How Banking-as-a-Service (BaaS) Can Fuel the Future of International B2B Payments

By Thomas Anderson Digitalization has been central to banking since the introduction of ATMs in the late 1960s. It has led to a rapid change in the way customers want to interact with money or matters related to it. With accelerating digital transformation changing operational risks, there has been a …

Four Key Reasons The Future Of B2B Commerce Is Collaborative

By Nancy Sansom For too long, the B2B invoice to cash cycle has been a transactional and poor customer experience. An invoice is entered in a system and a payment is made on the other side, if you’re lucky. Throw in disputes, lost invoices, daily distractions, and more, and there …

Raneiri leads Reach to new $30m Canadian Investment for Growth

Expansion continues, benefits online merchants, marketplaces and increase conversions, lower foreign payment processing costs and gain international customers CALGARY, AB–Reach, the leading global ecommerce payments enabler, has secured a $30 million Canadian investment, as it bids to accelerate its mission of unlocking a global customer base for merchants through a streamlined payments, tax …

Leveraging Canadian Payments Trends to Support Financial Inclusion

By Robert Hyde The COVID-19 pandemic deeply impacted the Canadian payments industry and accelerated the migration to digital and contactless payments. Canadians continue to seek more choice and flexibility in how they make payments without sacrificing security and convenience, but the pandemic has further underscored the need for more services …

Three Ways to Support Earned Wage Access in Canada

By Marco Margiotta Around the world, employers are experiencing first-hand the impacts of what’s being called the ‘Great Resignation,’ emerging from the COVID-19 pandemic. For our neighbours to the South, 4.5 million Americans quit their jobs in November 2021, which matches a series high from last September. This trend has …

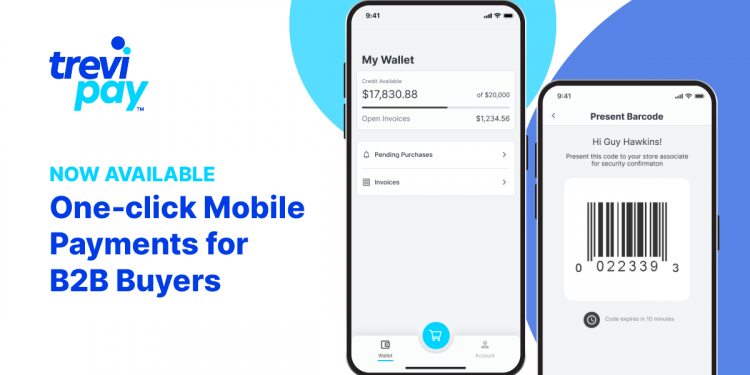

Four Areas to Address to Meet Digital B2B Commerce Expectations

By Brandon Spear Looking back on 2021, the global B2B payments landscape experienced notable changes in sales channel strategies as e-commerce accelerated. As B2B customer journeys become more digitally influenced, a merchants’ payments offerings and capabilities need to evolve to better secure the sale. Recent research from Forrester Consulting revealed …

Versapay Bolsters Executive Team

TORONTO, ON–Versapay, a leading provider of cloud-based payments and accounts receivable (AR) automation solutions, bolstered their executive team with the addition of three new members. Ward Schultz joins as Chief Financial Officer (CFO), Nancy Sansom joins as Chief Marketing Officer (CMO), and Alex Hoffmann joins as Executive Vice President of …

Web Rep rebrands as TransSource

New name reflects the company’s evolution into an industry leading solutions provider in the high-risk merchant transaction processing space SAN JUAN, PR–Kevin Cunningham, president of The Web Rep LLC, an industry leader in payment processing solutions for the world’s premier high-risk merchants, announced the change of its corporate name to …

Payfare, Cardlytics Partner to Launch Cash Back Rewards Program

Gig workers can now earn instant cash back with their Payfare cards TORONTO, ON–Payfare Inc., a leading fintech powering instant payout and digital banking solutions for the gig workforce, have created a new rewards program powered by Cardlytics. Payfare cardholders can now earn cash back when they shop thousands of …

Why Purchase Data Drives Customer Engagement

By Jason Howard Who hasn’t looked at their bank statement at one point and thought, “wait a minute, what’s this transaction again?” And often, there isn’t enough information on our digital bank statements to help us make sense of our purchase history. In most cases though, these confusing statement descriptors …