Canadian securities regulators move forward with embedded commissions bans

VANCOUVER, BC–Canadian securities regulators announced today that they will ban two types of commissions that are embedded in some mutual fund purchases. Canadian Securities Administrators (CSA) Staff Notice 81-332, Next Steps on Proposals to Prohibit Certain Investment Fund Embedded Commissions explains that the participating provinces and territories expect to publish …

BMO Appoints Sri Dronamraju as Chief Information Security Officer

TORONTO, ON–BMO Financial Group today named Sri Dronamraju as Chief Information Security Officer (CISO). The appointment is effective January 6, 2020. Dronamraju will oversee the bank’s global strategy for cyber security. Reporting to both Larry Zelvin, Head Financial Crimes, and Ken Librot, U.S. Chief Technology and Operations Officer, Mr. Dronamraju …

BMO Annual TFSA Study: Canadian Investors Show Changes in Financial Behavior and Build Momentum With Contributions in 2019

> More than half of Canadians (58 per cent) said they contributed what they had expected to their TFSA this year, while 11 per cent said it was more and 23 per cent said it was less than their anticipated plan > Average annual contribution is up 10 per cent …

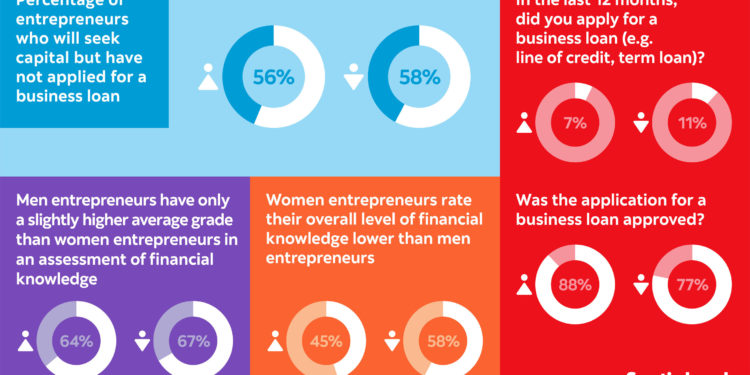

Women entrepreneurs who apply for business loans are more likely than men to be approved, Scotiabank survey finds

On its first year anniversary, The Scotiabank Women Initiative™ releases new survey findings, expands program to Global Banking and Markets (GBM) TORONTO, ON–Women entrepreneurs who apply for business loans may fare better than they expect, according to survey results released today by Scotiabank on the first anniversary of The Scotiabank …

Transaction Creates One of the World’s Largest Cinema Companies

Cineplex Signs Definitive Agreement to be Acquired by Cineworld Group TORONTO, ON–Cineplex Inc., one of Canada’s leading entertainment and media companies, today announced that it has entered into a definitive agreement with Cineworld Group, plc . With over 11,200 screensi around the globe, the proposed transaction will create one of …

RBC Investor & Treasury Services launches new Collateral Management service

New service leverages industry-leading technology to centralize and interpret data Toronto, ON— RBC Investor & Treasury Services (I&TS), part of Royal Bank of Canada, has launched a new collateral management service. This innovative middle office solution centralizes and interprets collateral management data to help asset managers comply with BCBS and …

Canadian executives express bullish outlook in times of economic uncertainty

EY Global Capital Confidence Barometer shows decline in M&A appetite despite optimism; Canadian executives optimistic that domestic and global economies are improving TORONTO, ON—Canadian executives are taking a cautious approach to dealmaking in the year ahead despite overwhelming economic optimism, according to the 21st bi-annual EY Global Capital Confidence Barometer. All …

Tracey Black to succeed Gerry Gaetz as President & CEO of Payments Canada

OTTAWA, ON–The Payments Canada Board of Directors today announced the appointment of Tracey Black to President and CEO, effective March 1, 2020. “Tracey joined Payments Canada in 2018 to lead the payments Modernization program. Her leadership, deep payments expertise and industry relationships have driven the program forward and helped foster …

Ann Fandozzi to Become Chief Executive Officer of Ritchie Bros.

VANCOUVER, BC–Ritchie Bros. Auctioneers, the world’s largest industrial auctioneer and a leading used equipment seller, says Ann Fandozzi will become Chief Executive Officer and join the Company’s Board of Directors, effective January 6th, 2020. Most recently, Fandozzi was CEO of ABRA Auto Body & Glass, a leading national damaged vehicle …

CFIB Survey asks “Where do Canada’s small businesses bank?”

RBC, Scotiabank remain the most used banks by entrepreneurs, but smaller institutions gained ground TORONTO, ON–With a market share of 20 per cent, Royal Bank of Canada continues to be the most used bank by small and mid-sized businesses while the smallest businesses, those with fewer than five employees, primarily …