why?

PB: Where does Canada stand with other countries on the adoption curve and why?

CD: Not nearly far enough along the adoption curve, in my estimation. Brett King’s Bank 4.0 book provides some sense of how rapidly we are being left behind. I’m also concerned that we are looking at issues related to consumer data consent and privacy only through the window of “protection” and not prosperity. Yes, consumers need to be protected, but they also need to be able to unlock the economic potential of their data.

On August 1, 2019, Australia passed its Consumer Data Rights Act. The need and motivation to act swiftly to create this innovative legislation emerged from the Australia Productivity Commission, a body charged with conducting public inquiries on key policy or regulatory issues bearing on Australia’s economic performance and community well-being. The Commission recognized the enormous economic value of data, the legal complexities related to ownership and the importance of giving consumers control over those data so that they could invest them where they see fit.

This challenges the traditional view, one that is all too common in Canada, where consumers simply need to be protected, not empowered. The role of the Privacy Commissioner of Canada’s role is entirely focused on “protecting” and “enforcing”, not on the equally important roles of “enabling” and “empowering”. This is why we chose to recommend that the Privacy Commissioner of Canada and the Canadian Commissioner of Competition both need to be involved in the development of the regulatory framework.

If we are to move up the open banking adoption curve at the rate required, we have got to look at this issue from an entirely more balanced perspective.

PB: What are the top challenges facing open banking?

CD: I think the biggest challenge is political will. The average Canadian is not demanding open banking. I expect that most Canadians have no idea what open banking is, or that we currently have a closed banking system. There will be no national survey citing open banking as an important issue. I’ll wager money that it’ll never be a debate question during the election.

Yet issues around data, consent and privacy are tremendously important: in an increasingly digital economy, they are central to our productivity growth. If we do not do a better job of managing these issues, we limit our ability to maximize opportunities in countless fields that are central to our domestic expenditures (e.g. healthcare), as well as other internal and export markets. The public’s urgency to address these issues grows every time another data breach is announced, but cybersecurity is only one element of how we manage consumer data rights in this country.

Moving forward swiftly with open banking will be a real step in the right direction for the government to help protect and empower Canadians in how they use their personal data. It is critical for policymakers to understand and prioritize that fact before we fall even further behind our global competitors.

PB: What are the lessons learned from the U.K. and Australian experiences?

CD: The U.K. was able to implement open banking in part through the existence of the General Data Protection Regulation (GDPR). The Australian example provided our committee with an interesting understanding of how consumer data rights can be viewed across sectors: where the consumer is in control.

Canada has its own unique challenges, including our geography and population. We can’t adopt another country’s strategy entirely but we can—and should—take note of lessons learned so that we can be one of the leaders in the new digital economy.

We were impressed that the implementation of open banking was devolved to the private sector in the U.K. through an initiative funded and led by the big banks. My only concern is governance: making sure that the open banking market opportunity values all size of participants and does not inadvertently or intentionally create barriers to new entrants. My background means I firmly believe that new entrants (e.g. FinTechs) can be just as capable—even more so—of serving customer needs than established groups (e.g. banks). I have heard concerns that the big banks held a bit too much influence in the Australian process, so I think we need to be sensitive to that risk.

Our Committee concluded that the government should act as facilitator, but that the open banking framework should be developed by industry. This is why I have been calling on Canadian FinTechs, aggregators and banks to sit down now, during this election period, to keep the issue moving. They can focus on areas of agreement, understand and explain the complexities that may be the source of disagreements and begin to identify the central elements that will shape the essential components of an open banking regulatory framework, like a common application programming interface (API).

It’s time we get going, learn from others and find that all-important starting point. Nothing gets done without a deadline, and we need to move even faster than they did in the U.K. and Australia if we want to be globally competitive.

PB: Outline the key Senate recommendations.

CD: Our report outlined ten recommendations, urging the federal government to pursue open banking as a means of encouraging innovation and the adoption of new technologies while also ensuring the protection of Canadians’ privacy.

In the longer term, this will require modernizing PIPEDA to ensure we are aligned with global standards. Also, designating regulatory and enforcement authorities for open data framework: we proposed a joint mandate between the Privacy Commissioner of Canada and the Canadian Commissioner of Competition.

In the shorter term, we recommend more research and public education as well as, crucially, that the government facilitate the development of a principles-based, industry-led open banking framework. As facilitator, the government should ensure equal participation by all stakeholders, including those involved in payments modernization. I’d love to see industry start this work now to allow the government to set ambitious timelines that respect the urgency required.

PB: Where do you see open banking in the next five years?

CD: I want us to take the actions needed to be at the forefront of open banking globally, combining our reputation for strong financial and regulatory systems, with our deep-seated respect for individual rights, our globally competitive technical skills and our capacity to innovate.

Canada is third in the world in terms of volume of digital transactions, so we have a large, proven market. This is an amazing opportunity to revolutionize our financial sector as well as our global competitiveness. The lessons we learn with open banking will have an enormous impact on how we deal with data in other sectors.

I truly hope that the next five years will have us emerging as an international leader. But without decisive action, I fear we will be importing, not exporting, many of our financial services and that is not a place I want us to be. Facebook will launch Libra in some form. I expect that they will be followed by Apple or Google or Microsoft. The financial industry is rapidly becoming global and digital.

Canada can be a leading and highly trusted financial service provider to the world, or an importer of what the world creates. I’m going to do all I can to make sure we choose the first option.