Future-shaping trends Look for personalization, redemption options and “points as currency”

By Len Covello The loyalty industry in Canada has left brands and consumers wanting more. The issue is that many of today’s loyalty programs run on unsophisticated technologies with little segmentation capabilities and zero personalization features. When it comes to loyalty redemption, customers want ease, choice and value, and they …

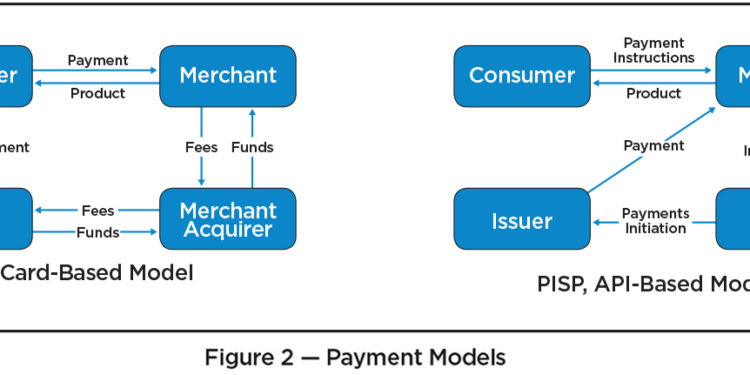

Adopting emerging payments solutions

By David Grindal Our traditional world of stable payment acceptance mechanisms is long gone. Payments used to just mean either cash and cards for a merchant or automated clearing house (ACH) and wire transfers and larger-amount cheques for a business, government or institution. The only person-to-person (P2P) payments that were …

Five reasons to automate invoices

By Anthony Loiacono All businesses are not created equal and neither are their accounting needs. There is no one-size-fits-all way to structure an accounts department. However, there may be an easier way to handle certain accounting tasks, such as invoicing, which can be automated to reduce the amounts of staff-hours …

Canadian credit unions take steps to expand international payments

By Brian Raine The payments environment in Canada and internationally is in flux. But credit unions are not just keeping pace with that change, they are now leading it. Bringing the benefits of low transaction fees, digital interfaces and convenience to all credit union members. Central 1 continues to focus …

How Gen Z guides payments

By Daniel Kornitzer ECommerce and mobile commerce (mCommerce) continue to grow in Canada. eMarketer forecasts that 31.5 per cent of the $64.6 billion in eCommerce sales in 2019 will be carried out using a smartphone or tablet. The connected growth of eCommerce and mCommerce is being driven in part by …

Libra: the AOL of crypto?

By Daniil Saiko The earliest iteration of email was a fringe application, only used by tech-savvy engineers and hobbyists. That changed with the introduction of AOL, which took the Internet and email from fringe to mainstream. Despite the mass amount of media coverage, cryptocurrencies are in the same position as …

Gaming: from play to pay

By Paul Parisi Today’s gaming industry has evolved dramatically over the past few years. According to the 2019 Newzoo Global Games Market Report, the global gaming economy is a major industry with over $150 billion in gaming revenue and an 11 per cent annual revenue growth. With that growth comes …

Combatting fraud with centralized data

By Stacy Gorkoff The Greek philosopher Aristotle once said, “The whole is greater than the sum of its parts.” When it comes to guaranteeing that every payment transaction completes as expected, this statement could not be more accurate. For retail banks, independent ATM deployers (IADs) and payment processors, transactions are …

Bright forecast for payments modernization

By Tracey Black Payments modernization around the world continues to progress, addressing consumer and business needs for greater speed, flexibility and security. In its sixth annual Flavors of Fast report, FIS identified 54 countries with active real-time payment programs, up from 40 in 2018. Here in Canada we are making …

Building the Digital ID foundation

By Neil Butters The payments industry has already made significant progress helping Canadians adopt and embrace new technologies, such as contactless and digital payments. Now it’s time to apply what we’ve learned to the development of a truly digital ID that will help people unlock the full potential of the …